3 Steel Producer Stocks to Escape Industry Headwinds

The Zacks Steel Producers industry has lost momentum after enjoying a strong recovery during the final quarter of 2023 as steel prices have come under pressure since the beginning of this year. Soft demand in China amid the economic slowdown is also a concern.

However, improved demand in the automotive space and a resilient non-residential construction market augur well for the industry. Industry players like Steel Dynamics, Inc. STLD, Ternium S.A. TX and Universal Stainless & Alloy Products, Inc. USAP are worth a look despite near-term headwinds.

About the Industry

The Zacks Steel Producers industry serves a vast spectrum of end-use industries such as automotive, construction, appliance, container, packaging, industrial machinery, mining equipment, transportation, and oil and gas with various steel products. These products include hot-rolled and cold-rolled coils and sheets, hot-dipped and galvanized coils and sheets, reinforcing bars, billets and blooms, wire rods, strip mill plates, standard and line pipe, and mechanical tubing products. Steel is primarily produced using two methods — Blast Furnace and Electric Arc Furnace. It is regarded as the backbone of the manufacturing industry. The automotive and construction markets have historically been the largest consumers of steel. Notably, the housing and construction sector is the biggest consumer of steel, accounting for roughly half of the world’s total consumption.

What's Shaping the Future of the Steel Producers' Industry?

Weaker Steel Prices to Hurt Margins: U.S. steel prices saw a significant downward correction after a strong run during the first three months of 2023. The benchmark hot-rolled coil (HRC) prices tumbled more than 40% from their April 2023 peak of around $1,200 per short ton to below the $700 per short ton level in late September. The downside was partly driven by shorter lead times. The United Auto Workers (UAW) strike and the lower cost of raw materials also weighed on HRC prices. Nevertheless, U.S. steel prices rebounded during the fourth quarter, with HRC prices breaking above $1,000 per short ton in December, driven by U.S. steel mills’ price hike actions and the resolution to the UAW strike. However, the upward momentum has lately hit a speed bump. HRC prices have again come under pressure since the start of 2024 on a pullback in steel mill lead times. Increased imports have also put pressure on steel prices. As such, lower realized prices are expected to weigh on the profitability and cash flows of steel-producing companies over the near term.

Slowdown in China a Concern: Steel demand in China, the world’s top consumer of the commodity, has softened due to a slowdown in the country’s economy, following a protracted property crisis and weak global demand. The real estate sector has taken a hard hit amid a decline in new home prices, property investment and housing sales. Notably, real estate accounts for roughly 40% of China's steel consumption. A slowdown in manufacturing activities has led to a contraction in demand for steel in China. The manufacturing sector has taken a beating due to weaker external demand for manufactured goods and a slowdown in infrastructure spending. China has also seen a slowdown in the construction sector. The sluggishness in these key steel-consuming sectors is expected to hurt demand for steel over the short term.

Strong Demand in Major Markets Bode Well: Steel producers are set to gain from strong demand across major steel end-use markets, including automotive and construction. They are expected to benefit from higher order booking from the automotive market. Steel demand in automotive is expected to rise on the back of an easing global shortage in semiconductor chips that has weighed heavily on the automotive industry for nearly two years. Also, the UAW reached a deal with the Detroit Big Three in November 2023, ending the roughly six-week strike that weighed on the U.S. steel industry due to a slowdown in automotive demand. The resolution to the UAW strikes augurs well for steel demand. Meanwhile, order activities in the non-residential construction market remain strong, underscoring the inherent strength of this industry. Demand in the energy sector has improved on the back of strength in oil and gas prices. Favorable trends across these markets bode well.

Zacks Industry Rank Indicates Downbeat Prospects

The Zacks Steel Producers industry is part of the broader Zacks Basic Materials Sector. It carries a Zacks Industry Rank #210, which places it at the bottom 16% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates a gloomy near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Despite the industry’s bleak near-term prospects, we will present a few stocks worth considering for your portfolio. But before that, it’s worth taking a look at the industry’s stock market performance and current valuation.

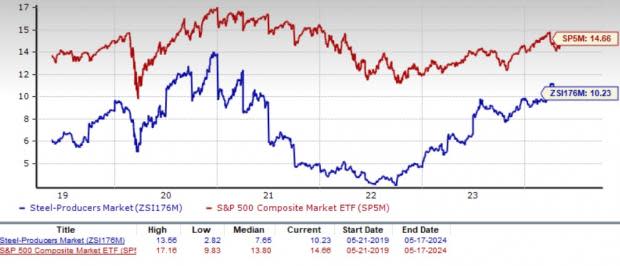

Industry Underperforms S&P 500

The Zacks Steel Producers industry has underperformed the Zacks S&P 500 composite while outperforming the broader Zacks Basic Materials sector over the past year.

The industry has gained 16.8% over this period compared with the S&P 500’s rise of 26.6% and the broader sector’s increase of 12.9%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing steel stocks, the industry is currently trading at 10.23X, below the S&P 500’s 14.66X and the sector’s 12.14X.

Over the past five years, the industry has traded as high as 13.56X, as low as 2.82X and at the median of 7.65X, as the chart below shows.

Enterprise Value/EBITDA (EV/EBITDA) Ratio

Enterprise Value/EBITDA (EV/EBITDA) Ratio

3 Steel Producers Stocks to Invest In

Steel Dynamics: Based in Indiana, Steel Dynamics is a leading steel producer and metals recycler in the United States. It benefits from strong momentum in the non-residential construction sector driven by healthy customer order activity. Steel Dynamics is also currently executing a number of projects that should add to its capacity and boost profitability. STLD is ramping up operations at its new state-of-the-art electric arc furnace flat-rolled steel mill in Texas. Moreover, the value-added flat-rolled steel coating lines, consisting of two paint lines and two galvanizing lines, will enhance the annual value-added flat-rolled steel capacity.

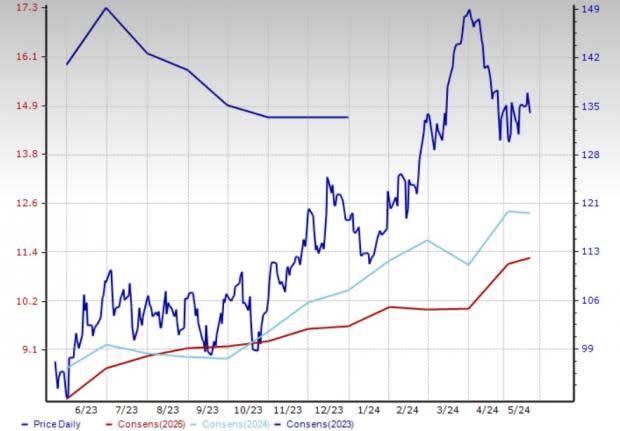

Steel Dynamics carries a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for 2024 earnings for STLD has been revised 10.2% upward over the past 60 days. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: STLD

Ternium: Based in Luxembourg, Ternium is a leading producer of flat and long steel products in Latin America. It is expected to benefit from strong demand for steel products. Its shipments in Mexico are likely to be aided by healthy demand from industrial customers and a rebound in the commercial market. TX is seeing increased demand in most industrial sectors, including automotive, in Mexico. Demand in automotive remains strong in Brazil while lower interest rates and infrastructure projects are expected to contribute to a pick-up in construction activities. Moreover, the company is benefiting from the cost competitiveness of its facilities. It is also taking actions to boost liquidity and strengthen its financial position.

Ternium carries a Zacks Rank #3. TX beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters. In this time frame, it has delivered an average earnings surprise of roughly 37.5%.

Price and Consensus: TX

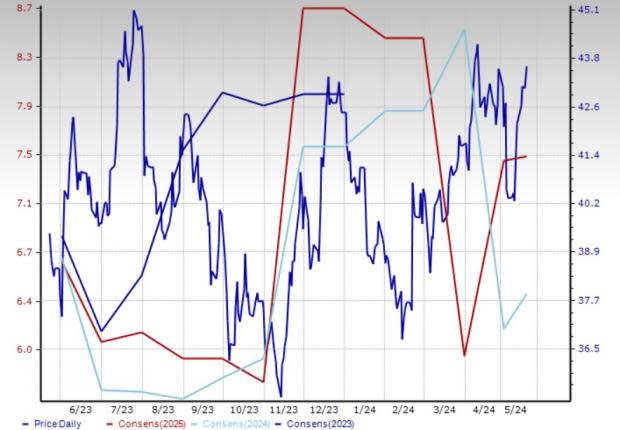

Universal Stainless & Alloy Products: Pennsylvania-based Universal Stainless & Alloy Products, carrying a Zacks Rank #3, makes and markets finished and semi-finished specialty steels, including stainless steel, tool steels and other alloy steels. The company is benefiting from strengthening demand in the aerospace market, which is driving its premium alloy sales and the top line. USAP is seeing strong growth in aerospace sales courtesy of increased demand for new airplanes backed by a recovery in air travel. The company is also gaining from a favorable product mix. The completion of its capital project is expected to enable the expansion of its portfolio with technologically advanced, higher-margin products.

Universal Stainless & Alloy Products has a projected earnings growth rate of 183% for 2024. The Zacks Consensus Estimate for 2024 earnings has been stable over the past 60 days.

Price and Consensus: USAP

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Ternium S.A. (TX) : Free Stock Analysis Report

Universal Stainless & Alloy Products, Inc. (USAP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance