4 REITs to ride on as Singapore property market approaches cyclical bottom

The FTSE ST Real Estate Investment Trusts Index has climbed some 10% year-to-date amid a challenging macro-economic environment.

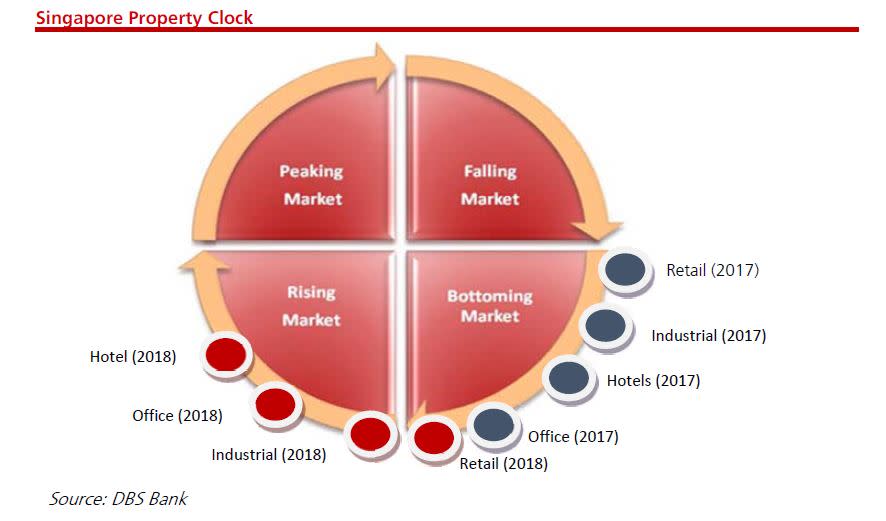

But DBS Group Research says strong interests in Singapore REITs is expected to continue, even as the republic’s property market approaches a cyclical bottom.

“We expect buying interest for S-REITs will continue in the immediate term, driven by high yield spread of 4.4%, and attractiveness from the continued strength of the Singapore dollar,” says DBS lead analyst Derek Tan in a Monday report.

“Outperformance, in our view, will hinge on the S-REIT’s potential to post higher earnings growth – organically or through acquisitions,” he adds.

DBS Group Research sees a bottoming out of the property market in 2018 with a fall-off in supply in majority of sectors – especially in the office, hotels, and industrial space – which is supportive for higher rents going forward.

Tan believes cyclical sectors such as hotels and office space will be buoyed by an improving economic environment, with GDP growth projected to continue to rise by 2.5%-2.8% per annum over the next two years.

In this light, DBS prefers CDL Hospitality Trusts (CDREIT), with an expected turnaround in its earnings.

DBS is keeping its “buy” call on CDREIT with a target price of $1.75.

As at 12.35pm, units of CDREIT are trading 1 cent higher at $1.62.

Tan also says the research house continues to be vest in landlords like Keppel REIT (KREIT).

DBS has a “buy” recommendation on KREIT with a target price of $1.23.

As at 12.39pm, units of KREIT are trading flat at $1.14.

In addition, industrial REITs are expected to see better prospects in 2018 amid improving business expectations from manufacturers, which could result in expansionary demand ahead.

Meanwhile, demand for space in business parks are likely to continue to be driven by firms in the technology, media and telecom (TMT) sector.

Tan says he prefers REITs with “attractive acquisition prospects” such as Mapletree Logistics Trust (MLT) and Frasers Logistics & Industrial Trust (FLT).

DBS has “buy” calls on both MLT and FLT, with target price of $1.28 and $1.10, respectively.

As at 12.39pm, units of MLT are trading half a cent higher at $1.20 and units of FLT are trading half a cent higher at 1.06.

Retail REITs, however, are expected to continue to see challenges going into 2018.

“Retail landlords are more generally cautious given the ongoing challenges faced by retailers but we believe that suburban space could be more resilient in the medium term,” says Tan.

This article first appeared on The Edge Markets

Related Articles From TheEdgeProperty.com.sg

Yahoo Finance

Yahoo Finance