3 High Insider Ownership US Growth Companies With Earnings Growth Up To 69%

As the U.S. markets continue to adapt to fluctuating economic indicators, with recent Treasury yield declines suggesting a potential easing of monetary policy, investors are closely monitoring growth opportunities. In this context, companies with high insider ownership can be particularly appealing as they often signal strong confidence in the firm’s future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.6% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15% | 84.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 22.9% | 100.1% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

We'll examine a selection from our screener results.

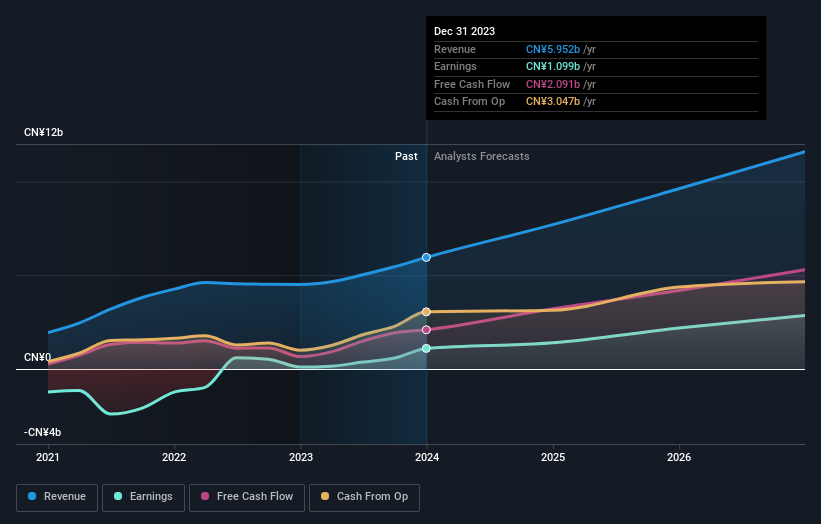

Kanzhun

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kanzhun Limited operates an online recruitment platform in the People's Republic of China, with a market capitalization of approximately $9.12 billion.

Operations: The company generates revenue primarily through its online recruitment services, totaling CN¥6.38 billion.

Insider Ownership: 16.3%

Earnings Growth Forecast: 23.5% p.a.

Kanzhun, a growth company with significant insider ownership, recently reported a substantial year-over-year earnings increase to CNY 244.95 million from CNY 32.66 million, with revenue also rising sharply to CNY 1.7 billion. The firm anticipates continued revenue growth, projecting up to CNY 1.96 billion next quarter, reflecting robust market conditions in China. Despite these positives, Kanzhun's Return on Equity is expected to remain low at 18.5% over the next three years, suggesting potential challenges in sustaining profitability relative to capital employed.

MP Materials

Simply Wall St Growth Rating: ★★★★★☆

Overview: MP Materials Corp. operates in the production of rare earth materials and has a market capitalization of approximately $2.40 billion.

Operations: The company generates its revenue primarily from the metals and mining sector, totaling approximately $206.43 million.

Insider Ownership: 12.3%

Earnings Growth Forecast: 59.5% p.a.

MP Materials, a growth company with high insider ownership, is poised for significant expansion with expected annual revenue and earnings growth outpacing the US market. Despite recent substantial insider selling and a notable drop in profit margins from last year, MP's valuation appears compelling, trading well below estimated fair value. Recent strategic moves include a US$58.5 million award to advance construction of America’s first fully-integrated rare earth magnet manufacturing facility, underscoring its commitment to enhancing its supply chain capabilities.

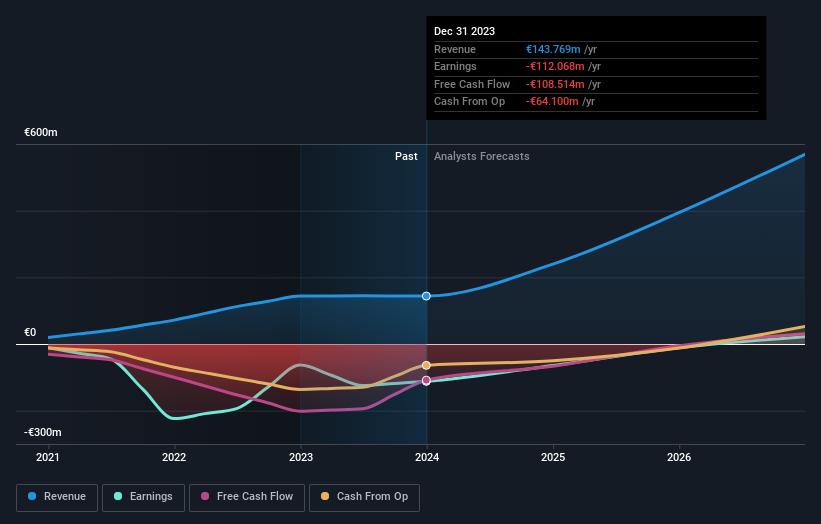

Wallbox

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wallbox N.V. is a global technology company that designs, manufactures, and distributes charging solutions for residential, business, and public use, with a market capitalization of approximately $290.02 million.

Operations: Wallbox's revenue is segmented into APAC (€1.71 million), NORAM (€25.77 million), and EMEA (€121.86 million).

Insider Ownership: 35.3%

Earnings Growth Forecast: 69.2% p.a.

Wallbox, a growth-oriented firm with high insider ownership, is navigating a transformative phase. Despite shareholder dilution over the past year, Wallbox's revenue is projected to grow substantially at 34.2% annually, outstripping the US market average. The company's profitability horizon is set within three years, aligning with an above-market profit growth forecast. Recent board appointments and strategic executive changes signal reinforced governance as it approaches profitability and continues to innovate in energy solutions.

Delve into the full analysis future growth report here for a deeper understanding of Wallbox.

Upon reviewing our latest valuation report, Wallbox's share price might be too pessimistic.

Summing It All Up

Get an in-depth perspective on all 183 Fast Growing US Companies With High Insider Ownership by using our screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:BZ NYSE:MP and NYSE:WBX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance