3 Technology Stocks With Modest Dividend Yield to Bet On

Technology stocks have been among the worst performers in 2022 so far. The Zacks Computer and Technology sector has plunged 29% year to date (YTD), while the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 indexes have fallen 12.6%, 24.2% and 17.2%, respectively.

The sector is suffering from inflationary pressure, higher wages and currency fluctuations. Supply-chain disruptions due to an acute shortage of chips and several other components are affecting the profitability of the companies in the space. Additionally, the ongoing Russia-Ukraine war has increased worries for investors about the near-term prospects of tech companies.

Enterprises are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues. In July 2022, Gartner lowered its forecast for worldwide IT spending growth rate to 3% from 4% mentioned earlier. The research firm’s report highlights that 2022 IT spending growth will be much slower than 2021 due to spending cutbacks across devices, software, IT services and communication services areas.

The aforementioned challenges are likely to persist in the near term, thereby negatively impacting the overall financial performances of the majority of tech stocks. But does that mean investors interested in tech stocks should stay away from investing in the space?

We believe that amid the ongoing macroeconomic headwinds and highly volatile market scenario, investing in high-quality dividend-paying tech stocks like —Texas Instruments Incorporated TXN, ASE Technology Holding Co., Ltd. ASX and Vishay Intertechnology, Inc. VSH — might fetch you handsome returns.

A stock with a history of increasing dividends is considered healthy and offers a capital appreciation opportunity irrespective of stock market movements. Dividend growth stocks generally act as a hedge against economic uncertainty and offer downside protection with a consistent increase in payouts.

Picking the Right Dividend Stocks

We have run the Zacks Stocks Screener to identify stocks that have a dividend yield in excess of 2% with five-year historical dividend growth of more than 0.1%. Furthermore, we have narrowed down our search by considering stocks considering with a Zacks Rank #2 (Buy) and a dividend payout ratio of less than 60%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s discuss the abovementioned tech stocks in detail:

Texas Instruments is an original equipment manufacturer of analog, mixed signal and digital signal processing (DSP) integrated circuits. The company is benefiting from a solid rebound in the automotive market.

The solid demand environment in the industrial, communication equipment and enterprise systems markets is a major positive. Additionally, strong momentum across the Analog segment, owing to robust signal chain and power product lines, is contributing well to the top line. Also, the robust Embedded Processing segment is performing well.

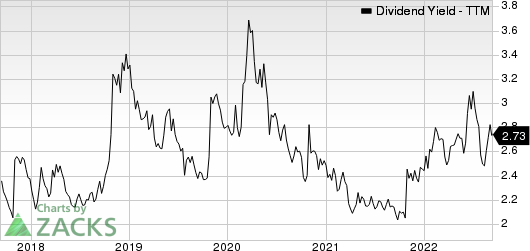

The stock has a dividend yield of 2.77% and a five-year historical dividend growth of 17.38%. Further, TXN's payout ratio is 50% of earnings at present. Check Texas Instruments’ dividend history here.

Texas Instruments Incorporated Dividend Yield (TTM)

Texas Instruments Incorporated dividend-yield-ttm | Texas Instruments Incorporated Quote

ASE Technology is a provider of semiconductor manufacturing services in assembly and testing. The company develops and offers complete turnkey solutions covering front-end engineering testing, wafer probing and final testing as well as IC packaging, materials and electronic manufacturing services.

ASE Technology has been benefiting from increasing demand in multi-die and co-packaging platforms. It recently unveiled an advanced packaging platform VIPack to enable vertically integrated package solutions. The launch of VIPack is a positive as it represents ASE’s next-generation 3D heterogeneous integration architecture that extends design rules and achieves ultra-high density and performance.

Solid demand for traditional electronic manufacturing services and System-in-Package services are contributing well to top-line growth. Additionally, ASX’s ability to cater to high volume and reliable business needs is noteworthy.

The company has a dividend yield of 6.31% and a five-year annualized dividend growth of 10.52%. Its dividend payout ratio is 29% of earnings. Check ASE Technology’s dividend history here.

ASE Technology Holding Co., Ltd. Dividend Yield (TTM)

ASE Technology Holding Co., Ltd. dividend-yield-ttm | ASE Technology Holding Co., Ltd. Quote

Vishay Intertechnology is a global manufacturer and supplier of semiconductors and passive components. The company’s products include metal oxide semiconductor field-effect transistors (MOSFETs), Diodes and Optoelectronic Components.

Vishay Intertechnology is steadily gaining from its robust resistor, diode, capacitor, inductor and optoelectronics product lines. Further, a recovery in the automotive sector and strong momentum across the industrial, telecommunications, power supplies markets are driving the top line.

In addition, Vishay Intertechnology’s robust magnetics is continuously driving the specialty business. Further, growing momentum across the areas of power transmission and electro cars with the help of robust capacitors is a tailwind. Additionally, VSH’s firm focus on expanding its manufacturing capacities remains a major driver.

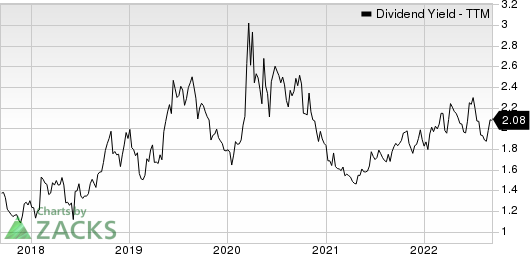

VSH has a dividend yield of 2.1% and a five-year annualized dividend growth of 8.12%. Also, the company's payout ratio is 14% of earnings at present. Check Vishay Intertechnology’s dividend history here.

Vishay Intertechnology, Inc. Dividend Yield (TTM)

Vishay Intertechnology, Inc. dividend-yield-ttm | Vishay Intertechnology, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

ASE Technology Holding Co., Ltd. (ASX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance