4 HK-Listed Chinese Banks To Own As Asset Quality Improves

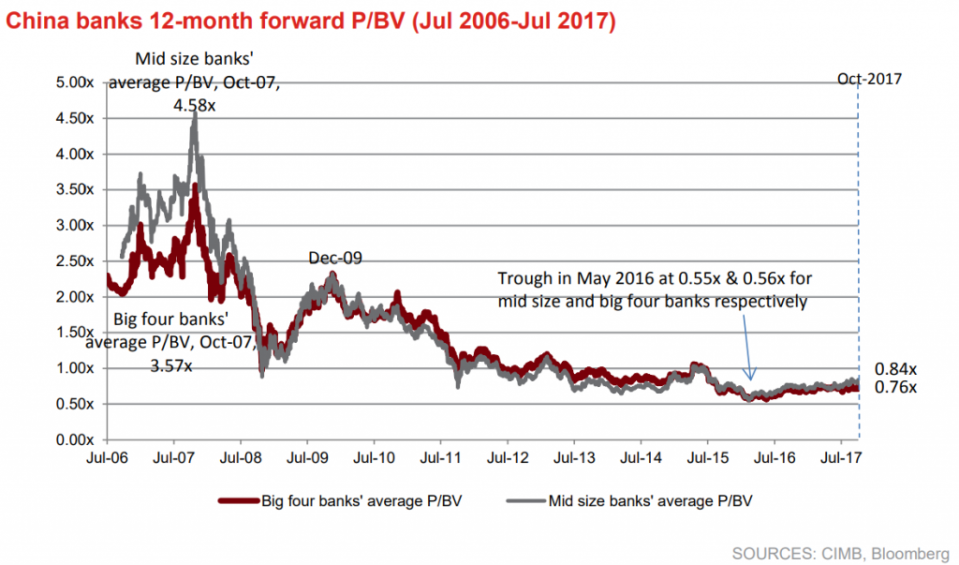

For years, Chinese banks have been experiencing PB de-ratings, and CIMB Research believes asset quality woes from China’s 2009 RMB4 trillion stimulus are the main reasons.

China’s banking sector forward P/BV multiples fell from 2.2x to a trough of 0.56x in Feb 2016.

‘True’ NPL falling, not just published NPL

Ever since 2009’s stimulus, Investors have been wary about the NPL ratios reported by Chinese banks.

Rather than looking at the banks’ published NPL ratios, investors are more concerned about the ‘True’ NPL, of which they believe is a more accurate depiction of the asset quality.

The ‘True’ NPL not only takes into account each bank’s loans, it also accounts for the shadow banking activities of banks.

CIMB Research notes that ‘True’ corporate NPL ratio has peaked at 15.1% in June. ‘True’ corporate NPL ratio fell to 12.3% in September.

Asset quality improvement assured by management’s guidance

But for the first time in six years, China banks’ management showed strong willingness to give investor guidance that the asset quality cycle has peaked.

This is a positive sign for the banking sector and assures investors that the banks’ asset quality outlook is improving.

According to CIMB Research, all reported asset quality metrics improved in 1H17 and should continue to improve in the near future.

With the Chinese banking sector set to experience a balance sheet-driven re-rating, CIMB Research recommends four Chinese banks that investors can invest to ride on the re-rating wave.

1. China Construction Bank

CIMB Research highlights China Construction Bank as one of the best capitalised among major banks in China.

Its core tier-1 ratio of 12.7% recorded at the half-year mark this year rivalled that of ICBC and was the highest in the industry. Other major banks’ average core tier-1 ratio is only 11.8%, almost 100 basis points lower.

Moreover, its loan-to-deposit ratio (LDR) of 76.9% recorded at the same time, was relatively low.

CIMB Research believes that investors will be more willing to pay a “valuation premium for strongly-capitalised banks with a low LDR, given the near-term tailwind from the current environment of elevated interest rates”.

Historically, China Construction Bank has one of the best cost-to-income ratio, ROA and ROE amongst the Chinese Banks.

CIMB Research: China Construction Bank (HKG: 0939) – BUY; Target Price HK$8.80

2. Bank of Communications

Bank of Communications is a proxy to the growing corporate loan in China and its corporate loans make up 67% of total loans in 1H17.

That is the highest among peers and well above the banking sector average of 55%.

Given that China’s economy is slowly strengthening, high corporate loan mix is well placed to drive Bank of Communications’ earnings.

CIMB Research: Bank of Communications (HKG: 3328) – BUY; Target Price HK$7.20

3. Bank of China

Bank of China is one of the few Chinese banks that has a larger-than-peer exposure to overseas business.

Given that the US is on a rate hike cycle, Bank of China will continue to ride on the benefits of rising interest rates.

Apart from that, Bank of China is also benefitting from China’s drive to liberalise the RMB as the main beneficiary amongst Chinese banks.

Moreover, moving forward, Bank of China will also be a primary beneficiary of China’s “One Belt One Road” policy to drive its loan business.

CIMB Research: Bank of China (HKG: 3988) – BUY; Target Price HK$5.20

4. Agricultural Bank of China

CIMB Research views Agricultural Bank of China as the best provisioned among the major banks in China.

Agricultural Bank of China’s loan loss reserve ratio of 4.0% at end-1H17 was the highest among the big four banks against the banking sector average of 2.7%.

With higher yields on interbank assets and an uptrend in loan yields, CIMB Research foresees Agricultural Bank of China’s net interest margins (NIM) to improve.

Above are just a few factors that will drive stronger earnings recovery for Agricultural Bank of China in the coming quarters.

Agricultural Bank of China (HKG: 1288) – BUY; Target Price HK$5.40

Yahoo Finance

Yahoo Finance