12 Best No Annual Fee Credit Cards in Singapore (2023)

Every year, you call that number on the back of your credit card, fumble with the answering machine’s 1,000 options and then finally after lots of hair-pulling frustration get to speak to a real human being in order to request a credit card annual fee waiver.

Rinse and repeat for ALL your cards. Otherwise, cancel your credit card.

Sick of the hassle, you start browsing “no annual fee credit card” articles. However, most articles lead you to credit cards with 2 or 3 year annual fee waivers. Umm… that’s not exactly a “no annual fee credit card”.

When times are bad, banks may tighten their belts and start charging users annual fee despite good banking relationships and prompt and full payments.

If you don’t want to be at the mercy of the banks’ whims and fancies, here is a list of the real, true blue credit cards with no annual fees—for life.

Best No Annual Fee Credit Cards in Singapore (2023)

1. Credit Cards in Singapore with No Annual Fees

There are few credit cards in Singapore with straight up no annual fees. Among the banks, CIMB is best known for their no annual fee credit cards.

Otherwise, your next best option includes digital bank credit cards such as Trust credit card, and digital provider credit cards such as Revolut, GrabPay cards etc.

You’ll also find an assortment of debt consolidation or credit line credit cards with no annual fees such as the Citi Double Cash, Citi Diamond Preferred etc. The majority of these cards don’t come with attractive rewards, miles, or cashback programmes. We will skip those unless they have some kind of benefits for you.

Of course, the trusty old debit cards charge no annual fees as well.

$0 Annual Fee Credit Cards | Annual Fee | Minimum spend (per month) |

$0 | $500 (for unlimited 2% cashback) | |

$0 | $800 (for 10% cashback, capped at $100/month) | |

$0 | $2,000 (for unlimited 2% cashback) | |

CIMB AWSM Card | $0 | – |

$0 | – | |

DBS SAFRA Card (for SAFRA members) | $0 | $500 (for 3% cash rebate) |

$0 | – | |

HSBC Premier Mastercard | $0 | $600 (for 5% cash rebate) |

UOB Professionals Platinum Card (for profession associations) | $0 | – |

OCBC Premier Visa Infinite (for OCBC Premier Banking) | $0 | – |

GrabPay Mastercard | $0 | – |

Trust Credit Card (Visa) | $0 | –

|

2. CIMB No Annual Fee Credit Cards

There are 4 CIMB credit cards in Singapore with no annual fees. They are namely:

CIMB World Mastercard

CIMB Visa Signature

CIMB Visa Infinite

CIMB AWSM Card

CIMB World Mastercard

MoneySmart Exclusive

Unlimited 2% cashback

CIMB World Mastercard

MoneySmart Exclusive:

Get S$250 Cash via PayNow OR $270 eCapita Vouchers OR an Apple AirPods 3rd Gen with Lightning Charging Case (worth $261.40) OR a ErgoTune Classic Ergonomic Chair (worth S$399) when you apply and spend a min of S$988. T&Cs apply.

PLUS enjoy up to 3% Unlimited Cashback* from CIMB with min. spend of S$2,500 per month. T&Cs apply.

Valid until 07 Oct 2023

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods. 1%* Cashback on all other spends.

1% Unlimited Bonus Cashback with min. spend of S$2,500 per month. Promo valid till 31 Oct 2023.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

The CIMB World Master is a pretty basic and entry-level cashback credit card suitable for everyday use.

The amount of cashback you get depends on how much you spend:

Spend below $500, get 1% unlimited cashback on selected categories

Spend $500, get 2% unlimited cashback on selected categories

The selected cashback categories are: wine, dine, online food delivery, movies, digital entertainment, taxi, automobile, and luxury goods. It’s a weird mix of categories, but who’s complaining when there are that many?

There’s also a 1% unlimited bonus cashback with a minimum spend of S$2,500 per month from now till 31 Oct 2023. That means you can get up to 3% cashback with the CIMB World Mastercard till end Oct 2023.

This CIMB World Mastercard replaces the well-loved CIMB Platinum MasterCard (ceased 31 May 21) which offered 10% cashback (capped at $100 a month and $20 per category) with $800/month minimum spend.

Annual fee is free for life, which saves you from having to call them up and beg them to waive annual fees!

CIMB Visa Signature

MoneySmart Exclusive

Up to 10% cashback

CIMB Visa Signature

MoneySmart Exclusive:

Get S$250 Cash via PayNow OR $270 eCapita Vouchers OR an Apple AirPods 3rd Gen with Lightning Charging Case (worth $261.40) OR a ErgoTune Classic Ergonomic Chair (worth S$399) when you apply and spend a min of S$988. T&Cs apply.

PLUS enjoy a lower minimum monthly spend requirement of only S$600 (previously S$800) to receive 10% cashback* on 5 eligible categories! T&Cs apply.

Valid until 07 Oct 2023

More Details

Key Features

10% Cashback on Beauty & Wellness, Online Shopping, Groceries, Pet Shops & Veterniary Services, Cruises

For a limited time only (till 31 October 2023), enjoy 10% cashback when you spend at least S$600, posted in the same statement month

Complimentary Travel Insurance up to S$500,000

Visa Signature Concierge

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals with discounts up to 50%

CIMB Visa Signature offers a very generous 10% cashback (capped at $100 a month and $20 per category) on beauty and wellness, online shopping, groceries, pet shops, vet services and cruises. Almost anyone can benefit from the grocery and online shopping cashback, and if you often go to spas or have a pet, the card becomes even more attractive.

The main drawback is that the minimum spending requirement of $800 is quite high. The good news is that from now till 31 Oct 2023, that minimum spend is lowered to $600.

On the bright side, the card charges no annual fees indefinitely, so it is truly free to use.

CIMB Visa Infinite

MoneySmart Exclusive

Unlimited 2% cashback

CIMB Visa Infinite

MoneySmart Exclusive:

Get S$250 Cash via PayNow OR $270 eCapita Vouchers OR an Apple AirPods 3rd Gen with Lightning Charging Case (worth $261.40) OR a ErgoTune Classic Ergonomic Chair (worth S$399) when you apply and spend a min of S$988. T&Cs apply.

Valid until 07 Oct 2023

More Details

Key Features

Unlimited 2%* Cashback on Travel, Overseas, Online Spend in Foreign Currencies. 1%* Cashback on all other spend.

* The 2% cashback consists of the base cashback of 1% and an additional 1% cashback.

Complimentary access to over 1,000 airport lounges via CIMB Airport Companion Programme

Visa Infinite Concierge

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals with discounts up to 50%

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Th CIMB Visa Infinite is pretty generous with its cashback—on top of a base 1% cashback, you get an additional 1% cashback on travel, overseas spending, and online spend in foreign currency. All unlimited (infinite, right?) cashback, of course. The only catches are:

This card requires you to have an annual income of $120,000, so it’s definitely not entry-level.

The bonus 1% cashback requires a minimum spend of S$2,000/month.

CIMB AWSM Card

The CIMB AWSM Card, on the other hand, is an entry-level credit card with annual income of $18,000 onwards (under 35 years old). You’ll earn 1% unlimited cashback on 3 categories:

Dining & entertainment

Online shopping

Telecommunications: Singtel, M1, Starhub, Circles.Life, and MyRepublic only

3. Standard Chartered No Annual Fee Credit Card

MoneySmart Exclusive

Earn up to 6% Cashback

Standard Chartered Smart Credit Card

MoneySmart Exclusive:

Get S$250 Cash via PayNow or an Apple AirPods 3rd Generation (worth $261.40) or a Nintendo Switch Lite (worth S$309) when you apply and spend a min. of S$250 in Eligible Transactions. T&Cs apply.

Valid until 31 Oct 2023

More Details

Key Features

0% interest 3-month EasyPay on all eligible expenditure with 100% cashback on fees. Earn Rewards Points on your instalments.

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life benefits program

6% cashback on your everyday spend at your favourite merchants across fast food dining, coffee and toast, digital subscriptions and on your daily commute (Bus/MRT). No minimum spend requirement.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The Standard Chartered Smart Credit Card is a cashback card that gives you 6% cashback on fast food dining, coffee and toast, digital subscriptions and on your daily commute (Bus/MRT). There’s no minimum spend requirement, and of course no annual fees.

4. DBS No Annual Fee Credit Card

SAFRA DBS Card

More Details

Key Features

3% cash rebate* on your local Mastercard contactless transactions (including bus/train rides via SimplyGo)

3% cash rebate* on online transaction

0.3% cash rebate* on all other retail transactions

Exclusive access to 6 SAFRA Clubhouses islandwide: enjoy access to club facilities* including swimming pools, gyms, and entertainment facilities at any of the 6 SAFRA Clubhouses.

Every dollar spent at participating outlets and facilities at SAFRA earns you 1 SAFRAPOINT, on top of the Credit/Debit cash rebates.

Simply tap and pay for your purchases of S$100 and below, at over 30,000 merchant outlets. No signature required!

You may also link your card to your Savings Account and use as your ATM Card.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

According to this handy summary of credit card annual fees from DBS, there’s only 1 DBS credit card with no annual fees—the SAFRA DBS Card. This card charges no annual fee as long as you are a SAFRA member. With a minimum spend of $500 per month, the card will give you:

3% cash rebate on your local Mastercard contactless transactions (including bus/train rides via SimplyGo)

3% cash rebate on online transactions

0.3% cash rebate on all other retail transactions

5. HSBC No Annual Fee Credit Card

There are 2 HSBC credit cards with no annual fees.

The HSBC Revolution Credit Card best known for its 10X reward points no longer charges annual fees! You can earn 10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments, or 1X Reward point for all other types of spending.

MoneySmart Exclusive

Earn Points for Everyday Spending

HSBC Revolution Credit Card

Get a Samsonite ZELTUS 69cm Spinner Exp Luggage with built-in scale (worth S$680) or S$150 cashback for new HSBC credit cardholders. Existing HSBC credit cardholders receive $50 cashback. Min. spends of S$1,000 upon card approval required and marketing consent provided upon applying. T&Cs apply.

Valid until 31 Dec 2023

More Details

Key Features

10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments.

1X Reward point for all other types of spending.

No min. spend required.

No annual fee

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 1-for-1 deals on dining, lifestyle and travel worldwide.

Cap of 10,000 rewards points per calendar month on eligible purchases. Other terms apply.

Alternatively, the HSBC Premier Mastercard gives you 5% cash rebate (capped at $150) on dining, groceries, petrol, transport—both locally and overseas —when you spend a minimum of $600 per month.

6. UOB No Annual Fee Credit Card

There’s only 1 card in the entire UOB credit card universe that doesn’t charge annual fees…the UOB Professionals Platinum Card.

It’s largely unheard of, but the UOB Professionals Platinum Card is reserved for members of professional associations such as:

Alumni Association

Institute of Singapore Chartered Accountants (ISCA)

Law Society of Singapore

Singapore Medical Association (SMA)

The Association of Chartered Certified Accountants (ACCA)

The Institution of Engineers, Singapore (IES)

You get dining discounts, fuel discount, and UOB$ cashback at selected merchants and retail outlets.

7. OCBC No Annual Fee Credit Card

The OCBC Premier Visa Infinite is an exclusive credit card for OCBC Premier Banking customers and doesn’t charge its members annual fees.

Benefits include 16 OCBC$ reward points per $5, and 28 OCBC$ reward points per $5 foreign currency spend

8. Grab Pay Card—Mastercard

If none of the above bank-issued credit cards tickled your fancy, you’ll find no annual fee cards with digital finance and bank providers such as the GrabPay Card. While you don’t get the conventional dining, shopping, or travel benefits like you would with usual credit cards, you get to earn GrabRewards points. However, we should warn you that as of 8 May 2023, your GrabPay card will only earn you GrabRewards Points at F&B merchants—and only selected F&B categories too. Here are their merchant category codes:

5811-Caterers, 5451-Dairy Products Stores

5814-Fast Food Restaurants

5812-Eating places and Restaurants

5462-Bakeries

5813-Drinking places (Alcoholic Beverages), Bars, Taverns, Cocktail lounges, Nightclubs and Discotheques

5441-Candy, Nut and Confectionery Stores.

ALSO READ: Guide to Merchant Category Codes: 15 Companies in Singapore with Surprising MCCs

9. Trust Credit Card

Founded in collaboration with Standard Chartered Bank and NTUC, the new Trust credit card doesn’t charge you any annual fees.

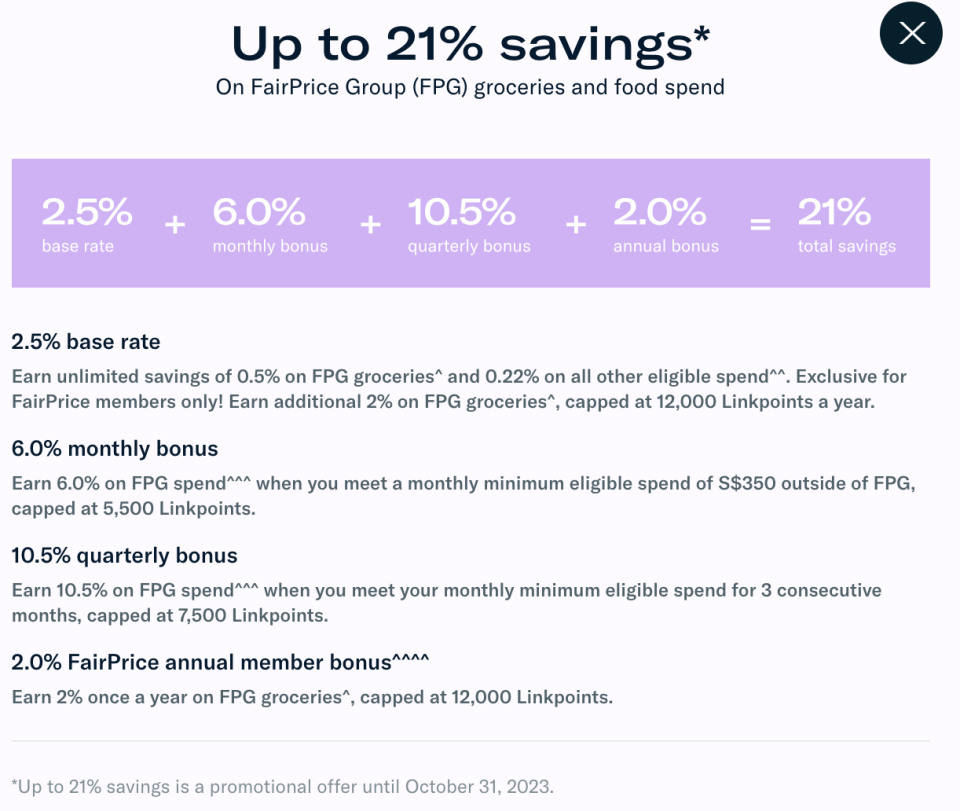

Key benefits currently include enjoying up to 21% savings on FairPrice Group (FPG) groceries and food spend when you hit a minimum monthly spend of S$350. The way this is calculated is pretty confusing though, and this rate is only till 31 Oct 2023. Here’s a breakdown of how you get 21%, from Trust themselves:

Image: Trust

10. Credit cards with 1, 2, or 3 years fee waiver

There’s a bunch of us out there who only get a credit card to enjoy the credit card sign-up promotion. Shortly after we receive our new Apple Watch or Sony wireless headphones, we cancel the card to restart the 1-year countdown until you’re considered a new-to-bank customer again, eligible for a new welcome gift.

If that’s you, then you aren’t going to need a lifetime annual fee waiver anyway. 1 year is enough, and 2 or 3 years should be plenty. In that case, here are some cards with a 1, 2, or 3 year annual fee waiver that you can consider getting.

Credit cards with first year annual fee waived

Sponsored

MoneySmart Exclusive

FLASH DEAL | APPLE WATCH SERIES 9

Standard Chartered Simply Cash Credit Card

MoneySmart Exclusive:

[FLASH DEAL | Apple Watch Series 9]

Get up to S$350 Cash via PayNow* OR a Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$575) OR a Nintendo Switch OLED (worth S$549) OR a Titan V1 7-Speed Foldable Bike (worth S$399) when you apply and spend a min. of S$500 in Eligible Transactions.

PLUS, redeem a FREE Apple Watch Series 9 GPS 41mm (worth S$599) when you are the first 2 successful applicants to submit the MoneySmart Claim Form at 2pm and 9pm daily! T&Cs apply.

Valid until 09 Oct 2023

More Details

Key Features

Flat 1.5% cashback rate for all eligible purchases

No cashback cap and no minimum spend

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life benefits program

2 year annual fee waiver, no minimum spend required

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

MoneySmart Exclusive

Convenience & Perks for Frequent Flyers

American Express Singapore Airlines KrisFlyer Ascend Credit Card

Receive an American Tourister Hypebeat Spinner 79/29 Exp TSA luggage (worth S$239) and up to 20,300 KrisFlyer miles from Amex when you apply and pay the card's annual fee in the first billing statement. T&Cs Apply.

Valid until 31 Oct 2023

More Details

Key Features

1.2 KrisFlyer miles = S$1 for all eligible card spend

2 KrisFlyer miles = S$1 in foreign currency spent overseas in June & December with no cap

2 KrisFlyer miles = S$1 for eligible purchases made on singaporeair.com, SingaporeAir mobile app and KrisShop with no cap

3.2 KrisFlyer miles = S$1 for eligible Grab Singapore transactions, capped at S$200 per month

Complimentary one night stay at particpating Hilton properties and 4 complimentary access each year to any participating SATS Premier Lounge in Singapore and Plaza Premium Lounge around the world.

Receive 5,000 KrisFlyer miles upon first spend on card, applicable for first-time American Express Singapore Airlines Credit Card applicants only

Spend S$15,000 or more on eligible purchases on singaporeair.com within the qualifying period to be rewarded with a Double KrisFlyer Miles Accrual Voucher

Spend S$15,000 or more on eligible purchases on singaporeair.com within first 12 months of Card approval and get an accelerated upgrade to KrisFlyer Elite Gold Membership

Up to S$1 million Travel Inconvenience & Travel Accident Benefits

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

MoneySmart Exclusive

MoneySmart x UOB GIVEAWAY

UOB Lady's Card

MoneySmart Exclusive:

[MoneySmart GIVEAWAY]

Stand to receive a ASUS Vivobook x BAPE ® (worth S$2,349) OR a Sony PlayStation®5 Disc Console (worth S$799) OR a Nintendo Switch OLED (worth S$549) when you successfully apply for an eligible UOB Credit Card through MoneySmart and meet the Giveaway eligibility criteria! T&Cs apply.

PLUS receive up to S$350 Grab Vouchers from UOB when you are the first 200 new-to-UOB customers who successfully apply and spend a min. of S$1,000 per month, for 2 consecutive months from the card approval date. T&Cs apply.

Valid until 17 Oct 2023

More Details

Key Features

15X UNI$ (or 30 miles) per S$5 spent on your preferred category with no min. spend required. Choose from Beauty & Wellness, Dining, Entertainment, Family, Fashion, Transport and Travel

Flexibility to change your Preferred Category(ies) Spending every quarter.

UOB Lady's LuxePay Plan 6 or 12-month installment plan with no interest or processing fees

Free e-Commerce protection for online purchases up to USD$200

High female cancer coverage of up to S$200,000 sum assured with UOB Lady's Savings Account

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Credit cards with 2-year annual fee waiver

MoneySmart Exclusive

Cashback for Family Spending

HSBC Visa Platinum Credit Card

Get a Samsonite ZELTUS 69cm Spinner Exp Luggage with built-in scale (worth S$680) or S$150 cashback for new HSBC credit cardholders. Existing HSBC credit cardholders receive $50 cashback. Min. spends of S$1,000 upon card approval required and marketing consent provided upon applying. T&Cs apply.

Valid until 31 Dec 2023

More Details

Key Features

5% cash rebate on local dining and groceries (food deliveries and online groceries included).

Up to 17% instant discount plus 5% cash rebate at Caltex and Shell stations.

1X Reward point per dollar spent.

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 1-for-1 deals on dining, lifestyle and travel worldwide.

Meet min. spending of S$600 monthly in a calendar quarter to earn 5% cash rebate.

Cash rebate capped at S$250 per calendar quarter.

New Cardholders Exclusive: Spend SGD1,000 in the quarter you have applied to unlock the 5% cash rebate. This is a one-time exclusive applicable for new cardholders who have just received their approved card.

MoneySmart Exclusive

High Spend on Dining

OCBC 365 Credit Card

MoneySmart Exclusive:

Get a Apple Watch SE (GPS) 40mm (worth S$379) OR a Titan V1 7-Speed Foldable Bike (worth S$399) OR S$330 eCapita Vouchers OR S$300 Cash via PayNow when you apply and spend a min. of S$500 in Qualifying Spend within 30 days of card approval. T&Cs apply

Valid until 07 Oct 2023

More Details

Key Features

5% cashback on everyday dining (including local, overseas and online food delivery)

6% cashback on fuel spend at all petrol service stations locally and overseas

3% cashback on groceries, land transport, online travel, recurring telco and electricity bills

0.25% cashback on everything else

Min. spend of S$800 per month, with cashback capped at S$80 per month

Unlock up to S$160 cashback per month with a min. spend of S$1600 per month

2 years fee waiver for principal card (S$194.40), subsequent years waived with min. spend of S$10,000 p.a.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Shipping Rebates on Lazada

Citi Lazada Credit Card

More Details

Key Features

5X Reward Points on Dining, Travel, Entertainment and Commute

Earn 1X Reward Points on everything else, no cap

Accelerated Rewards capped at a maximum of 9,000 Points per statement month. Bank's T&Cs apply.

Enjoy complimentary shipping rebates with min. spend of S$50 per transaction on Lazada, capped at 4 shipping rebates per calendar month. T&Cs apply.

Enjoy the freedom of redeeming your Reward Points with Citi Pay with Points or for cash rebate via SMS.

Get exclusive offers on Lazada throughout the year for Citi Lazada Credit Cardholders only

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Credit cards with 3-year annual fee waiver

Online Promo

Earn up to 8% Cashback

Maybank Family & Friends Card

Online Promo:

Get $200 cashback OR an Apple AirPods 3rd Generation (worth S$261.40) OR a pair of American Tourister Linex 66/24 Luggage TSA (worth S$336) when you successfully apply for a Maybank Credit Card AND a CreditAble account, and spend a min. of S$600 on Eligible Transactions each month for 2 consecutive months from card approval date. T&Cs apply.

Valid until 31 Oct 2023

More Details

Key Features

Up to 8% cashback on all restaurant spends in Singapore and Malaysia

Up to 8% cashback on and data communication & online TV streaming

Up to 8% cashback on petrol and groceries including online gorcery stores spend in Singapore and Malaysia

Up to 8% cashback on selected shopping stores, contactless bus and train rides, taxi and all passenger transportation servcies such as Grab and GOJEK

Earn 8% cashback globally on your 5 preferred cashback categories from the list of 10 options.

Earn 8% cashback on all Malaysian Ringgit spend on top of your 5 preferred cashback categories

0.3% cashback on all other spend with no cap on cash rebates

3 years annual fee waived; spend min. S$12,000 per year to get subsequent waiver

ICBC Global Travel MasterCard Credit Card

More Details

Key Features

Up to 3% unlimited cash back on all spends (Local and Overseas)

No minimum spend or maximum cap in cash back earned

Complimentary access to Dragon Pass Lounges. Such as Plaza Premium Lounge, SATS Premier Lounge and more

3 years Annual Fee Waiver

Know anyone else sick of having to call in to get their credit card annual fee waived yearly? Share this article with them!

The post 12 Best No Annual Fee Credit Cards in Singapore (2023) appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post 12 Best No Annual Fee Credit Cards in Singapore (2023) appeared first on MoneySmart Blog.

Original article: 12 Best No Annual Fee Credit Cards in Singapore (2023).

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance