2 Under-the-Radar Stocks to Buy for Long-Term Value and Growth

The stock market has been almost eerily calm in April and the VIX continues to hit 52-week lows. Volumes remain well below average to start the busy part of Q1 earnings season, as Wall Street appears unwilling to make any significant moves until the tech giants that helped the market surge higher finally report.

Nvidia, Meta Platforms, Salesforce, and others have all soared over 50% YTD. Tesla’s report out on Wednesday afternoon and the market’s reaction could help investors understand what’s next.

Many are worried a big drawdown is in order even if the big tech names provide solid reports given their bloated valuations, mixed with lingering inflation and a possible recession.

The current backdrop and unknowns might mean some investors want to avoid chasing these big tech names, while remaining exposed to stocks. Today we dive into two highly-ranked Zacks stocks that have outperformed the market over the last year and over the long haul that also offer great value, dividends, and more.

Omnicom Group Inc. (OMC)

Omnicom Group is the company behind some of the biggest advertising agencies in the world, including BBDO and TBWA. Omnicom’s offerings include advertising, strategic media planning and buying, digital and interactive marketing, PR, and more. OMC has over 5,000 customers in around 70 countries.

OMC posted strong organic revenue growth in 2022, which strips out the impact of currency fluctuations, acquisitions, and disposals, as well as 9% higher adjusted earnings. The firm then topped our Q1 FY23 sales and EPS estimates on April 18, with organic revenue up 5% to boost adjusted EPS by 12%. Omnicom has now topped EPS estimates for five years running and its earnings outlook has continued to improve.

Image Source: Zacks Investment Research

OMC expects to keep growing despite an economic slowdown because its clients want its “highly-specialized marketing and communications services.” Zacks estimates call for its reported revenue to climb by around 3% in both 2023 and 2024 to boost its earnings by 4% and 5%, respectively. It is also worth remembering that Omnicom is a titan in industries—ads, PR, and marketing—that are never going out style.

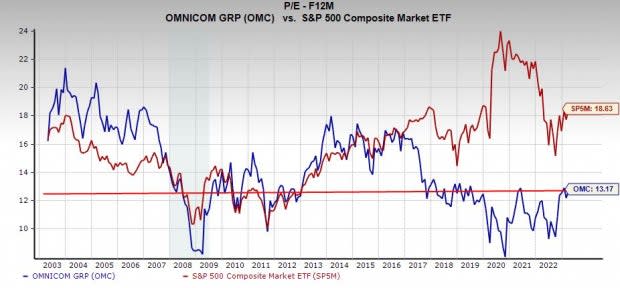

OMC has outperformed the S&P 500 over the last 30 years and it is up 12% in the last 12 months to top its industry and the benchmark. Omnicom hit new 52-week highs on Tuesday, only to fall on Wednesday as investors take home some profits. OMC is also trading solidly above both its 200-day and 50-day moving averages.

Image Source: Zacks Investment Research

Despite its long-term outperformance, OMC trades at a 40% discount to its own 20-year highs and below its median at 13.2X forward earnings. This also marks 45% value compared to the Zacks Business Services Sector.

Omnicom’s dividend yields 2.9% at the moment. Omnicom currently lands a Zacks Rank #2 (Buy), but that could change as more analysts update their estimates following its Q1 FY23 release.

Graphic Packaging Holding Company (GPK)

Graphic Packaging provides an array of paper packaging products that are crucial components in the consumer-driven economy. GPK caters to customers in various sectors such as food and beverages, food service, personal care, household goods, and beyond via a comprehensive range of folding cartons, cooking solutions, food service containers, cups, and various other products.

The Atlanta, Georgia-headquartered firm works with tons of recognizable companies and it greatly expanded its reach when bought one of Europe’s leading packaging companies, AR Packaging, in late 2021. Graphic Packaging is trying to “extend its position as the lowest-cost, highest-quality paperboard producer in North America.” It is now cemented within an area of the economy that isn’t likely to look much different 20 years from now.

Image Source: Zacks Investment Research

GPK’s adjusted earnings soared 78% last year on 32% stronger revenue, which followed 6% average sales growth between 2019 and 2021. GPK’s revenue is projected to climb another 5% in 2023 to help boost its adjusted EPS by 18%.

Graphic Packaging has strung together a nice stretch of earnings beats and its EPS outlook continues to improve to help it land a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

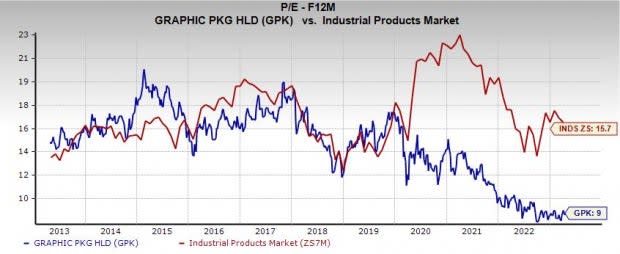

Graphic Packaging shares have outperformed the benchmark over the past 20 years, up 522% vs. 351%. GPK jumped 14% in the last 12 months and 12% YTD, yet the stock still trades 13% below its average Zacks price target at around $25 a share. Like OMC, GPK trades well above both its 50-day and 200-day moving averages.

Despite trading right near all-time highs, GPK offers stellar value. Graphic Packaging trades near its own decade-long lows (8.3X) at 9X forward 12-month earnings, which marks a 60% discount to its own highs and 45% against its median. And its dividend yields 1.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance