2 Stocks to Buy for the Spring Season

With April here, several companies will be beneficiaries of this year's spring season. Even better, their stocks appear attractively valued considering the boost they may receive.

Let's take a look at two such stocks that investors may want to consider buying right now.

American Airlines (AAL)

With warmer weather on the way, American Airlines Stock (AAL) is worthy of consideration sporting a Zacks Rank #2 (Buy).

As the largest airline in the U.S. in terms of passangers, American Airlines should benefit as we get closer to peak travel season which is typically May-October. Furthermore, travel is expected to be higher in 2023 with pent-up demand lingering from the pandemic.

Notably, American Airlines’ earnings estimates have continued to trend higher in the last week. More impressive, fiscal 2023 earnings estimates have now climbed 38% over the last 90 days with FY24 EPS estimates up 9%.

Image Source: Zacks Investment Research

American Airlines earnings are now forecasted to rebound and soar 352% this year at $2.26 per share compared to EPS of $0.50 in 2022. Fiscal 2024 earnings are expected to jump another 21% to $2.74 per share.

Sales are projected to be up 9% in FY23 and rise another 3% in FY24 to $55.53 billion. Plus, fiscal 2024 sales would be 21% above pre-pandemic levels with 2019 sales at $45.76 billion.

Image Source: Zacks Investment Research

What makes American Airlines’ recovery more intriguing is the company’s price-to-earnings valuation. Shares of AAL trade at $14 and just 6.5X forward earnings. This is nicely below the industry average of 12.1X and the S&P 500’s 19X.

American Airlines stock also trades 70% below its historical high of 21.1X and slightly beneath the median of 6.9X since its merger and formation with US Airways in 2013. Shares of AAL are up +13% year to date to top the S&P 500 and the Transportation-Airline Markets +7% performances.

Image Source: Zacks Investment Research

H&R Block (HRB)

Progressing through the spring, we will round out this year’s tax season on April 18 and H&R Block (HRB) stock could benefit. As a leading provider of tax preparation services H&R Block's stock also sports a Zacks Rank #2 (Buy) at the moment.

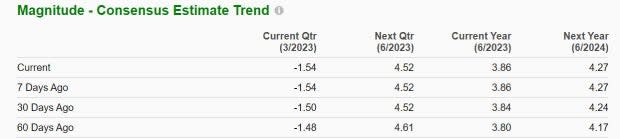

Earnings estimates revisions have trended higher over the last two months. H&R Block’s earnings are now expected to rise 10% in FY23 and jump another 10% in FY24 at $4.27 per share. On the top line, sales are forecasted to be up 2% this year and rise another 3% in FY24 to $3.65 billion.

Image Source: Zacks Investment Research

H&R Block’s P/E valuation also sticks out at the moment. Shares of HRB trade at $35 and 9.1X forward earnings which is below its industry average of 11X and the benchmark. H&R Block stock also trades 54% below its decade-long high of 19.7X and at a 31% discount to the median of 13.2X.

H&R Block stock is down -3% YTD to slightly trail the Consumer Services-Miscellaneous Markets +1% and the S&P 500. However, this year's slight drop may be a buying opportunity as shares of HRB are still up a stellar +160% over the last three years to largely outperform the benchmark’s +55% and its Zack Subindustry’s -22%.

Image Source: Zacks Investment Research

Takeaway

Rising earnings estimates are a great sign that business should be stronger for American Airlines and H&R Block as we progress through the spring. This should also translate into more upside in American Airlines and H&R Block stock, especially when considering their attractive P/E valuations.

Furthermore, at their current levels, both American Airlines and H&R Block look like viable investments for 2023 and beyond considering their solid outlooks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

H&R Block, Inc. (HRB) : Free Stock Analysis Report

American Airlines Group Inc. (AAL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance