With A 34% Price Drop For Metis Energy Limited (SGX:L02) You'll Still Get What You Pay For

Metis Energy Limited (SGX:L02) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 42% in that time.

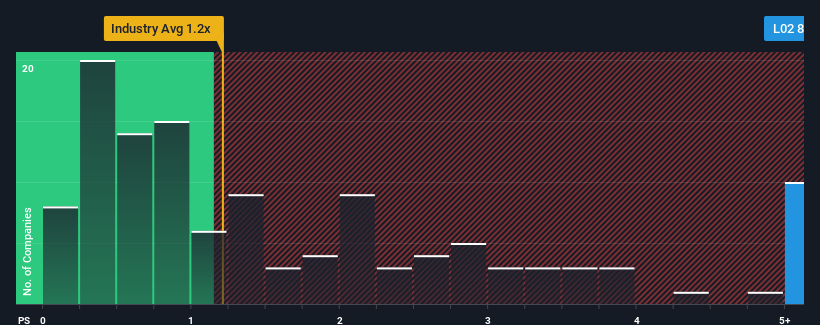

In spite of the heavy fall in price, given around half the companies in Singapore's Shipping industry have price-to-sales ratios (or "P/S") below 2.2x, you may still consider Metis Energy as a stock to avoid entirely with its 8.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Metis Energy

How Has Metis Energy Performed Recently?

Revenue has risen firmly for Metis Energy recently, which is pleasing to see. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Metis Energy, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

How Is Metis Energy's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Metis Energy's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. Revenue has also lifted 18% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 9.4% shows it's a great look while it lasts.

With this information, we can see why Metis Energy is trading at a high P/S compared to the industry. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

What We Can Learn From Metis Energy's P/S?

A significant share price dive has done very little to deflate Metis Energy's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As detailed previously, the strength of Metis Energy's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Metis Energy (1 makes us a bit uncomfortable!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance