3 Communication Stocks Poised to Soar Despite Industry Woes

The Zacks Diversified Communication Services industry appears to be mired in high capital expenditures for 5G infrastructure upgrades, unpredictable raw material prices owing to Middle East geopolitical tensions, supply-chain disruptions amid the prolonged Russia-Ukraine war and Israel-Hamas conflict and high customer inventory levels. However, the industry is likely to benefit in the long run from an accelerated 5G rollout and increased fiber densification.

Nevertheless, Telefonica, S.A. TEF, Telenor ASA TELNY and Vivendi SE VIVHY should benefit in the long run from higher demand for scalable infrastructure for seamless connectivity amid the wide proliferation of IoT and transition to cloud network.

Industry Description

The Zacks Diversified Communication Services industry comprises firms that provide a wide array of communication services, including wireless, wireline and Internet, to business enterprises and consumers. These companies offer mobile and wireline telephone services, high-speed Internet, direct-to-home satellite television and other value-added services. In addition to providing integrated information and communications technology services to businesses and governments, some of these companies operate as local exchange carriers or full-service providers of data center colocation and related managed services in state-of-the-art data center facilities. Some industry participants also provide IP networks, private lines, network management and hosting services, along with sales, installation and maintenance of major branded IT and telephony equipment.

What's Shaping the Future of the Diversified Communication Services Industry?

Surging Production Costs: High raw material prices due to inflation, economic sanctions against the Putin regime and intensifying war-mongering conditions in the Middle East have affected the operation schedules of various firms. Extended lead times for basic components are also likely to hurt the delivery schedule and escalate production costs. The demand-supply imbalance has crippled operations and largely affected profitability due to inflated equipment prices.

Demand Erosion: Efforts to offset substantial capital expenditure for upgrading network infrastructure by raising fees have reduced demand, as customers tend to switch to lower-priced alternatives. Moreover, local-line access for traditional telephony services continues to decline among large customers due to higher wireless substitution and migration to IP-based services. This is reflected in the persistent erosion in overall network access services on a year-over-year basis, hurting revenues of local and long-distance operations. In addition, a shift toward wireless services and the aggressive rollout of VoIP and long-distance services by Tier-1 competitors have resulted in access line erosion. These adverse impacts have become more pronounced with the soft economic recovery in China, the prolonged Russia-Ukraine war and the Israel-Hamas conflict.

Diminishing ROI: Video and other bandwidth-intensive applications have witnessed exponential growth owing to the wide proliferation of smartphones and increased deployment of the superfast 5G technology. This has forced the industry participants to invest considerably in LTE, broadband and fiber to provide additional capacity and ramp up the Internet and wireless networks. These companies are rapidly transforming themselves from legacy copper-based telecommunications firms to technology powerhouses with capabilities to meet the growing demand for flexible data, video, voice and IP solutions. At the same time, the industry participants continue to focus on leveraging wireline momentum, expanding media coverage, improving customer service and achieving a competitive cost structure to generate higher average revenue per user while attracting new customers. Although these infrastructure investments are likely to be beneficial in the long run, short-term profitability has largely been compromised.

Integrated Service Offering: To improve profitability, the companies are increasingly focusing on providing support services to various small and mid-sized businesses (SMBs) with an integrated portfolio of voice, data and technology services. The firms are tailoring their services to suit individual business needs and are facilitating SMBs to better adapt themselves to necessary technology advancements. At the same time, the industry is battling hard-to-mitigate operating risks stemming from volatility in demand, an unpredictable business environment and challenging geopolitical scenarios by offering free services to low-income families and seamless wireless connectivity to the masses.

Zacks Industry Rank Indicates Bearish Trends

The Zacks Diversified Communication Services industry is housed within the broader Zacks Utilities sector. It carries a Zacks Industry Rank #159, which places it in the bottom 36% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few diversified communication stocks that are well-positioned to outperform the market based on a relatively modest earnings outlook, let’s take a look at the industry’s recent stock market performance and valuation picture.

Industry Lags S&P 500, Sector

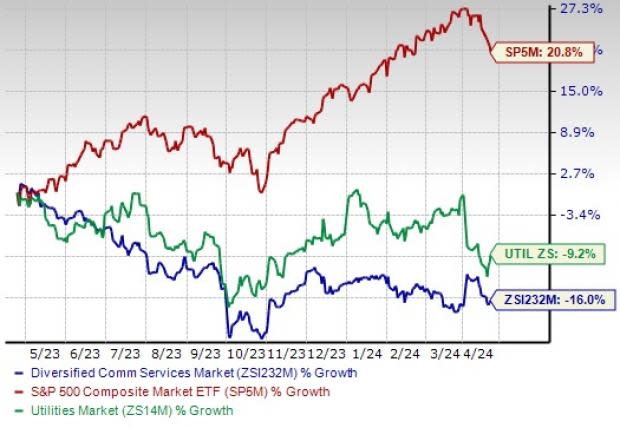

The Zacks Diversified Communication Services industry has lagged the S&P 500 composite and the broader Zacks Utilities sector over the past year largely due to macroeconomic headwinds.

The industry has lost 16% over this period against the S&P 500’s growth of 20.8% and the sector’s decline of 9.2%.

One Year Price Performance

Industry's Current Valuation

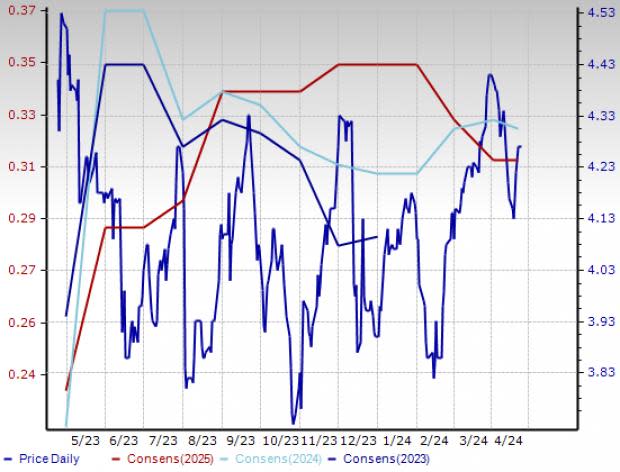

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), which is the most appropriate multiple for valuing telecom stocks, the industry is currently trading at 11.57X compared with the S&P 500’s 14.35X. It is trading below the sector’s trailing 12-month EV/EBITDA of 14.68X.

Over the past five years, the industry has traded as high as 18.45X, as low as 8.36X and at the median of 13.08X, as the chart below shows.

Trailing 12-Month enterprise value-to EBITDA (EV/EBITDA) Ratio

3 Diversified Communication Services Stocks to Watch

Telefonica: Based in Madrid, Spain, Telefonica provides mobile and fixed communication services in Europe and Latin America. In recent years, Telefonica has invested heavily in the deployment and transformation of its network to provide excellent connectivity in terms of capacity, speed, coverage and security. The rollout of fiber and LTE (Long-Term Evolution) is set to drive considerable growth. Also, the company’s 5G coverage has reached more than 2,800 towns and cities in the U.K. and about 116 cities in Brazil. The Zacks Consensus Estimate for current-year and next-year earnings has been revised upward by 50% and 39.1%, respectively, since January 2023. This Zacks Rank #3 (Hold) stock has a VGM Score of B. The company has a long-term earnings growth expectation of 4.4% and delivered a trailing four-quarter earnings surprise of 61.1%, on average.

Price and Consensus: TEF

Telenor: Headquartered in Fornebu, Norway, Telenor offers mobile communication, fixed-line communication and broadcasting services worldwide. The company has completed a $15-billion merger to emerge as a leading telecom services provider in Malaysia that is likely to contribute significantly toward the growth of the country’s digital ecosystem and economy. The Zacks Consensus Estimate for current-year earnings has been revised upward by 113.8% since April 2023. Telenor sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: TELNY

Vivendi: Headquartered in Paris, France, Vivendi operates as a diversified content, media and communications group. The company functions as an integrated group committed to transforming its businesses to meet the expectations of the public and contribute to building more open, inclusive and responsible societies. The Zacks Consensus Estimate for current fiscal-year earnings has increased 11.1% over the past year. Vivendi has a Zacks Rank #2 (Buy).

Price and Consensus: VIVHY

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Telefonica SA (TEF) : Free Stock Analysis Report

Vivendi SA (VIVHY) : Free Stock Analysis Report

Telenor ASA (TELNY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance