3 US Growth Companies With Insider Ownership As High As 27%

The United States stock market has shown robust performance, rising 1.7% over the past week and achieving a 26% increase over the last year, with earnings projected to grow by 15% annually. In this thriving environment, stocks with high insider ownership can be particularly appealing as they often indicate a strong alignment of interests between company management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 26% | 21% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 22.4% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 77.5% |

Capital Bancorp (NasdaqGS:CBNK) | 34.9% | 27.2% |

Neonode (NasdaqCM:NEON) | 24.7% | 158% |

Let's explore several standout options from the results in the screener.

Liquidia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Liquidia Corporation is a biopharmaceutical company based in the United States that focuses on developing, manufacturing, and commercializing products designed to address unmet patient needs, with a market capitalization of approximately $970.82 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, amounting to $15.97 million.

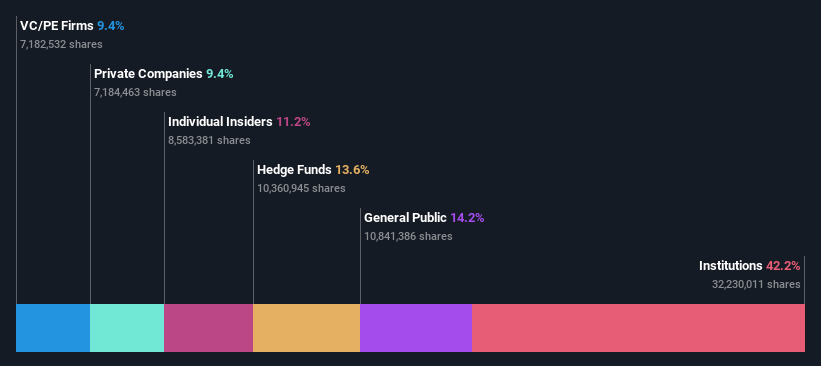

Insider Ownership: 11.2%

Liquidia, a company with significant insider transactions recently, shows a mixed financial picture. Despite reporting a substantial increase in losses in Q1 2024 (US$40.93 million from US$11.75 million year-over-year) and a decrease in sales to US$2.97 million from US$4.49 million, the firm is expected to grow revenue by 37.8% annually, outpacing the market's 8.3%. Furthermore, Liquidia is forecasted to turn profitable within three years, indicating potential for growth despite recent setbacks and ongoing legal challenges regarding its new drug application for YUTREPIA™.

Afya

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Afya Limited is a medical education group based in Brazil with a market capitalization of approximately $1.71 billion.

Operations: The company generates its revenue through its operations in the medical education sector in Brazil.

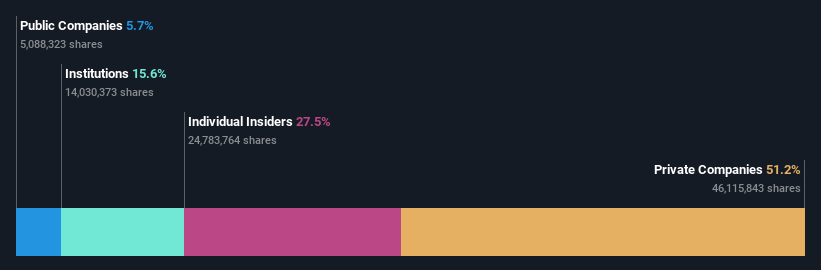

Insider Ownership: 27.5%

Afya, a growth-oriented company with high insider ownership, has demonstrated robust financial performance. In the first quarter of 2024, Afya reported a significant increase in net income to BRL 203.39 million from BRL 112.12 million year-over-year and reaffirmed its revenue guidance for the year at around BRL 3.15 billion to BRL 3.25 billion. Despite slower forecasted revenue growth at 8.5% annually compared to higher market averages, Afya's earnings are expected to grow significantly over the next three years, underpinned by a strong past earnings growth rate of 22.7% per annum over five years and trading well below its estimated fair value.

Navigate through the intricacies of Afya with our comprehensive analyst estimates report here.

Our valuation report here indicates Afya may be undervalued.

Genius Sports

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Genius Sports Limited specializes in providing technology-driven products and services to the sports, sports betting, and sports media industries, with a market capitalization of approximately $1.16 billion.

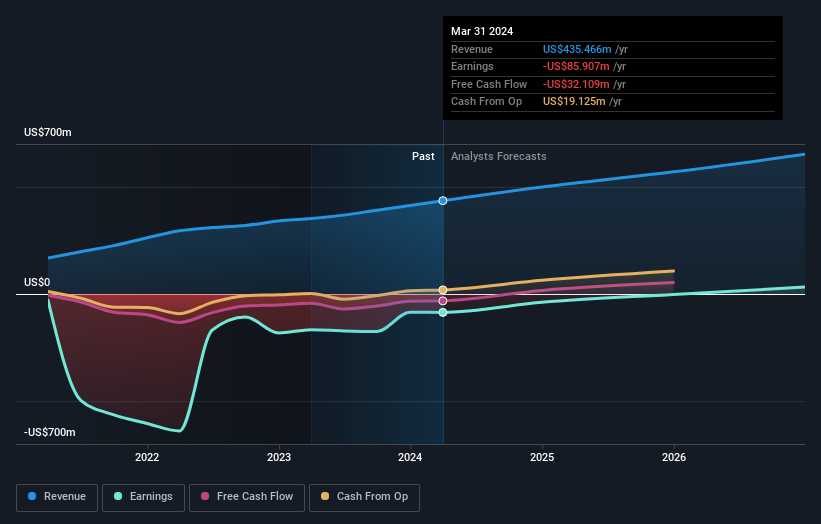

Operations: The company generates revenue primarily through its data processing segment, which reported earnings of $435.47 million.

Insider Ownership: 11.8%

Genius Sports, a company with high insider ownership, reported Q1 2024 sales of US$119.72 million, reflecting an increase from the previous year. Despite a consistent net loss of US$25.54 million, the firm is optimistic, projecting annual revenues to reach US$500 million by year-end. The company's revenue growth is expected to outpace the market average significantly at 13.7% annually. However, challenges remain with a low forecasted return on equity and ongoing profitability concerns as it strives for its first profitable year within three years.

Key Takeaways

Explore the 176 names from our Fast Growing US Companies With High Insider Ownership screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:LQDA NasdaqGS:AFYA and NYSE:GENI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance