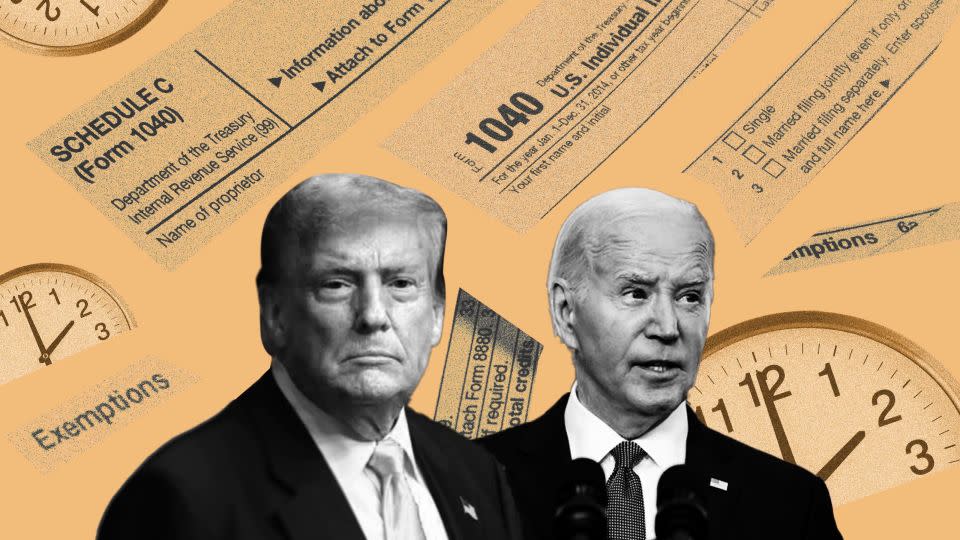

$3.4 trillion in individual tax cuts are expiring next year. Biden and Trump would handle it very differently

Whoever wins the presidency in November will have some especially tough financial choices to make next year.

More than $3.4 trillion in individual income and estate tax cuts – heralded by Republicans for spurring economic growth and largely decried by Democrats for disproportionately benefitting the rich – are set to expire at the end of 2025. Add in some corporate tax changes and interest, and the impact on the deficit swells to $4.6 trillion, according to the Congressional Budget Office.

That means the parties whom voters select to control the White House and Congress next year will be particularly consequential.

President Joe Biden and former President Donald Trump, the presumptive 2024 presidential nominees, have already laid out general positions on how they’d handle the lapsing provisions of the 2017 Tax Cuts and Jobs Act, one of the signature achievements of Trump and the GOP-led Congress in his first term.

Trump and Biden’s Treasury Secretary Janet Yellen are scheduled to speak Thursday to business leaders at different venues, where they are expected to touch on tax provisions.

In keeping with Biden’s long-standing policy promises, the president has said that he would allow the income tax cuts for the rich to expire while protecting those who earn less than $400,000 annually from any tax hikes. Plus, he has proposed raising the corporate tax rate to 28%, up from the 21% rate that the TCJA put in place permanently – which, along with higher taxes on the wealthy, would help pay for extending tax cuts for most other Americans, he argues.

“Donald Trump was very proud of his $2 trillion tax cut that overwhelmingly benefited the wealthy and biggest corporations and exploded the federal debt,” Biden posted on X in April, citing the original 10-year cost estimate. “That tax cut is going to expire. If I’m reelected, it’s going to stay expired.”

Trump, meanwhile, has promised big tax cuts for people of all incomes, as well as for businesses. And he told a crowd of wealthy donors at a fundraising dinner in April that one of his core issues for a second term would be extending the law’s sweeping array of tax cuts – a view echoed recently by House Speaker Mike Johnson and Senate Republicans.

“Instead of a Biden tax hike, I’ll give you a Trump middle class, upper class, lower class, business class big tax cut,” Trump said at a rally in New Jersey in May. “You’re going to have the biggest tax cut.”

Biden and some Democratic lawmakers also see the looming battle as an opportunity to revive or extend other popular but pricey tax provisions, including the enhanced child tax credit, which was in place only for 2021, and the more generous Obamacare premium subsidies, which expire at the end of next year. Both were contained in the American Rescue Plan Act that congressional Democrats pushed through Congress soon after Biden was inaugurated in 2021.

But how Congress handles the TCJA’s expiring tax provisions likely won’t be that simple, experts say. There are many costly measures to contend with, and their fate will have big implications for both taxpayers and the federal budget. Another consideration: Will lawmakers agree to pay for at least part of any extensions through other measures?

It’s also possible that a deeply fractured Congress won’t be able to come to a resolution, which could prompt lawmakers to kick the can down the road and temporarily extend the provisions – as they did in 2010 when the big tax cut packages passed during the George W. Bush administration were about to sunset. Most of those measures were made permanent in 2013.

A multitude of tax cuts

The TCJA contained a bevy of individual income and corporate tax reductions, making it one of the largest tax cut packages in US history. Unlike the individual income tax provisions, most of the corporate measures are permanent.

Here are some of the key things the law did that lapse at the end of next year:

Lowered many individual income tax rates, notably the top rate from 39.6% to 37% for the highest earners.

Nearly doubled the standard deduction so only about 10% of filers now itemize their deductions.

Eliminated the personal and dependent exemptions.

Capped the state and local tax deduction at $10,000 per filer, which generally hits blue states harder.

Doubled the annual child tax credit to $2,000 and allowed more higher-income parents to claim it.

Significantly reduced the number of filers subject to the alternative minimum tax, known as AMT.

Essentially doubled the estate and gift tax exemption, so even fewer wealthy people are subject to it.

In addition, the law temporarily created a special deduction for the owners of certain pass-through entities who pay their business taxes on their individual tax returns. The deduction, which also expires at the end of 2025, allows these taxpayers to exclude up to 20% of their business income from their federal income tax. These so-called pass-through businesses include partnerships, such as those formed by lawyers, doctors or investors.

Also, congressional Republicans included a handful of corporate tax increases in the TCJA to offset part of its cost – the largest of which ends businesses’ ability to immediately deduct the cost of their US-based research. Instead, they have to write off the expense over five years. Some GOP lawmakers are trying to unwind those increases in exchange for augmenting the child tax credit, which Democrats have sought to do. But the bipartisan package is stalled in the Senate, with some in Congress arguing it should be part of the tax reform debate next year.

What’s not expiring are the law’s main corporate tax measures, which include reducing the corporate rate from 35% to 21% and shifting to more of a territorial tax system for US multinational firms. Prior to the TCJA, American companies had to pay taxes on all their profits no matter where the income was earned, though they could defer the tax bill until they brought the money home – giving them the incentive to park the profits overseas. Now, these firms don’t owe taxes on certain types of income repatriated from abroad. In addition, the law created a number of minimum taxes to prevent companies from avoiding taxes.

While the TCJA reduced taxes for most people, the rich benefited far more than others. If the individual income tax provisions are extended, more than 60% of the benefits would go to those in the top 20% of income, according to the Tax Policy Center, a nonpartisan research group. More than 40% of the benefits would go to those in the top 5%.

Those making between $400,000 and $1 million would get an average tax cut of about $15,000, lifting their after-tax incomes by 3.1%, according to the center’s estimates. Those who earn $1 million or more would enjoy an average tax cut of about $50,000, raising their after-tax incomes by 2.3%.

Only about a quarter of those in the lowest income households would see their taxes reduced. Their tax cut would be $100, on average, which would bump up their after-tax incomes by 0.5%.

Big implications for the federal budget

Allowing the individual income tax cuts for the wealthy to expire would wallop a small but influential set of American taxpayers, but extending all the provisions would greatly increase the federal deficit. These two factors will complicate the conversations on Capitol Hill.

The debate will come at a time when the nation’s fiscal health is in the spotlight. Lawmakers on both sides of the aisle – particularly Republicans – have repeatedly voiced concerns about the US deficit and debt levels. Federal Reserve Chair Jerome Powell has warned that the nation is on “an unsustainable fiscal path.” And even before Congress addresses the expiring tax cuts, it will have to contend with the return of the federal debt ceiling in January, which is expected to spark more heated discussions over the size of the nation’s budget.

Extending the individual and estate tax provisions would add more than $3.4 trillion to the federal deficits over a decade, while addressing certain business tax changes could add about another $550 billion, according to the latest CBO estimate released last month. In addition, interest costs would rise by more than $600 billion.

While Republicans often argue that tax cuts pay for themselves, the effects of the TCJA are a matter of debate. Complicating the analysis is the arrival of the Covid-19 pandemic in 2020, which temporarily threw the economy into a tailspin and prompted Congress to approve trillions of dollars in stimulus and relief spending, as well as the surge in inflation in recent years.

The law’s supporters say that it accelerated economic growth and business investment, spurred companies to bring profits back to the US and raised household incomes. They argue that it’s crucial to extend or make permanent the expiring provisions or those gains will be lost.

Tadd Fowler, treasurer and senior vice president for global taxes at Procter & Gamble, ticked off the impact of the TCJA on the multinational consumer goods manufacturer at a recent Tax Foundation event. Some 44% of the company’s sales are now in the US, compared with 39% prior to the act, thanks to increased domestic investment that led to greater demand for its products. Procter & Gamble has made close to $6 billion in new manufacturing investments in the US and added more than 4,000 new jobs since the law’s passage. It also repatriates nearly $7 billion a year, up from about $1 billion annually in the years immediately preceding the TCJA.

“We’re a great example of what can happen with pro-growth and competitive tax policies,” Fowler said, noting the law has “promoted a healthy investment climate in the US and a system that levels the playing field for US companies relative to our global competitors.”

Opponents, meanwhile, contend that the rich benefited most from the law, and that there’s little evidence that any economic rewards trickled down to other Americans. Some scoff at the Trump administration’s promise that the tax cuts would boost household wages by $4,000. Instead, tax revenue as a share of the US economy has fallen compared with projections, contributing to deeper deficits, while stock buybacks skyrocketed, benefitting investors.

“Most Americans saw very little from TCJA,” Lindsay Owens, executive director of the Groundwork Collaborative, a progressive policy group, said at a Politico event last month. “The benefits really, really skewed to the very, very wealthiest Americans.”

Also, the faster economic growth that could be spurred by extending the expiring provisions would only pay for between 1% to 14% of the cost of continuing the measures, according to a recent Committee for a Responsible Federal Budget review of analyses from four organizations spanning the ideological spectrum and comments from the CBO’s director.

“It dramatically worsens a fiscal situation that’s already headed in the wrong direction,” said Marc Goldwein, senior policy director at the committee. “The last thing we need is to cut out some of our biggest revenue sources.”

For more CNN news and newsletters create an account at CNN.com

Yahoo Finance

Yahoo Finance