3 Stocks Set to Race Ahead in 2023

It looks like we’re back to the “good news is bad news” scenario because the latest economic data (rising consumer prices, rising producer prices, stronger-than-expected retail sales, weaker-than-expected unemployment insurance) are all pointing to an economy that’s more resilient than anyone, and particularly the Fed, was expecting. Some of the big banks have also upped their GDP expectations (of which we'll see a new revision this week).

While a single month can hardly be considered a trend, the breadth of positive numbers shows that we could easily have a scenario where the economy continues to grow while inflation remains sticky at a much higher level (maybe around the current 5-ish percent) than desired (about 2%).

For investors, what this means is that the Fed will continue to hike rates, at perhaps an accelerated rate. The voices on the street that were saying that the Fed slowed down sooner than it should have are growing louder. And they appear to be right. But this is a tight rope that’s really hard to walk when we’re trying our best to avoid a recession.

From the looks of things, the Fed is going to come down very strongly now, sending rates higher than the previously estimated 5-5.5% and then holding them there longer. This could easily send us into a hard landing/recession.

Be that as it may, there are certain segments of the market that will do better than others. And it may be a good idea to increase your exposure in these areas. With that in mind, I’ve picked 3 stocks that are currently expected to do well in the case of any eventuality.

Kinross Gold Corporation KGC

Headquartered in Toronto, Canada, Kinross Gold acquires, explores and develops gold properties principally in the U.S., Brazil, Chile and Mauritania. It is also involved in the extraction and processing of gold-containing ores; reclamation of gold mining properties; and production and sale of silver.

When rates are headed higher, treasuries follow suit, attracting more funds from aboard, which therefore tends to make the dollar stronger as well. This is negative for gold because both the dollar and treasuries make good investments. But China’s reopening should also be considered a big positive for the industry this year because China is the world’s biggest consumer of gold.

Additionally, gold is valuable because of its stability and if anything, this is likely to be another volatile year for the stock markets. 2024 could follow in the same direction. The Zacks Industry Rank for the Mining – Gold industry places the industry in the top 25% of Zacks-classified industries. Therefore, adding a little exposure to gold may be a positive for the long term.

Kinross Gold seems like a good bet based on numbers that are available to us now. The Zacks Rank #2 (Buy) stock beat estimates in the last quarter by 2 cents (28.6%). It is seeing upward revision in its estimates (by 3 cents in 2023 and by 2 cents in 2024 over the last 7 days). Analysts currently expect its revenues to grow 5.9% in 2023, followed by a 5.3% decline in 2024.

Earnings are, however, expected to grow a respective 81.8% and 43.1%. The stock seems ideal for all investors, whether with a Value, Growth or Momentum focus based on our style score system (Value A, Growth B, Momentum A).

At 9.1X P/E, Kinross is also deeply undervalued with respect to both the industry and the S&P 500. It is currently trading at a discount of 49.5% to the industry and 50.5% to the S&P. It’s also trading at a 18.5% discount to its own median value over the last five years.

Meta Platforms, Inc. META

Menlo Park, CA-based Meta Platforms owns and operates some of the most popular social media platforms in Facebook, Instagram, Whatsapp, etc. Its two operating segments are Family of Apps (FoA) and Reality Labs (RL). The Family of Apps segment includes Facebook, Instagram, Messenger and WhatsApp. The Reality Labs segment provides augmented and virtual reality related products including consumer hardware, software and content. Most of the revenue and expenses, including capital expenses, are in the FoA segment.

In the last earnings release, Meta detailed a massive restructuring initiative, which will include the consolidation/subleasing/early termination/abandoning of its office spaces and trimming its workforce by 11,000. This, according to management will align the company with its longer-term strategic imperatives. While there will be related charges to the tune of a billion dollars to contend with (this year), the resultant downscaling will have a positive impact on profitability.

Revenue is not the strongest we have seen in the past as year-on-year comparisons are hurt not only by the significant decline in the price per ad but also because of a negative currency effect. Importantly, ad impressions continue to grow strongly, helped by steady growth in daily and monthly users.

The Zacks Rank #2 stock has scored a B for Value, Growth and Momentum. The Internet – Software industry to which it belongs is in the top 30%. The buy rank and placement of the industry in the top 50% of Zacks-classified industries are a solid combination that has historically resulted in above-market performance in the near term.

In this case, this data is supported by the 2023 EPS, which is up $1.73 (21.8%) in the last 30 days. The 2024 estimate is also encouraging, rising $1.99 (20.9%) over the past month. This represents 1.8% earnings decline in 2023 followed by an 11.4% increase in 2024. Revenue is, however, expected to grow 4.5% this year and 11.4% in the next. For anyone doubting Meta’s ability to beat estimates, it may be worth mentioning that it beat by 41.5% in the last quarter.

At 17.5X earnings, the shares are trading at a 20.5% discount to its median value over the last five years. It’s also a slight discount of around 5.0% to the S&P 500 and a 64.0% discount to the industry.

Weatherford International plc WFRD

Houston, Texas-based Weatherford provides equipment and services for the drilling, evaluation, completion, production and intervention of oil, geothermal and natural gas wells worldwide. It operates through the Drilling and Evaluation; Well Construction and Completions; and Production and Intervention segments.

While oil prices have been treading water this year, there’s reason to believe that things may change as we move through the year. An economic slowdown is always bad news for oil prices and the ongoing uncertainty with rate hikes is leading to conflicting analyses from market watchers. The US government’s decision to sell 26 million barrels of crude from its Strategic Petroleum Reserves also isn’t helping.

But the resultant increase in supply is a very short-term thing. Looking a little further out, it’s clear that producers will not be increasing capacity much because of the long-term goal of moving away from fossil fuels. At the same time, China, which has several new refineries set to move into action is getting back into the equation this year.

This along with the OPEC+ decision to curb production by 2 million barrels per day until the end of the year -- and Russia’s decision to cut production by 500,000 bpd in March, after the West’s price caps on Russian oil and oil products -- all point toward lower supply, and therefore, higher prices. Therefore, it’s hardly any wonder that the Oil and Gas - Field Services industry is in the top 22% of Zacks industries.

Zacks #2 ranked Weatherford looks good because of the strong estimate revisions trend: the 2023 EPS estimate is up $1.23 (44.6%) in the last 30 days while the 2024 estimate is up $1.61 (40.5%). Revenue is expected to grow 12.8% in 2023 and 10.4% in 2024 with earnings growing 364.0% and 40.0%, respectively. Therefore the 33.3% earnings beat in the last quarter is not expected to be a one-off thing and justifies the #2 rank and style scores of B for Value, A for Growth and B for momentum.

Weatherford has not generated profits in all of 2022. Therefore, a P/E valuation may not be appropriate. Its P/S valuation of 0.91 indicates that investors are not fully valuing its sales potential. Both the S&P 500 and the relevant industry have significantly higher valuations.

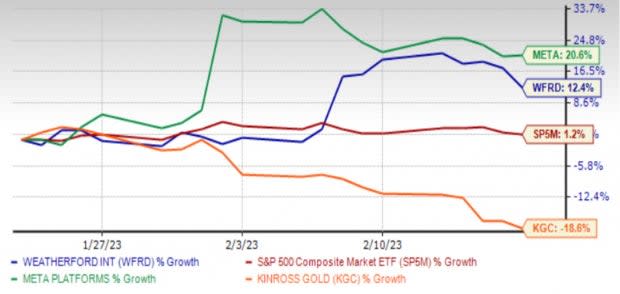

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Weatherford International PLC (WFRD) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance