3 Ways Singaporean Investors Can “Trump-Proof” Their Portfolios

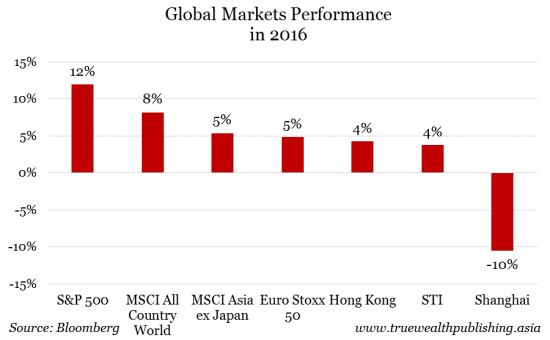

2016 was kind to investors. Most major stock markets saw positive returns – including Singapore’s STI. But positive performance in 2017 will be made more challenging with a new American president who claimed Singapore was stealing jobs from America during his campaign, and vows to cancel a trade agreement that would have boosted Singapore’s economy. With a cloud of uncertainty hanging over this year’s global markets – especially for Singapore – now is a good time to take stock and make sure your portfolio is protected. Singapore’s STI climbed 4 percent last year. The S&P 500 was up 12 percent; the MSCI All Country World Index was up 8 percent; the MSCI Asia ex Japan Index gained 5 percent. Even troubled Europe’s markets had a positive year, up 5 percent. In fact, one of the only major markets that had a negative year was China – the Shanghai Composite lost 10 percent in 2016.

After a relatively good run, it’s easy to think that next year will be more of the same. But this status quo bias is the enemy of portfolio performance. Investing is like driving: It’s best to be defensive. So here are three steps you should take to ensure that you’re not caught off guard in 2017. (If you want to learn more, click here for our free special report about what President Trump means for you and your portfolio.)

There's never been a better time to diversify internationally

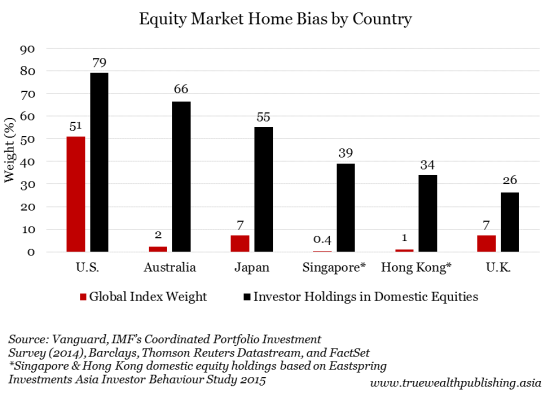

It’s never a bad idea to diversify and hold uncorrelated assets. This involves investing in different asset classes (like stocks and bonds), and different sectors and companies – ideally ones that won’t all move in the same direction at the same time. But it’s also important to diversify by geography. The problem is most investors invest way too much in their home country. For instance, even though Singapore’s stock market is only 0.4 percent of the world total, Singaporeans invest about 39 percent in domestic equities. One study showed that the average American with a stock portfolio has 79 percent of her money in U.S.-listed stocks – while U.S. stocks accounted for just slightly over half of the world’s total market capitalisation. Investors in Japan put about 55 percent of their money in Japan-listed stocks, although Japanese shares were just 7 percent of the total. And people in Australia have two-thirds of their portfolio in local stocks, which accounted for only 2 percent of the world’s shares.

So make sure to show your portfolio the world. It’s true that most of the world’s markets tend to move in the same direction at the same time – correlations have been climbing over the past decade. But the better reason to diversify globally is to help boost your returns. For example, and as shown in an earlier chart, Singapore’s STI was only up 4 percent last year. But the MSCI All Country World Index grew by 9 percent. The S&P 500 was up 12 percent. And Thailand’s market saw excellent performance, gaining 16 percent. Including these other markets in your portfolio would have boosted your portfolio’s returns in 2016.

Hold more cash

You’d be smart to have more cash in your portfolio. Yes, it doesn’t pay much, its value erodes over time (thanks to long-term inflation), and if you lose it (or put it through the washing machine), it’s gone forever. But, over the short term – like the next year or so – the value of your cash stays constant (unless you live in Venezuela or Zimbabwe). And the value of your cash won’t change if markets crash. Holding cash is one of the easiest ways to hedge your portfolio. Hedging helps reduce investment losses when your investment strategy doesn’t work out as planned. Here’s an example of how it works… Let’s say you have $50,000 in stocks and an equal sum in cash, for a total portfolio value of $100,000. Then let’s say the stocks drop 5 percent, but the cash’s value stays the same. This means that you have a paper loss of $2,500 on a $100,000 portfolio – down 2.5 percent. But if the entire portfolio was in stocks, the loss would be $5,000, or 5 percent. So, cash was the perfect hedge, cutting your losses in half.

Plus, having some cash on hand lets you take advantage of any great investment opportunities that may come up. It lets you pick up “money lying in the corner.” So take some profits off the table to free up some cash.

Own gold

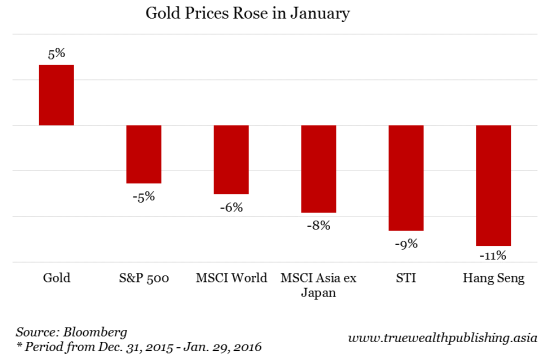

Gold seems to have been forgotten by investors following Trump’s election win. But gold remains one of the best hedges against market volatility because it moves independently of other asset classes, like stocks or bonds. For instance, about this time last year, markets were reeling due to worries over China’s economy and the devaluation of the renminbi. Many markets around the world entered bear market territory – meaning they were down 20 percent from their recent peaks. Singapore’s Straits Times Index lost 9 percent that month. And the MSCI World Index was down 6 percent. But gold gained 5 percent last January… on its way to its best quarterly performance since 1986.

And even though gold prices fell towards the end of last year, are up about four percent so far in 2017. And there are a number of compelling reasons to own gold right now. (We outline the entire case for gold in a special report you can download here, for free.) These include: China and the Muslim world are gold buyers China has been aggressively accumulating gold over the last few years. Look for China to accelerate buying into the current weakness in gold prices. Also, the new Sharia Gold Standard (approved on December 5, 2016) allows gold-based Sharia-compliant products to be offered throughout the Muslim world. This allows the world’s 1.6 billion Muslims to enter the gold market. Brexit worries and global uncertainty Gold’s recent highs, in the summer of 2016, came after the U.K.’s vote to withdraw from the EU. Since that spike in global fear and uncertainty, Brexit concerns have ebbed but could be ready for a resurgence. However, Britain’s withdrawal is likely to get increasingly messy. There are now fears that other countries could look to exit the EU. Worries of Europe’s biggest bank, Deutsche Bank, going bust are a wildcard with far-reaching implications for the global economy and markets. The Trump effect The anti-government, protectionist sentiment that’s given rise to Donald Trump is a global phenomenon and will have unknown worldwide repercussions in the months ahead. Gold has historically done well when there is a high level of global uncertainty. Finally, you an own assets that stand to benefit from the actions of President Donald Trump. For example, one of the world’s cheapest stock markets offers opportunities… and we recently highlighted an asset that stands to rise if a U.S.-China trade war happens. You can find out all the details, and learn how to subscribe, by clicking here.

Kim Iskyan

Yahoo Finance

Yahoo Finance