3 Energy Stocks to Buy Pre Earnings

About four years ago, amidst the panic of the COVID-19 pandemic outbreak, U.S. crude oil futures prices did the unthinkable and went to zero. Since then, oil prices have soared, with the most popular oil ETF, the U.S. Oil Fund ETF (USO), jumping more than 400%, driven by soaring demand, OPEC cuts, and rising geopolitical escalations. Though energy stocks have come a long way, there are several reasons that they are just getting started, including:

Rotation out of High Valuation Tech Stocks into “Old Economy” Stocks

Last week, the market sent a clear message that investors are shifting away from high-flying, high-valuation tech stocks, into slower-moving, cheaper, and more stable “old economy” stocks. For example, the Nasdaq 100 ETF (QQQ) was hammered for a more than 5% loss last week while the Dow Jones Industrial ETF (DIA) was flat.

Geopolitical Tensions Reach a Fever Pitch

The war between Russia and Ukraine began in February of 2022 and has no end in sight. Evidence that the war is likely to drag on came this weekend when the U.S. House of Representatives approved nearly $100 billion in foreign aid mainly to help Ukraine and Israel. Meanwhile, tensions between Israel and Iran (and its proxies) are escalating at an alarming pace. Over the weekend, a video emerged of Israel’s bomb strikes in the Rafah region of the Gaza Strip. The geopolitical tensions alone should keep a floor below oil prices.

Reversion to the Mean Potential

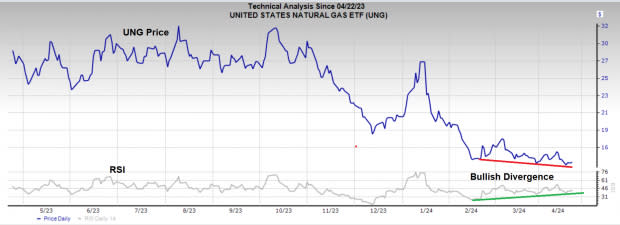

TheUnited Natural Gas Fund (UNG) is down nearly 50% over the past year. However, the Relative Strength Indicator (RSI), a popular tool used by technical investors, is flashing a bullish divergence (occurs when RSI/momentum makes a higher high while price prints a fresh low).

Image Source: Zacks Investment Research

A much-needed bounce in Natural Gas could be a bullish catalyst for energy companies with natural gas operations.

Below are 3 energy stocks to buy, along with reasons to buy each:

Exxon Mobil (XOM): EPS Due April 26th

XOM is a best-in-breed energy name that should benefit from its rock-bottom valuation. The company sports a forward P/E ratio of just 12.16x, which compares favorably to the S&P 500’s 20.13x.

Image Source: Zacks Investment Research

Also, options buyers have been actively buying September and October out-of-the-money call options – a sign of investor confidence. Finally, XOM is attractive because it has a positive ESP score (aka it’s likely to beat EPS expectations), benefits from several new discoveries (like Guyana), and will reap the rewards of enhanced operational efficiencies due to its Pioneer acquisition.

Occidental Petroleum (OXY): EPS Due May 7th

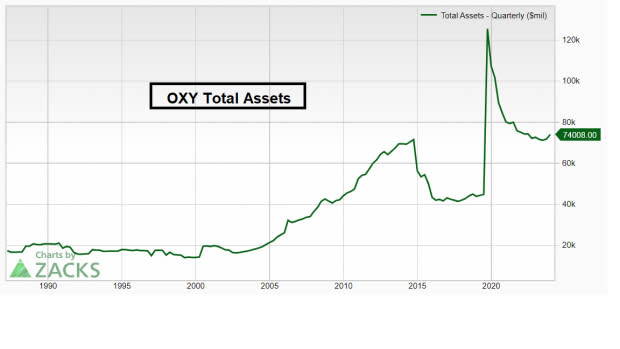

Speaking of value plays, Occidental Petroleum should be at the top of the list. After all, Warren Buffet’s Berkshire Hathaway owns nearly 30% of the firm. Piggybacking Buffett’s investments is rarely a poor choice in the long-term, and one must assume that he will look to acquire more shares in the future, as he did with other high-conviction positions such as Apple (AAPL). As is often the case with a core Berkshire holding, OXY has a pristine balance sheet and has seen its total assets grow consistently in the long term.

Image Source: Zacks Investment Research

Antero Resources (AR): EPS Due April 24th

Investors wanting to take a shot at a natural gas reversion-to-the-mean play should look at AR. Despite plummeting natural gas prices, AR grew EPS 82% last quarter on a year-over-year basis. In other words, if natural gas reverts to the mean, AR should explode. AR also sports a Zacks Rank #3 (Hold) combined with a positive ESP score, meaning it’s likely to beat Wall Street expectations when it reports later this week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR Dow Jones Industrial Average ETF (DIA): ETF Research Reports

United States Oil ETF (USO): ETF Research Reports

Antero Resources Corporation (AR) : Free Stock Analysis Report

United States Natural Gas ETF (UNG): ETF Research Reports

Yahoo Finance

Yahoo Finance