3 Must-Own Blue Chips In The Great Stock Market Sale

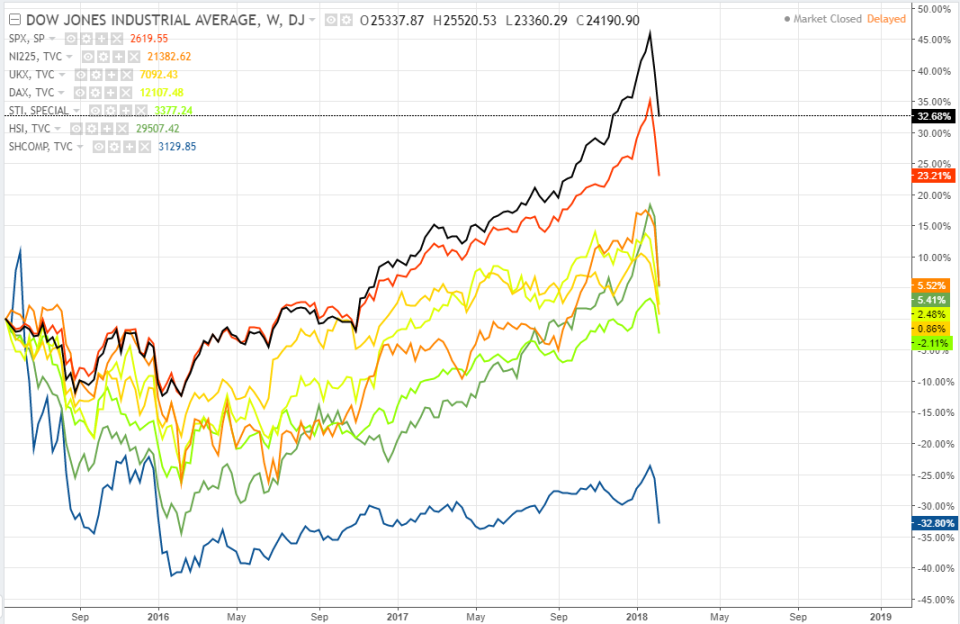

The global stock market suffered its worst week since the global financial crisis in 2008. After all, when Wall Street sneezes, the rest of the world catches a cold. Following a loss in investor confidence on Wall Street, Asian markets tumbled over the past week. Even when markets recovered the following day, it wasn’t enough to cover what was lost the previous day.

Source: TradingView

The pertinent question that is on every investors’ mind is whether this is the correction that is long overdue, or whether it is the beginning of an end to the bull market. According to CIMB, the drop in overall markets signals a correction, rather than the end of the bull market. While CIMB caveats that it does not know how long the correction will last, CIMB views the correction as an opportunity to buy.

To prepare for the imminent great stock market sale, here are three stocks that CIMB recommends for their strong fundamentals.

3 Must-Own Stocks In The Great Stock Market Sale

Keppel Corporation

At its current valuation, CIMB believes that the market has under-priced Keppel Corp’s property arm. Given that the property market is rebounding, its property arm deserves to be valued in line with other Singapore developer’s valuations.

While its offshore and marine (O&M) arm is still affected by the industry’s diminishing outlook, there are multiple catalysts that could push Keppel Corp’s share price. New O&M orders and sale of deferred rigs to unlock cash could reignite investors’ confidence. Restarting the stopped-work semi-submersible for Petrobras could also help Keppel Corp regain investor confidence.

BUY at $7.95; TP at $10.00

Genting Singapore

CIMB has set its target price for Genting Singapore at 9 times FY19 EV/EBITDA. Based on historical performance, CIMB’s target price is set to close at -1 standard deviation of its 6-year average. CIMB highlights that careful credit loosening in its VIP business will help to lift overall gross gaming revenue this year.

BUY at $1.20; TP at $1.45

ST Engineering

ST Engineering’s peer SIA Engineering recently saw its earnings beat consensus forecast. According to CIMB, this could be an early indication of returning engine maintenance, repair and overhaul (MRO) trend. Given ST Engineering’s exposure to the CFM engines for narrow body aircraft, ST Engineering could also beat consensus earnings forecast.

BUY at $3.15; TP at $3.85

Yahoo Finance

Yahoo Finance