2 Auto Stocks Up More Than 25% YTD That Still Have Room to Run

Year 2022 has been a mixed bag for the auto space. While the demand for cars managed to remain strong, parts shortage (a byproduct of COVID-19 that got worsened by the Russia-Ukraine war) choked supplies, while low stockpiles impacted sales. Even though historically low new-vehicle inventories had been a thorn in the side of the sector, automakers found relief in affluent car shoppers ready to pay a hefty price for vehicles.

As the curtains roll down on 2022, one set of challenges seems to be replaced by another. We know that inventory levels are finally picking up as supply chain snafus are gradually starting to ease. While improving inventory levels should help meet pent-up demand through 2023, rising interest rates and uncertain economic conditions might play spoilsports.

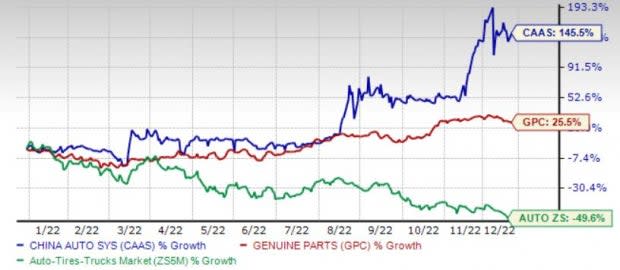

On that note, we have shortlisted two stocks from the Zacks Auto, Tires and Trucks sector —namely China Automotive Systems CAAS and Genuine Parts Company GPC — which have rallied at least 25% year to date and also appear well positioned for 2023. Before we delve into the stocks, let’s look at the trends likely to shape the sector’s destiny next year as well as some key projections regarding 2023 vehicle sales.

Factors to Govern Auto Sector’s Path in 2023

With challenges associated with new-vehicle production starting to abate, we are seeing noticeable improvements in the inventory levels. Strong production levels are likely to offer shoppers more vehicle options in 2023. Electric vehicle sales will continue to provide a major boost to overall vehicle sales. With many automakers planning to roll out new models, increased product availability and government incentives have set the stage for more than one million EV sales in the United States in 2023, per Cox Automotive.

Cox Automotive forecasts new vehicle sales in 2023 to increase 3% year over year to 14.1 million units. Meanwhile, Edmunds estimates a 7% increase in new vehicle sales next year from the projected 13.8 million unit sales in 2022.

Indeed, the cost of vehicle financing is expected to keep rising, courtesy a hawkish Fed. To purchase the same vehicle at the same monthly payment, buyers are now forced to increase their down payment, which may result in new affordability challenges. But the expected fall in the price of vehicles in 2023 from the peak levels of 2022 is likely to provide some relief to buyers. J.P. Morgan Research predicts that prices will decline by around 2.5- 5% for new cars and by 10-20% for used cars in 2023. Nonetheless, high borrowing costs will make it difficult for less-affluent and subprime consumers to find affordable vehicle payments to suit their monthly budgets.It's yet to be seen if automakers resort to better incentives, sweeter financing deals and discounts to hold up the demand if customers get unwilling to shell more for these discretionary items.

2 Auto Outperformers With More Upside Potential

China Automotive Systems: The company manufactures and sells automotive systems and components in China. It is one of the leading suppliers of rack and pinion power steering gears for cars and light-duty vehicles.

China Automotive Systems is seeing strong sales in China on the back of higher customer demand for its products. Robust demand for hydraulic products is driving its top line. In the last reported quarter, the firm’s Wuhu subsidiary sales, primarily Chery Auto, rose 50.2% year over year. Net sales in Brazil also shot up 51.9% year over year. Additionally, sales of electric power steering by CAAS’ Henglong KYB operation jumped 93.7% year over year. Last month, management raised the company’s revenue guidance for full-year 2022 to $540 million from $500 million estimated earlier. China Association of Automobile Manufacturers forecasts a 3% year-over-year uptick in vehicle sales in China. This bodes well for CAAS’ top-line growth next year. A low-leverage balance sheet (with total debt to capitalization of 12.4%) also provides the company financial flexibility to tap on growth opportunities.

CAAS sports a Zacks Rank #1 (Strong Buy) and has a Value Score of A. The Zacks Consensus Estimate for China Automotive Systems’ 2023 sales implies 8% growth each in 2022 and 2023.CAAS has a trailing four-quarter earnings surprise of roughly 321.7%, on average. The stock has returned more than 145% in the year-to-date period.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Genuine Parts: Atlanta-based Genuine Parts distributes auto and industrial replacement parts across the United States, Canada, Mexico, Australia, New Zealand, Singapore, Indonesia, France, the United Kingdom, Germany and Poland.

Genuine Parts’ third-quarter results marked the company’s sixth consecutive quarter of double-digit sales growth and the ninth consecutive quarter of double-digit earnings growth. The KDG and Inneco acquisitions have bolstered the company’s Industrial segment. Other strategic bolt-on acquisitions, including Winparts, Rare Spares, PartsPoint and Alliance Automotive Group, are adding to the top-line growth of the Automotive segment. Genuine Parts projects 2022 revenues from Automotive and Industrial segments to increase 7-8% and 31-32%, respectively. Ongoing initiatives, such as the expedited rollout of the NAPA brand, digitization, footprint optimization efforts and investments in B2B and B2C omni-channel, bode well for the long run. GPC’s dividend aristocrat status boosts investors’ confidence.

GPC carries a Zacks Rank #3 (Hold) and has a Value Score of B. The Zacks Consensus Estimate for Genuine Part’s 2023 sales and revenues implies year-over-year growth of 3% and 5%, respectively. GPC has a trailing four-quarter earnings surprise of roughly 9.9%, on average. The stock has returned more than 25% in the year-to-date period.

Year-To-Date Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

China Automotive Systems, Inc. (CAAS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance