4 Dividend-Paying Tech Stocks to Curb Market Volatility Risk

The broader equity market has been hammered by recession fears, inflationary pressure and soaring interest rates. The ongoing Russia-Ukraine war has further increased worries for investors about the global economic recovery.

The major stock indexes, Dow Jones Industrial Average, Nasdaq Composite and S&P 500, have declined 9.5%, 34.7% and 20.6%, respectively, year to date (YTD).

Technology is among the most-battered sectors amid a broader market sell-off this year so far. Technology Select Sector SPDR Fund, which seeks to provide investment results that, before expenses, generally correspond to the price and yield performance of the Technology Select Sector Index, has lost approximately 30.2% of its value YTD.

Tech companies are witnessing lower demand for their products and solutions as organizations are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues. Additionally, the sector is suffering from inflationary pressure, higher wages and currency fluctuations. Supply-chain disruptions due to an acute shortage of chips and several other components are affecting the profitability of the companies in the space.

The aforementioned challenges are likely to persist in the near term, thereby negatively impacting the overall financial performances of the majority of tech stocks. We believe that investing in high-quality dividend-paying tech stocks like — NetApp NTAP, Avnet AVT, Broadcom AVGO and Texas Instruments TXN — amid the ongoing macroeconomic headwinds and the highly volatile market scenario might fetch handsome returns.

A stock with a history of increasing dividends is considered healthy and offers a capital appreciation opportunity irrespective of stock market movements. Dividend growth stocks generally act as a hedge against economic uncertainty and offer downside protection with a consistent increase in payouts.

How to Identify Stocks?

We ran the Zacks Stocks Screener to identify stocks that have a dividend yield in excess of 2% with five-year historical dividend growth of more than 0.1%. Furthermore, we have narrowed down our search by considering stocks with a Zacks Rank #3 (Hold) and a dividend payout ratio of less than 60%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s discuss the abovementioned tech stocks in detail:

NetApp provides enterprise storage as well as data management software and hardware products and services. This Sunnyvale, CA-based company’s product line comprises two storage platforms — the FAS storage platform and the E-Series platform. The company’s all-flash storage portfolio comprises NVMe-based storage systems and new cloud-based services in order to provide hybrid storage architecture.

NetApp is benefiting from continued strength in Hybrid Cloud and Public Cloud segments and robust billings growth. The company is well positioned to gain from data-driven digital and cloud transformations. Also, it is gaining from the higher clout of FAS hybrid arrays and storage systems portfolio. The rapid adoption of Azure NetApp Files, Amazon Web Services FSx for ONTAP and Google CVS is a tailwind. Recent collaborations with Kyndryl, NVIDIA and Alluxio bode well.

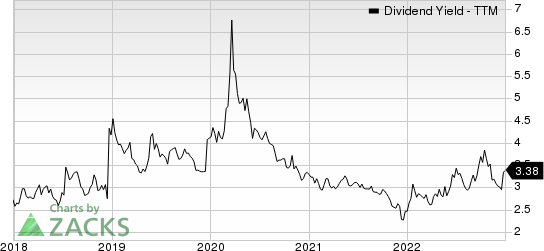

NTAP has a dividend yield of 3.4% and a five-year annualized dividend growth of 18%. Also, the company's payout ratio is 44% of earnings at present. Check NetApp’s dividend history here.

NetApp, Inc. Dividend Yield (TTM)

NetApp, Inc. dividend-yield-ttm | NetApp, Inc. Quote

Avnet is one of the world’s largest distributors of electronic components and computer products. The company’s customer base includes original equipment manufacturers, electronic manufacturing services providers, original design manufacturers, and value-added resellers. Avnet maintains an extensive inventory, including electronic products from more than 300 component and system manufacturers, which it distributes to customers worldwide.

Avnet is benefiting from robust demand for its products in the communication and defense market. Strong growth across all markets is a positive. Its continued focus on boosting Internet of Things capabilities is helping it expand in newer markets and gain customers. Avnet’s expanding partner base along with acquisitions are likely to boost top-line growth. Moreover, cost-saving efforts are aiding profitability.

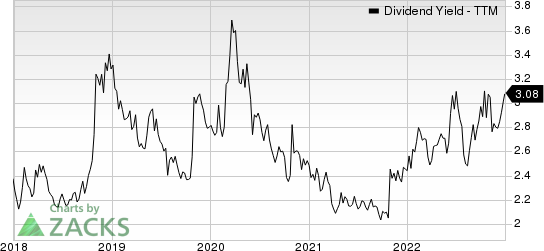

The company has a dividend yield of 2.8% and a five-year annualized dividend growth of approximately 7.7%. Its dividend payout ratio is 15% of earnings. Check Avnet’s dividend history here.

Avnet, Inc. Dividend Yield (TTM)

Avnet, Inc. dividend-yield-ttm | Avnet, Inc. Quote

Broadcom is a premier designer, developer and global supplier of a broad range of semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor (CMOS) based devices and analog III-V-based products.

Broadcom is benefiting from strong demand for its networking solutions, PON fiber and cable modems. The strong adoption of Broadcom’s server storage solutions by hyperscalers, acceleration in 5G deployment, production ramp-up and an increase in radio frequency content are driving top-line growth. Additionally, the robust adoption of Wi-Fi 6 and Wi-Fi 6E for access gateways, courtesy of solid demand from homes, enterprises, telcos and other service providers, is expected to continue driving revenue growth in the broadband end market.

The stock has a dividend yield of 3.3% and a five-year historical dividend growth of 26.3%. Further, AVGO's payout ratio is 47% of earnings at present. Check Broadcom’s dividend history here.

Broadcom Inc. Dividend Yield (TTM)

Broadcom Inc. dividend-yield-ttm | Broadcom Inc. Quote

Texas Instruments is an original equipment manufacturer of analog, mixed-signal and digital signal processing integrated circuits. The company has manufacturing and design facilities, including wafer fabrication and assembly/test operations in North America, Asia and Europe.

Texas Instruments is benefiting from a solid rebound in the automotive market. Further, solid demand environment in the industrial, communication equipment and enterprise systems markets is a major positive. Additionally, solid momentum across the Analog segment owing to robust signal chain and power product lines is contributing well to the top line. Also, the robust Embedded Processing segment is contributing well.

The company has a dividend yield of 3% and a five-year annualized dividend growth of approximately 15.7%. Its dividend payout ratio is 48% of earnings. Check Texas Instruments’ dividend history here.

Texas Instruments Incorporated Dividend Yield (TTM)

Texas Instruments Incorporated dividend-yield-ttm | Texas Instruments Incorporated Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Avnet, Inc. (AVT) : Free Stock Analysis Report

NetApp, Inc. (NTAP) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance