With 1% stake in Great Eastern, Malaysia's Sungei Bagan Rubber Co sees shares jump to record high

The estimated proceeds of RM426.88 million is more than its existing market capitalisation of RM371.46 million.

Shares of Sungei Bagan Rubber Co (Malaya) Bhd rose as much as 76 sen (21.7 cents) or 15.29% to a new record high on May 10, following news of a privatisation bid for GEH Holdings (GEH), in which it owns a 1% stake.

Earlier on May 10, Oversea-Chinese Banking Corporation (OCBC) announced a voluntary offer for a 11.56% stake it does not own in GEH for $1.4 billion, or $25.60 per share.

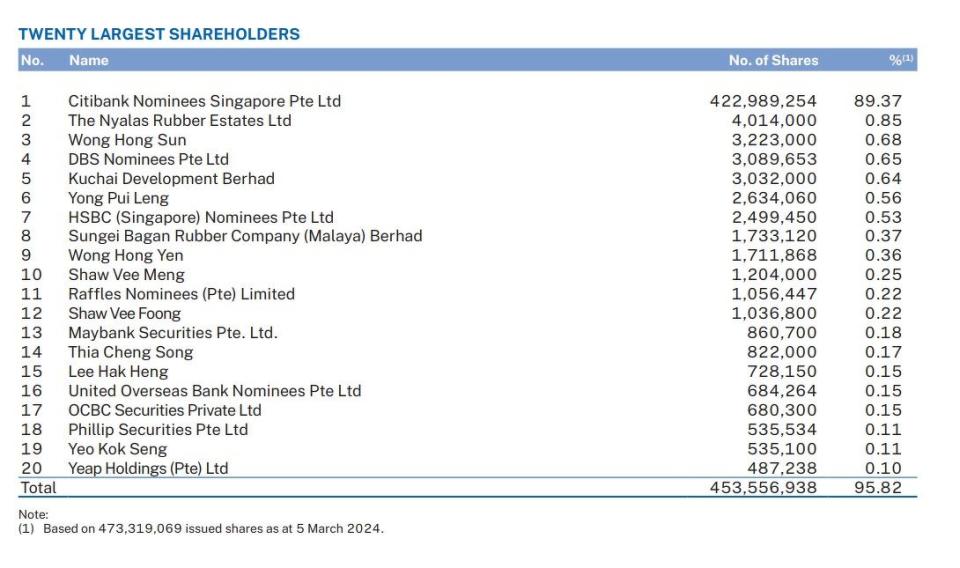

Sg Bagan owns 4.763 million shares in GEH, which has a value of $121.93 million, based on OCBC’s offer price. Sg Bagan is the insurer's eighth largest shareholder, as at March 5.

Sg Bagan's shares rose to its new record high of RM5.73 on the news. At 5pm, shares of Sg Bagan pared some gains to close at RM5.60, still up 63 sen, or 12.68%.

Should Sg Bagan take up the offer, the estimated proceeds of RM426.88 million is more than its existing market capitalisation of RM371.46 million, based on its last trading price of RM5.60.

The cash proceeds would amount to RM4.556 per Sg Bagan share, based on its outstanding share base of 93.7 million shares.

Sg Bagan’s stake in GEH was initially just 1.73 million shares. However, it acquired another 3.03 million shares in the insurer from sister company Kuchai Development Bhd (KDB) this year.

The acquisition was part of a restructuring involving the two companies, where KDB divested RM275.47 million worth of assets and liabilities to Sg Bagan in return for 27.51 million new Sg Bagan shares.

At RM5.60, Sg Bagan trades at a discount of 43.34% to its net book value of RM9.88 per share at end-December. GEH share price averaged at just $17.08 in 2023, which, for Sg Bagan shareholders, amounted to a carrying value of RM3.04 per share.

A vesion of this story first appeared on The Edge Malaysia.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Despite hiccups, local banks stay resilient with STI well-supported

Great Eastern shares close 37.5% higher at $25.72, above OCBC’s $25.60 offer price

OCBC’s spike in new non-performing assets shows modest stress ahead: Bloomberg Intelligence

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance