3 Leading Canadian Dividend Stocks Yielding Up To 6.7%

In recent weeks, the Canadian market has experienced a shift, with yields climbing and most stock indexes trending downward. However, after significant rallies in both the S&P 500 and the TSX, some level of consolidation or profit-taking was anticipated. In this context, dividend stocks can be particularly appealing as they offer potential for steady income streams and may provide some buffer against market volatility.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.67% | ★★★★★★ |

Bank of Nova Scotia (TSX:BNS) | 6.71% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.71% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.47% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.92% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.46% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.14% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.07% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.97% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.76% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

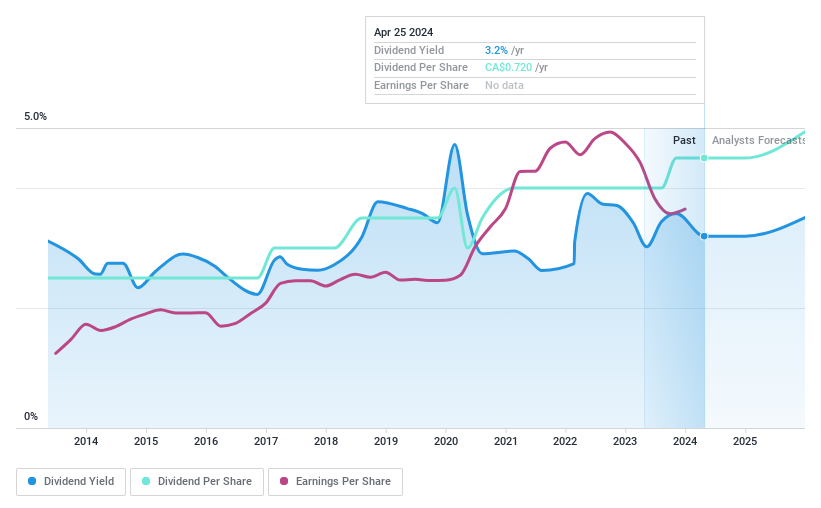

Leon's Furniture

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited, a Canadian retailer specializing in home furnishings, mattresses, appliances, and electronics, has a market capitalization of approximately CA$1.53 billion.

Operations: Leon's Furniture Limited generates CA$2.45 billion from the sales of home furnishings, mattresses, appliances, and electronics.

Dividend Yield: 3.2%

Leon's Furniture Limited reported a decline in annual sales to CA$2.45 billion and net income to CA$138.86 million for 2023, reflecting a decrease from the previous year. Despite this, the company maintains a dividend of CA$0.18 per share, supported by a low payout ratio of 32.3% and an even lower cash payout ratio of 23.5%, indicating good coverage by both earnings and cash flow. However, dividends have shown volatility over the past decade with no consistent growth pattern, raising concerns about their reliability and stability going forward.

Delve into the full analysis dividend report here for a deeper understanding of Leon's Furniture.

Our valuation report unveils the possibility Leon's Furniture's shares may be trading at a discount.

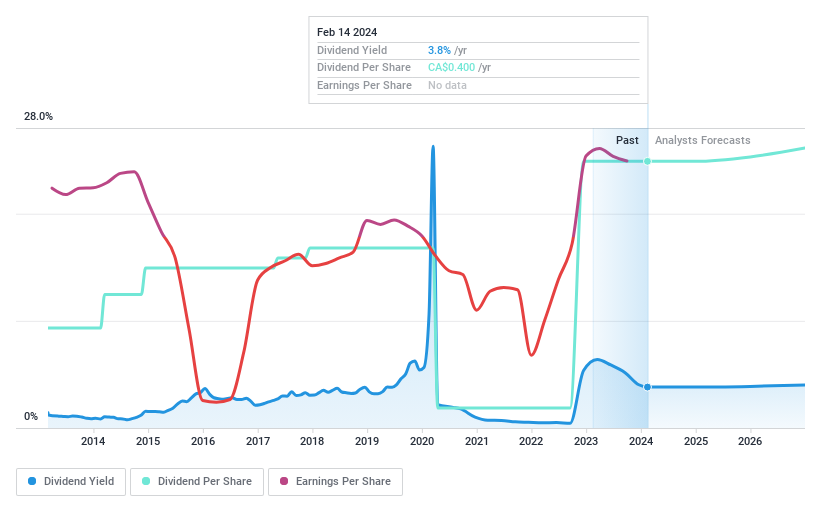

Secure Energy Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in waste management and energy infrastructure primarily in Canada and the United States, with a market capitalization of approximately CA$3.20 billion.

Operations: Secure Energy Services Inc. generates its revenue primarily through its involvement in waste management and energy infrastructure sectors in North America.

Dividend Yield: 3.5%

Secure Energy Services recently reported a significant increase in Q1 sales to CA$2.85 billion and net income to CA$422 million, up from CA$55 million the previous year. The company maintains a modest dividend yield of 3.46%, with a low payout ratio of 20.6% suggesting sustainability from earnings, although its dividend yield is below the top quartile for Canadian stocks. Recent debt financing activities, including a CA$300 million notes issue at 6.75%, aim to optimize capital structure and support strategic initiatives while maintaining shareholder returns.

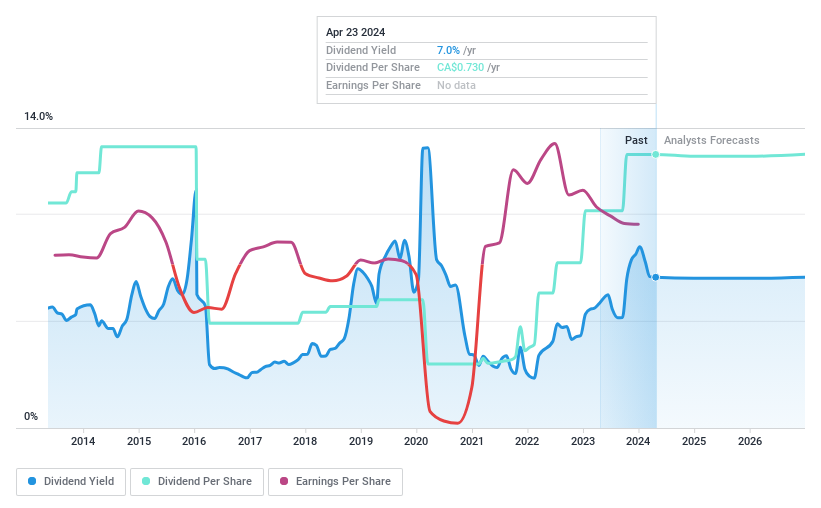

Whitecap Resources

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is an oil and gas company specializing in the acquisition, development, and production of oil and gas assets in Western Canada, with a market capitalization of approximately CA$6.50 billion.

Operations: Whitecap Resources Inc. generates its revenue primarily from the acquisition, development, and production of oil and gas assets located in Western Canada.

Dividend Yield: 6.7%

Whitecap Resources Inc. has demonstrated a consistent ability to cover its dividend payments, with a payout ratio of 53.1% from earnings and 81.9% from cash flows, indicating sustainability. Despite recent declines in quarterly revenue and net income, the company maintains a high dividend yield of 6.71%, placing it among the top 25% of Canadian dividend payers. Additionally, Whitecap has increased production guidance for 2024 following positive first-quarter production results, suggesting operational resilience amidst market challenges.

Turning Ideas Into Actions

Click here to access our complete index of 34 Top Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:LNFTSX:SES and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance