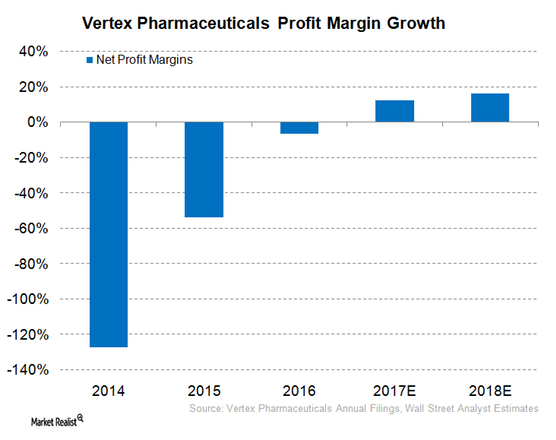

Can Vertex Pharmaceuticals Report Solid 2017 Net Profit Margins?

Should Investors Be Interested in Vertex Pharmaceuticals in 2018? In 3Q17, Vertex Pharmaceuticals (VRTX) reported non-GAAP (generally accepted accounting principals) net profits of ~$136 million, which is a YoY (year-over-year) growth of ~216.3%, driven mainly by the rapid rise in total cystic fibrosis (or CF) drug sales. The company reported non-GAAP combined SG&A (selling, general, and administrative) and R&D (research and development) expenses of ~$334 million, which is a YoY rise of 13.2%.

Yahoo Finance

Yahoo Finance