4 Insurers Set to Outperform Estimates This Earnings Season

Per the latest Earnings Preview, the Finance sector’s first-quarter 2024 earnings are expected to improve 11.6%. Revenues are estimated to rise 3.6%. Results of Insurance, one of the Finance sector industries, are likely to reflect better pricing and exposure growth, accelerated digitalization and an improved interest rate. However, cat losses are likely to have weighed on profitability.

With the help of the Zacks Stock Screener, we have identified four insurers, namely, Aflac Incorporated AFL, AXIS Capital Holdings Limited AXS, Horace Mann Educators Corporation HMN and Primerica, Inc. PRI, which are poised to outshine the Zacks Consensus Estimate in first-quarter earnings. These stocks have the ideal combination of two ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), #2 (Buy), #3 (Hold) — to surpass expectations. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Factors Likely to Impact Q1 Results

First-quarter underwriting results are likely to benefit from continued better pricing, portfolio repositioning, proper segmentation, reinsurance covers and favorable reserve development.

Non-life insurers, by the nature of their business, are exposed to catastrophe losses. Thus, their profitability is vulnerable to catastrophe losses. Gallagher Re’s National Catastrophe and Climate Report estimates global insured losses from natural catastrophes at $20 billion in the first quarter of 2024. Catastrophes continued to provide impetus to policy renewal rates and aided in better pricing in the first quarter. Per a report in Insurance Journal, Marsh stated that global commercial insurance rates improved by 1% on average in the first quarter of 2024.

Auto premiums are likely to have improved, given increased travel across the world. On the flip side, increased severity per claim due to higher vehicle repair and medical costs is likely to have affected the loss ratio.

A stronger mortgage market is likely to have favored mortgage insurance premiums. A low unemployment rate is likely to have aided commercial insurance and group insurance.

Life insurers have been redesigning products, focusing on protection products. The quarter is likely to have witnessed solid sales, given a rise in demand for protection products. Life insurers continue to roll out investment products that provide bundled covers of guaranteed retirement income, life and healthcare to cater to customers preferring policies with “living” benefits more than those with death benefits.

A larger investment asset base, higher reinvestment rate and alternative investments in an improved rate environment are likely to have aided net investment income, an important component of insurers’ top line.

Continued investment in technological advancements is likely to have saved costs and improved efficiency, in turn, leading to margin expansion. Share buybacks are expected to have provided an additional upside to the bottom line.

Potential Q1 Outperformers

Aflac provides supplemental health and life insurance products. Net premiums earned derived from growing cancer insurance sales coupled with cost-cutting initiatives, partly offset by the impact of paid-up policies, are expected to shape its quarterly results. Aflac’s revenues are likely to have benefited from strong contributions from its Japan and U.S. businesses. Improved net premiums earned in both Japan and U.S. businesses are expected to have driven the overall net premiums of Aflac. (Read more: Here's How You Should Play Aflac Ahead of Q1 Earnings).

The Zacks Consensus Estimate for first-quarter earnings is pegged at $1.58, indicating an increase of 1.9% from the year-ago reported figure. AFL has an Earnings ESP of +0.63% and a Zacks Rank #3.

Aflac Incorporated Price and EPS Surprise

Aflac Incorporated price-eps-surprise | Aflac Incorporated Quote

Axis Capital Holdings offers a broad range of specialty insurance and reinsurance solutions. AXS’ Insurance segment is likely to have benefited from a diversified portfolio of global specialty businesses, leadership positions and growth opportunities across major business lines. Rate increases in both its Insurance and Reinsurance segments are likely to have benefited the quarter’s performance. An increase in income from fixed maturities portfolio due to higher yields is likely to have favored net investment income. Continued share buyback boosted the bottom line.

The Zacks Consensus Estimate for AXS’ first-quarter earnings is pegged at $2.72, suggesting an increase of 15% from the year-ago reported figure. AXS has an Earnings ESP of +1.56% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axis Capital Holdings Limited Price and EPS Surprise

Axis Capital Holdings Limited price-eps-surprise | Axis Capital Holdings Limited Quote

Horace Mann Educators is the largest financial services company serving the U.S. educator market. Niche focus, improving product offerings, better pricing and a strengthened distribution model are likely to benefit first-quarter results. Earned premium growth ahead of loss cost growth is likely to have favored combined ratio. Continued share buybacks are expected to have boosted the bottom line.

The Zacks Consensus Estimate for HMN’s first-quarter earnings is pegged at 77 cents, suggesting an increase of 234.8% from the year-ago reported figure. HMN has an Earnings ESP of +15.03% and a Zacks Rank #3.

Horace Mann Educators Corporation Price and EPS Surprise

Horace Mann Educators Corporation price-eps-surprise | Horace Mann Educators Corporation Quote

Primerica is the second-largest issuer of term-life insurance coverage in North America. Solid sales growth, persistency and a strong network of life-licensed sales representatives are likely to aid PRI’s first-quarter results. Sales and policy persistency are likely to have benefited from the strong demand for protection products. Adjusted direct premiums are likely to have been driven by premiums from new sales. An improved interest rate environment is likely to have favored net investment income.

The Zacks Consensus Estimate for PRI’s first-quarter earnings is pegged at $4.11, suggesting an increase of 17.8% from the year-ago reported figure. PRI has an Earnings ESP of +0.46% and a Zacks Rank #3.

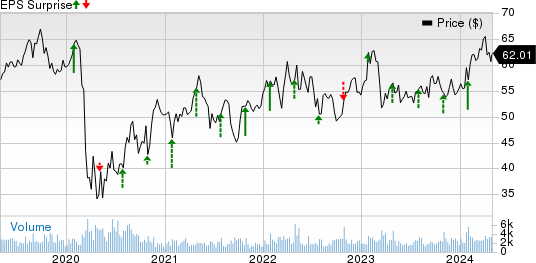

Primerica, Inc. Price and EPS Surprise

Primerica, Inc. price-eps-surprise | Primerica, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Primerica, Inc. (PRI) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance