3 Foreign Bank Stocks Worth a Look in a Prospering Industry

Banks across the globe have been continuously undertaking restructuring efforts to focus more on core operations. While these efforts are expected to result in elevated expenses, they will aid growth in the long run. Moreover, while the uneven economic recovery in developed and emerging nations has been hurting revenue growth for companies within the Zacks Foreign Banks Industry, the current high interest rate environment will continue to provide support.

Thus, despite the geopolitical concerns, industry players like HSBC Holdings plc HSBC, Barclays PLC BCS and Deutsche Bank Aktiengesellschaft DB are well-poised to benefit from higher interest rates.

About the Industry

The Zacks Foreign Banks Industry consists of overseas banks with operations in the United States. Since a foreign banking organization may have federal and state-chartered offices in the country, the Federal Reserve plays a major role in supervising their U.S. operations. In addition to providing a broad range of products and services to customers in the United States, the banks offer financial services to corporate clients having businesses in the country. The financial firms establish relations with U.S. corporations operating in their home countries. Some units of foreign banks offer a broad range of wholesale and retail services, and conduct money-market transactions for their parent organizations. Some firms are involved in developing only specialized services.

3 Foreign Bank Industry Trends to Watch

High Interest Rates Likely to Aid Top-Line Growth: The efforts undertaken by the central banks across the globe to cushion economies from the pandemic-induced economic slowdown in 2020 (reducing benchmark interest rates to record lows) were successful in aiding immediate economic growth. However, it eroded banks’ profitability to a great extent. The pace of economic recovery, which has been uneven in the developed (home to a number of major foreign banks) and emerging nations, also hampered banking operations globally. Nevertheless, almost all central banks across the globe began raising interest rates since the beginning of 2022 to counter inflation, which supported banks’ top-line growth. Thus, in the current high interest rate environment, banks are expected to continue witnessing growth in their net interest incomes and margins.

Restructuring Efforts Likely to Keep Costs Elevated: Several foreign banks are undertaking business-restructuring efforts. Many banks have been divesting/closing non-core operations to increase focus on core businesses and regions. While restructuring efforts are expected to boost growth in the long run, these have been leading to higher expenses. Increased costs related to technology upgrades are likely to keep hampering banks’ bottom-line growth to some extent in the near term.

Uneven Global Economic Recovery Poses Concern: After the coronavirus outbreak, business confidence was shattered across the globe as the pandemic loomed over corporate earnings and economic growth. While the economy has recovered from the negative impacts of the pandemic in almost all parts of the world, growth has slowed in some regions because of certain other geopolitical concerns. Banks’ performances are directly linked to the performance of the overall economy. Thus, uneven economic growth may hurt banks’ finances to an extent in the upcoming period.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Foreign Banks Industry is a 67-stock group within the broader Zacks Finance Sector. The industry currently carries a Zacks Industry Rank #95, which places it in the top 38% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates outperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a decent earnings outlook for the constituent companies in aggregate.

Thus, we present a few stocks from the industry that you may want to keep an eye on. But before that, let us check out the industry’s recent stock market performance and valuation picture.

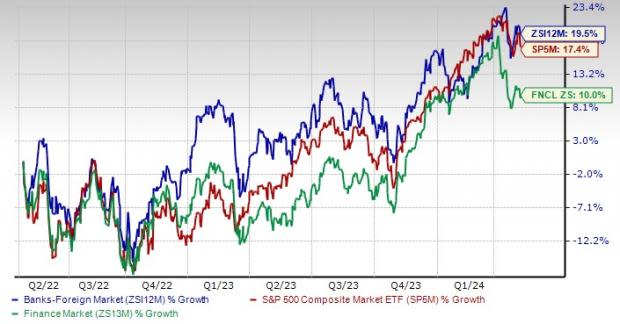

Industry Outperforms the S&P 500 and Finance Sector

The Zacks Foreign Banks Industry has outperformed the S&P 500 and its sector in the past two years.

Stocks in the industry have collectively gained 19.5%. The S&P 500 composite has rallied 17.4% and the Zacks Finance Sector has appreciated 10%.

Two-Year Price Performance

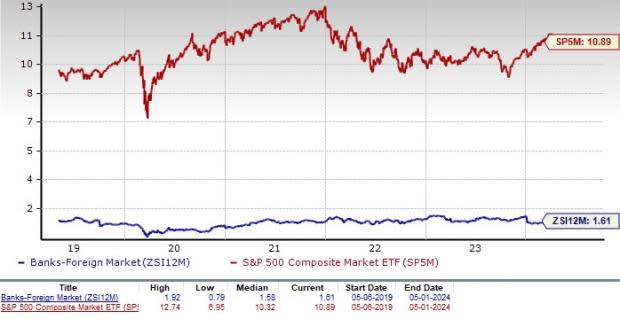

Industry's Current Valuation

One might get a good sense of the industry’s relative valuation by looking at its price-to-tangible book ratio (P/TBV), which is commonly used for valuing banks because of large variations in their earnings results from one quarter to the next.

The industry currently has a trailing 12-month P/TBV of 1.61X. When compared with the highest level of 1.92X over the past five years, there is a slight upside left. Notably, the current value compares with the median value of 1.58X.

Additionally, the industry is trading at a significant discount when compared with the market at large, as the trailing 12-month P/TBV for the S&P 500 is 10.89X.

Price-to-Tangible Book Ratio (TTM)

As finance stocks typically have a lower P/TBV ratio, comparing foreign banks with the S&P 500 might not make sense to many investors. However, a comparison of the group’s P/TBV ratio with that of its broader sector ensures that it is trading at a decent discount. The Zacks Finance Sector’s trailing 12-month P/TBV of 4.09X and the median level of 4.24X for the same period are above the Zacks Foreign Banks Industry’s ratios.

Price-to-Tangible Book Ratio (TTM)

3 Foreign Banks to Consider

HSBC Holdings: Headquartered in London, it is a major global banking and financial services firm, with $3 trillion in assets as of Mar 31, 2024.

The company remains committed to bolstering its performance with a special focus on building operations across Asia. It intends to position itself as a top bank for high-net-worth and ultra-high-net-worth clients in the region.

In sync with this, in October 2023, HSBC announced a deal to acquire Citigroup's retail wealth management business in China. Also, it re-launched its private banking business in India as the country has been experiencing a surge in the number of super-rich. In 2022, HSBC acquired 100% of the issued share capital of AXA Insurance in Singapore and L&T Investment Management Limited.

HSBC has been restructuring its operations to further improve operating efficiency. In 2020, it announced its transformation plan to reshape underperforming businesses, simplify complex organizations and reduce costs. In April 2024, HSBC announced an agreement to divest its Argentina business, whereas it agreed to sell its Armenian unit in February. The company has already exited retail banking businesses in the United States, Canada, France, New Zealand and Greece, and is in the process of fully exiting Russia.

HSBC’s brand, capital strength, extensive global network and positioning enable it to continuously attract and retain clients. The company’s product and service leadership in alternative investments, foreign exchange, credit, investment advice and many other cross-border banking services help it widen its customer base.

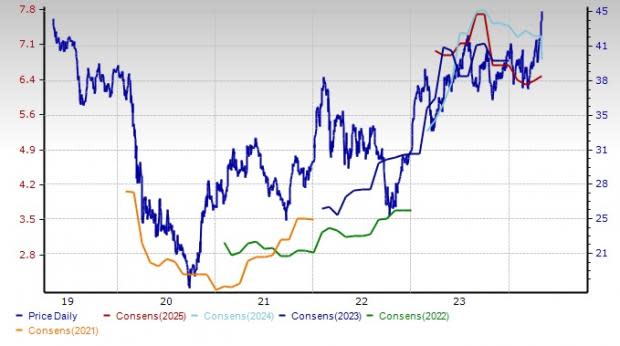

Shares of the company have gained 20.2% on the NYSE in the past year. The Zacks Consensus Estimate for its current-year earnings has moved 8.1% lower in the past 60 days. The consensus estimate indicates a rise of 7.1% from the previous year’s reported number. Currently, HSBC carries a Zacks Rank #3 (Hold).

Price and Consensus: HSBC

Barclays: Headquartered in London, this Zacks Ranked #3 company is a major global banking and financial services firm, with £1,577.1 billion ($1,990 billion) in total assets as of Mar 31, 2024.

Over the past few years, Barclays has been striving to simplify operations and focus on core businesses. As part of its business overhaul, the company announced changes to its operating divisions effective first-quarter 2024.

In February 2024, the company announced the sale of $1.1 billion in credit card receivables to Blackstone’s Credit & Insurance segment, as part of its plan to optimize its risk-weighted assets and bolster lending capacity for Barclays Bank Delaware in the United States.

In the same month, BCS announced a deal to acquire Tesco’s retail banking business. This move is expected to complement its existing business and strengthen its position in the market. In 2023, it acquired Kensington Mortgage, which bolstered its mortgage business in the U.K. Driven by these initiatives, the company’s profitability is expected to improve over time.

Moreover, Barclays’ initiatives to improve efficiency over the past few years have been bearing fruit, as evident from a fall in expenses. While its total operating expenses increased in 2022 and 2023, the same declined, seeing a compound annual growth rate (CAGR) of 2.4% over the six years ended 2021. Overall costs are expected to remain manageable, as business restructuring initiatives continue to offer support.

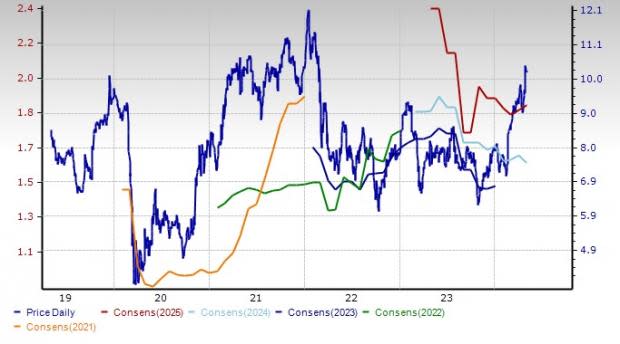

BCS shares have gained 37.2% on the NYSE in the past 12 months. The Zacks Consensus Estimate for the company’s 2024 earnings has moved 1.3% lower in the past 60 days. The estimate implies a year-over-year rise of 14.5%.

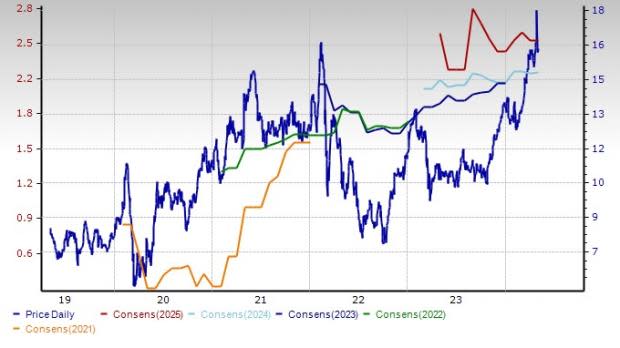

Price and Consensus: BCS

Deutsche Bank: Headquartered in Frankfurt am Main, this is the largest bank in Germany and one of the largest financial institutions in the world, as measured by total assets. It offers a wide variety of investment, financial, and related products and services.

Growth in net revenues has been a key strength at Deutsche Bank. The metric has seen a CAGR of 2.7% over the five years ended 2023. Notably, the bank’s efforts to shift focus from investment banking to more stable businesses, such as private bank, corporate bank and the asset management unit, will likely continue to aid revenues in the upcoming period. The bank closed the acquisition of Numis, which is likely to aid the Asset Management segment.

Moreover, solid deposit balances support DB’s financials. The metric witnessed a CAGR of 2% over the five years ended 2023. The company benefits from its well-diversified deposit base across various client segments and regions. Also, its loan-to-deposit ratio reflects a strong and stable funding base. Thus, we believe that the stable deposit balance will strengthen the company’s balance sheet.

Deutsche Bank has been returning excess capital to shareholders through dividends and share buybacks. It has a share repurchase program authorizing it to buy back shares amounting to €675 million. The program is expected to be completed by Jul 23, 2024.

The buyback authorization is 50% higher than the bank’s €450-million program completed in 2023. Combining its dividend payments and share repurchases, DB expects to return €1.6 billion to shareholders in capital distributions in the first half of 2024.

The Zacks Consensus Estimate for the company’s 2024 earnings has been revised marginally lower over the past 60 days. The estimate indicates a year-over-year rise of 0.5%. DB shares have gained 57.5% on the NYSE in the past year. The company currently carries a Zacks Rank of 3.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: DB

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Barclays PLC (BCS) : Free Stock Analysis Report

Deutsche Bank Aktiengesellschaft (DB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance