2 Banks With Solid Dividend to Shield Against Market Bloodbath

Following the release of still red-hot inflation numbers, market participants are now expecting the Federal Reserve to again go ahead with a 75-basis-point interest rate hike later this month. Some are even projecting a full percentage point increase. This resulted in the major indexes tumbling to the lows not seen since June 2020.

Despite serious near-term macroeconomic concerns, the banking industry seems to have regained some momentum after a disastrous start to 2022. As the banks’ financial performance is tied to that of the economy, the near-term prospects look upbeat. The interest rate hikes and steady loan demand are likely to keep supporting banks this year.

Yet, investors must remain cautious while picking bank stocks. The operating environment is gradually turning grim with risks of a hard landing gaining traction as the inflation number remains stubborn and the central bank prepares to take all necessary actions to rein it in. In such a situation, banks will not be untouched by the problems. So, we have selected two banks — Citigroup C and Zions Bancorporation ZION — that are part of the S&P 500 Index and have been paying dividends regularly.

Investors must always look out for stocks with a track of steady and incremental dividend payouts to safeguard their portfolios. This is because dividend-paying stocks have a long history of profitability and a robust business model, which help them endure market volatility.

Here’s How We Selected These Banks

To choose these banks, we ran the Zacks Stocks Screener to identify stocks with a dividend yield in excess of 2.5% and five-year historical dividend growth of more than 10%. Further, both the banks have a payout ratio of less than 60, thus indicating that there is enough room for future dividend hikes.

Also, these two stocks currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Our Choices

Headquartered in New York, Citigroup is a globally diversified financial services holding company providing a range of financial products and services. The company, which is among the top four U.S. banks, has around 200 million customer accounts across 160 countries and jurisdictions.

A diverse business model, focus on core operations and streamlining of international consumer businesses will continue to drive the company’s growth. C continues to optimize its branch network, with a focus on core urban markets and improving digital channels. It is also making efforts to simplify operations and reduce costs. All these initiatives will likely augment its profitability and efficiency over the long term.

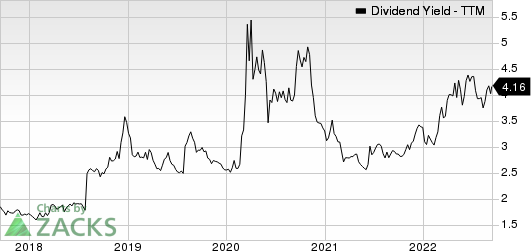

The stock has a dividend yield of 4.16% and a five-year annualized dividend growth of 10.7%. Further, the payout ratio of C is 23% of earnings at present. Check Citigroup’s dividend history here.

Citigroup Inc. Dividend Yield (TTM)

Citigroup Inc. dividend-yield-ttm | Citigroup Inc. Quote

Based in Salt Lake City, UT, Zions is a diversified financial service provider. The company operates through a network of more than 400 branches across 11 western states, namely Utah, Idaho, California, Nevada, Arizona, Colorado, Texas, New Mexico, Washington, Oregon and Wyoming.

Robust loans and deposit balance, and higher interest rates should keep aiding revenues. In the rising interest rate environment, Zions’ net interest margin is likely to witness decent improvement. Business simplifying initiatives and a robust balance sheet position are the other positives. Further, given the earnings strength, Zions is likely to continue meeting debt obligations, even if the economic situation worsens.

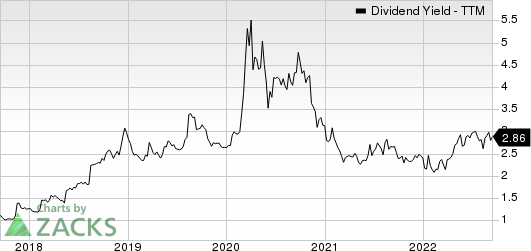

The company has a dividend yield of 2.86% and five-year annualized dividend growth of 18.4%. Further, ZION's payout ratio is 28% of earnings at present. Check Zions’ dividend history here.

Zions Bancorporation, N.A. Dividend Yield (TTM)

Zions Bancorporation, N.A. dividend-yield-ttm | Zions Bancorporation, N.A. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance