4 Blue-Chip Retail Stocks for a Balanced Investment Portfolio

Navigating the ever-changing stock market can be daunting for investors seeking both stability and growth. The current economic landscape, marked by high interest rates, persistent inflation and geopolitical tensions in the Middle East, exacerbates this challenge. Additionally, the Federal Reserve is anticipated to maintain current interest rates during its policy meeting as inflation remains above the 2% target and the economy continues to exhibit resilience.

Amid such a scenario, blue chip stocks offer a refuge of stability and potential growth. By focusing on established companies with strong financials and market leadership, investors can better navigate the complexities of today's market and position themselves for future success.

Blue-chip companies are less susceptible to sudden stock price fluctuations, making them a reliable choice for both experienced and novice investors. Moreover, for those seeking regular income, blue-chip companies provide steady dividend payouts, adding to their stability.

These companies boast a winning combination of established market positions, strong brand recognition, loyal customer bases and extensive market penetration. These traits give them a distinct competitive advantage, making them favorites among investors and unlocking new opportunities for growth.

For long-term stability, market experts incline toward highly reputable companies with substantial market capitalization. These industry giants showcase financial resilience and have a history of delivering robust returns to shareholders. Here, we have identified four stocks from the Retail - Wholesale sector — Walmart Inc. WMT, Costco Wholesale Corporation COST, The Home Depot, Inc. HD, and Lowe's Companies, Inc. LOW.

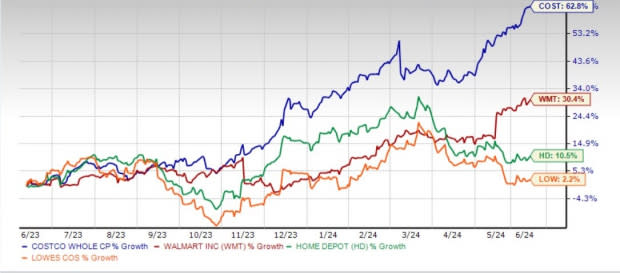

Past-Year Price Performance

Image Source: Zacks Investment Research

4 Prominent Picks

Walmart: This omnichannel retail giant has been diligently working to strengthen its already formidable presence in the market. The company has embarked on a series of strategic e-commerce initiatives, encompassing acquisitions, partnerships and significant improvements in its delivery and payment systems. Simultaneously, Walmart is committed to elevating its merchandise offerings, ensuring a diverse and appealing product assortment. Innovation extends to its supply chain, wherein the company is enhancing capacity and introducing cutting-edge solutions.

Walmart has a market cap of $538.6 billion as of Jun 10, 2024. This Zacks Rank #2 (Buy) stock has a trailing four-quarter earnings surprise of 8.3%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Walmart’s current financial-year sales and earnings suggests growth of 4.3% and 9%, respectively, from the year-ago reported numbers. The company pays out a quarterly dividend of about 21 cents per share (83 cents annualized). WMT’s payout ratio is 36, with a five-year dividend growth rate of 1.8%. (Check WMT’s dividend history here)

Costco: This consumer defensive stock has been surviving the market turmoil pretty well. Strategic investments, a customer-centric approach, merchandise initiatives and an emphasis on memberships have been this discount retailer’s primary strengths. Costco's distinctive membership business model and pricing power set it apart from traditional players. Through a calculated approach that involves identifying untapped markets and tailoring offerings to meet customer preferences, Costco has managed to deepen its roots.

Costco has a market cap of $376.1 billion. This Zacks Rank #3 (Hold) stock has a trailing four-quarter earnings surprise of 2.3%, on average.

The Zacks Consensus Estimate for Costco’s current financial-year sales and EPS implies growth of 4.9% and 9.9%, respectively, from the year-ago period’s actuals. The company pays out a quarterly dividend of $1.16 per share ($4.64 annualized). COST’s payout ratio is 29, with a five-year dividend growth rate of 11.7%.

Home Depot: Headquartered in Atlanta, GA, this company stands as another distinguished blue-chip stock, dominating the home improvement retail sector. Its consistent expansion in both Professional and Do-It-Yourself segments, fortified by an extensive product lineup and digital innovations, underpins its remarkable success. The company's interconnected retail strategy and robust technological infrastructure have amplified web traffic, leading to growth in digital sales. Moreover, as mortgage rates decline, it could potentially stimulate homebuying activity and subsequently drive demand for renovation and remodeling projects.

Home Depot has a market cap of $329.8 billion. This Zacks Rank #3 stock has a trailing four-quarter earnings surprise of 2%, on average.

The Zacks Consensus Estimate for Home Depot’s current financial-year sales and EPS calls for growth of 1% and 1.3%, respectively, from the year-ago period’s actuals. The company pays out a quarterly dividend of $2.25 ($9.00 annualized) per share. HD’s payout ratio is 60, with a five-year dividend growth rate of 11.1%.

Lowe's Companies: Lowe’s has demonstrated remarkable adaptability in responding to evolving consumer behaviors and market dynamics. The company has recalibrated its strategies to focus on smaller, non-discretionary projects and enhance value propositions for customers. Initiatives like the MyLowe’s Rewards loyalty program and investments in omnichannel experiences underscore Lowe’s commitment to meeting evolving consumer needs and driving long-term growth. The Pro segment remains a significant growth driver for Lowe’s, with the company leveraging its multi-year strategy to enhance product offerings, fulfillment options and the overall shopping experience for professional customers.

Lowe's Companies has a market cap of $124.3 billion. This Zacks Rank #3 stock has a trailing four-quarter earnings surprise of 2.8%, on average. The company pays out a quarterly dividend of $1.15 per share. LOW’s payout ratio is 35, with a five-year dividend growth rate of 21.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance