Travel Insurance Singapore Guide (2024): Must-Knows for Choosing the Best Travel Insurance

Travelling is a favourite Singaporean pastime. A national sport, if you will. But while we all love travel and wanderlust, most of us don’t give much thought to buying travel insurance.

Buying travel insurance in Singapore is something a lot of us take for granted. Few of us bother to buy travel insurance ahead of time, and even fewer compare policies to find the best travel insurance in Singapore.

Here is everything you should look out for before buying travel insurance in Singapore.

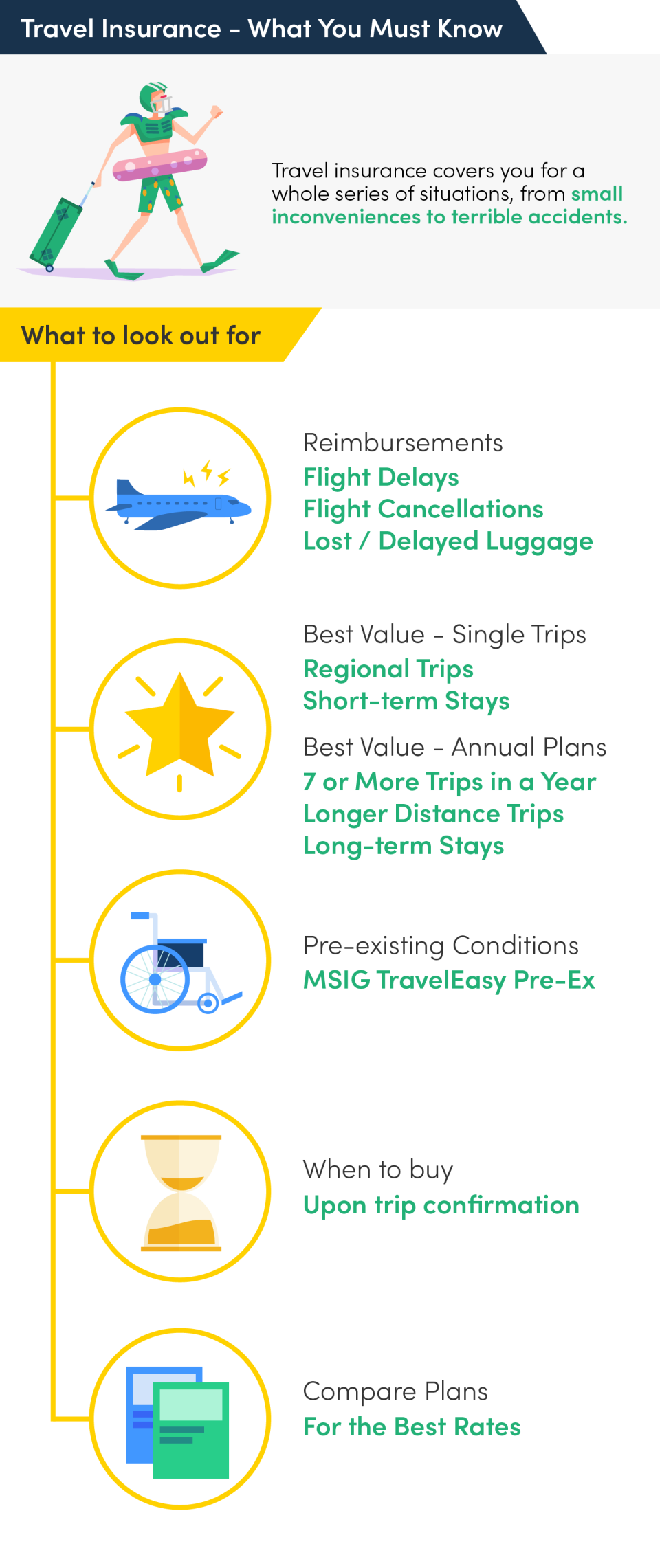

Key features to look out for in travel insurance

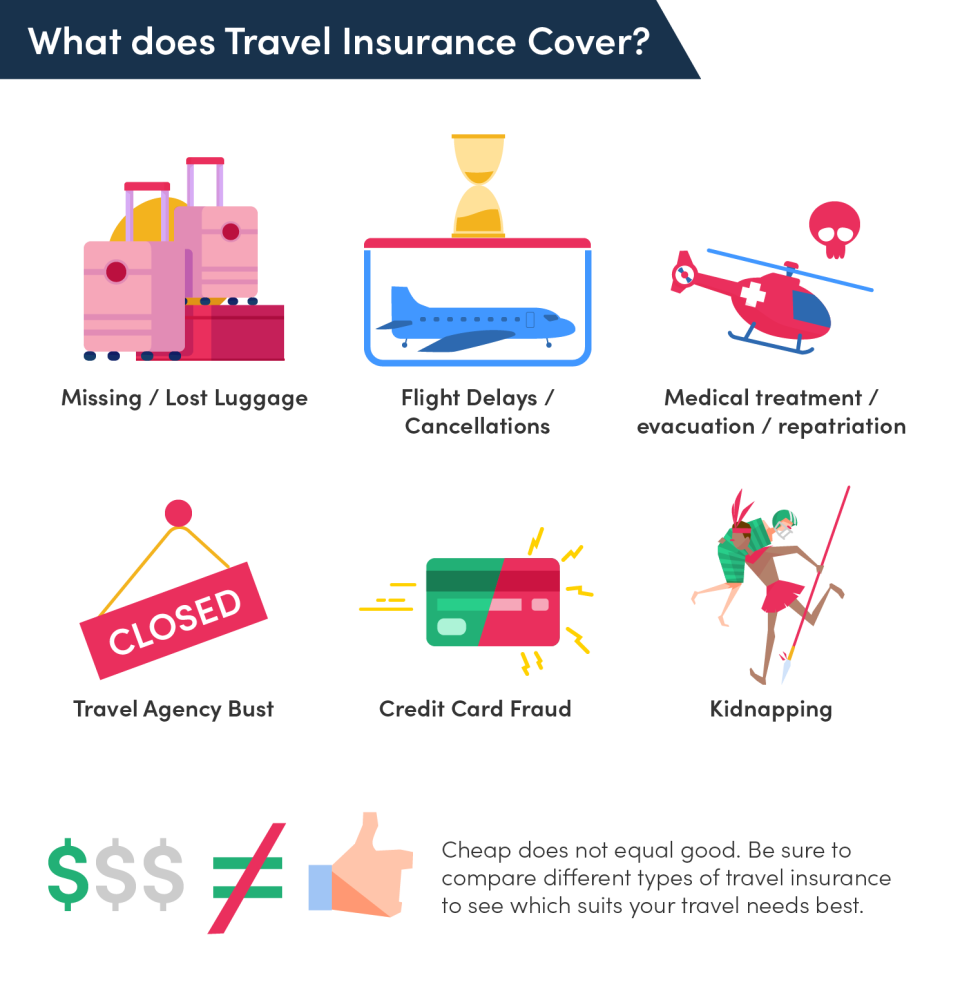

1. What does travel insurance cover you for?

A good travel insurance policy covers you for a whole series of situations, from the small inconveniences to the most terrible.

Trust me, you never want to be in a situation that you’re not covered for.

It could be a minor inconvenience, like having your luggage delayed and being forced to spend at least one night in the same clothes you wore on the entire flight. Or it could be a serious medical emergency, like getting stung badly by jellyfish in the middle of a remote island adventure and needing immediate medical attention.

These days, almost all travel insurance in Singapore automatically includes COVID-19 coverage. That means, you’ll be able to claim from your travel insurance if you get Covid-19 while travelling.

You should also have coverage for everything from lost and delayed luggage, flight delays and cancellations, all the way to medical treatment, medical evacuation and even repatriation in case of serious illness and death. All these different situations have different claim limits, of course.

Travel insurance also covers things like reimbursing deposits if your travel agent goes bust, if your credit card is used fraudulently overseas, or if you damage your rental car. Some policies even pay you if you are kidnapped while overseas! And the best part is that travel insurance is relatively cheap and convenient to buy.

2. How to choose travel insurance

With so many different benefits in a travel insurance plan, it can be tough to decide if a particular travel insurance plan is worth your money. You should look out for how much you are reimbursed for common travel hiccups.

Find a travel insurance that covers flight delays and cancellations: Flight delays happen more often than you realise. They can be extremely inconvenient, especially if it ends up causing you to miss your connecting flight. Ensure that your policy covers you for a decent period of time. For example, if your flight is delayed, some policies pay you $100 for every 6 consecutive hours of delay. There’s usually a cap of around $200-$500, but if you want more coverage DirectAsia Voyager 150 pays out up to $1,000 for travel delay.

Total Premium

S$23.10

40% OffTotal PremiumS$38.50

MoneySmart Exclusive

ROLEX GRAND DRAW | Free coverage for children

DirectAsia Voyager 150

MoneySmart Exclusive:

[Win a Rolex, Samsonite Luggage & More! | FLASH DEAL]

• Enjoy 40% off your policy premium

• Receive up to S$25 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

BONUS:

For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw.

Stand a chance to score:

• 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000)

• 1x Samsonite Robez 68/25 EXP (worth S$550) weekly

Increase your chances of winning when you refer friends today. T&Cs apply

Valid until 21 May 2024

More Details

Key Features

Additional coverage for Travel Insurance - Sports equipment, Maid and COVID-19. Extreme Sports add-on only available for Annual Plans.

Kids go free – up to four kids travel for free with a Family policy only (2 adults)

Matching kids limits – children enjoy the same coverage limits as adults

Emergency Dental – Accidental Dental treatment can be costly, so it is covered under the main medical expenses coverage which is higher than a separate dental benefit

Optional COVID-19 coverage on trip cancellation, medical expense, and emergency evacuation. Only for Single Trip.

Lost or delayed baggage: Make sure your policy covers you well for such situations. Many policies pay $100 for every 6 consecutive hours your baggage is delayed, including Bubblegum Travel Insurance which pays up to $3,000 for lost or damaged baggage. Don’t forget to also pay attention to the maximum amount you’re covered for.

Total Premium

S$46.85

10% OffTotal PremiumS$52.05

MoneySmart Exclusive

Most fuss-free plan

Bubblegum Travel Insurance

MoneySmart Exclusive:

[Receive your cash as fast as 30 days*]

• Enjoy 10% off your policy premium

• Get an Eskimo Global 1GB eSIM with every policy purchased.

• Additionally, receive up to S$25 via PayNow and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

Valid until 21 May 2024

Apply NowApply directly on MoneySmart

More Details

Key Features

Bubblegum offers just 1 affordable plan to suit all your travel needs to maximise your savings

Overseas medical expenses up to $150,000 SGD (Covid-19 sub-limit of $65,000 included)

24-Hour global Emergency Assistance services including Emergency Medical Evacuation and Repatriation

Covid-19 trip related cancellation/curtailment up to $600 SGD included

Adventurous activities like scuba diving and hot air ballooning are covered with no limit on depth or height.

Medical coverage overseas: Since you can never predict what might happen on your trip, it literally pays to be safe than sorry. A good travel insurance policy covers you for at least $200,000 for overseas medical coverage and unlimited coverage for emergency medical evacuation and repatriation. One value-for-money insurance policy that fits the bill is Starr TraveLead Comprehensive Bronze.

S$25.55

58% OffS$60.84

MoneySmart Exclusive

ROLEX GRAND DRAW | Best Value Plan

Starr TraveLead Comprehensive Bronze

MoneySmart Exclusive:

[Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive]

• Enjoy an exclusive 58% off your policy premium for a limited time only! Valid till 20 May 2024.

• Get an Eskimo Global 1GB eSIM with every policy purchased.

• Additionally, receive up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

BONUS:

For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw.

Stand a chance to score:

• 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000)

• 1x Samsonite Robez 68/25 EXP (worth S$550) weekly

Increase your chances of winning when you refer friends today. T&Cs apply

Valid until 20 May 2024

More Details

Key Features

For Cruise to nowhere insurance: Find out more here

Personalise your travel insurance-Flexible coverage allows you to create a travel insurance plan with different types of coverage and addon that can adapt to your needs

Overseas Covid-19 related medical expenses of up to $15,000 SGD included (Excluding China).

No sublimit or restriction on outpatient expenses and number of visits

24 hours Global Emergency Assistance Services help you when you need it most, connecting you with medical treatment and transportation

Seamless and Cashless claims via PayNow

Covers travel expenses for sending back an unattended child during the hospitalisation of the insured person

Please note that travelling to Russia and Ukraine is not covered in Starr’s insurance with immediate effect.

Travel insurance with COVID-19 coverage: Ideally, your policy should offer coverage for a range of COVID-19 expenses you might encounter during your travels (and even before you fly!). Look out for the travel insurance policies’ coverage for trip cancellation and postponement and medical expenses due to Covid-19. Overseas quarantine cash allowance is an added bonus. For example, AIG Travel Guard® Direct – Enhanced covers $100 per day for 14 days if you’re quarantined overseas due to COVID-19.

Premium

S$83

Premium

MoneySmart Exclusive

Most Flexible Plan

AIG Travel Guard® Direct - Enhanced

MoneySmart Exclusive:

[Receive your cash as fast as 30 days*]

• Get up to S$220 worth of cash and rewards with eligible premiums spent.

• Additionally, receive an Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply.

Valid until 21 May 2024

More Details

Key Features

Voted TripZilla's Best Travel Insurance (Single Trip).

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct

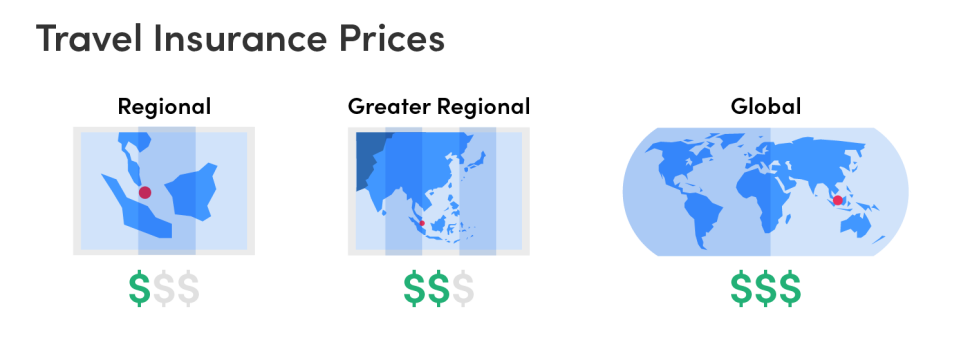

3. Travel insurance prices in Singapore

Travel insurance in Singapore is very price-sensitive, and sometimes insurers can compete to shave off even $1 from their premiums to make their policies more enticing (yay for us!).

One way to get a cheaper plan is to see which insurers offer regional travel insurance. If you are only travelling to Thailand, for example, it is usually cheaper to get a policy that covers only SEA or ASEAN countries, rather than a worldwide coverage policy.

However, price is not the only factor—especially since cheap insurance policies often mean significantly less coverage. Buying travel insurance is not like buying a “warehouse sale” LV bag in Chatuchak Market. You don’t just shop around, look for the stall owner with the weakest bargaining skills, and haggle the price down as low as can get.

Look at other aspects of the policy when buying travel insurance. There are many other factors to consider—for example, how much coverage you’re eligible for, and how quickly your claims can be processed. Make sure that you don’t have to wait till the next blue moon before you can see the results of your claims.

4. Which travel insurance to buy in Singapore?

Like anything else you purchase, the best travel insurance is what gives you the most value for money. Say you are only travelling to Thailand for a weekend shopping trip, for example. You’re probably travelling light and don’t need more than $3,000 coverage for loss of baggage, even if you can pay just $3 more for significantly more coverage. Save that $3 and treat yourself to all the Thai milk tea you can drink!

As we said earlier, you shouldn’t be so stingy and only buy the cheapest. The cheapest may have lots of terms and conditions when it comes to claims. For example, an insurer might not cover delayed luggage if it is only delayed returning to Singapore. If this is the only inconvenience you face in your entire trip, you might be understandably upset that it’s not claimable.

The important thing is to read the terms and conditions of your preferred policy carefully and make sure you’re not caught unawares. This is especially important when it comes to medical pre-existing conditions.

5. Common mistakes when buying travel insurance

How many of us actually know how to go about buying a good travel insurance that is suitable for our needs? Here are five common mistakes to avoid when buying travel insurance:

Buying the most “convenient” travel insurance: Do you just buy the first travel insurance you see on Google? It is important to read the details of the coverage provided to see if they are adequate for your needs or to cover the risks of the destination you’re travelling to, eg. medical coverage and loss of personal belongings.

Buying travel insurance at the last minute: Do you often buy your travel insurance when waiting to board your flight or while making your way to the airport? Yes, better late than never. However, you should be aware that some of the benefits of the travel insurance are applicable (eg. natural disasters, airline strike, tour agency bankruptcy) if you buy travel insurance ahead of your trip.

Not buying travel insurance for the entire length of your trip: Should you purchase travel insurance only for the days you are actually overseas? No. You should include flights to and from your holiday destination. In the event of baggage delays, loss or damage, or overbooking of flights, you’d then be able to make a claim. For long haul trips, do remember to cater for the +1 or +2 days that it takes for your flight to reach Singapore.

Not reading your travel insurance policy: Not all travel insurances are created equal. In fact, the policy document and terms of coverage makes for rather interesting reading. Do go through the policy document for what’s included and excluded, claim limits, and what you gotta do in order to make a claim.

Assuming travel insurance is “one size fits all”: If your holiday includes adventurous elements like skydiving or scuba diving, check to ensure that the travel insurance you are considering covers these activities. MSIG TravelEasy Elite covers a whole range of activities, including sky diving, hot air ballon rides, and bungee jumping. Alternatively, check to ensure that adventurous activities are not excluded from the claims.

Total Premium

S$49.50

45% OffTotal PremiumS$90

MoneySmart Exclusive

ROLEX GRAND DRAW | Most Comprehensive

MSIG TravelEasy Elite

MoneySmart Exclusive:

[Win a Rolex, Samsonite Luggage & More! | MoneySmart Exclusive]

• Enjoy up to 45% off your policy premium

• Get an Eskimo Global 1GB eSIM with every policy purchased.

• Additionally, receive up to S$45 via PayNow OR 1 x Apple AirTag (worth S$45.40) and up to S$20 iShopChangi e-voucher with eligible premiums spent. T&Cs apply.

BONUS:

For a limited time only, there are over S$11,000 worth of prizes to be given away in our Grand Draw.

Stand a chance to score:

• 1x Rolex Oyster Perpetual - 124200 34mm Silver (worth S$9,000)

• 1x Samsonite Robez 68/25 EXP (worth S$550) weekly

Increase your chances of winning when you refer friends today. T&Cs apply

Valid until 21 May 2024

More Details

Key Features

COVID-19 coverage of up to $300,000 medical cover and up to $5,000 travel inconvenience benefit for your trip protection.

Stay protected and enjoy a wide range of adventurous activities from sky diving, scuba diving, white-water rafting to winter sports like dog sledding, tobogganing, sledging and ice-skating.

Get covered across all TravelEasy Plan types with a high limit of S$1,000,000 for emergency medical evacuation & repatriation

MSIG provides cover for insolvency of licensed travel agencies registered with the Singapore Tourism Board (includes NATAS registered travel agencies)

6. Will pre-existing conditions affect my travel insurance?

One of the biggest travel insurance stories in 2017 was when a Singaporean man had a heart attack in Tokyo and fell into a coma. The medical costs alone cost $120,000 and bringing him back to Singapore via medical evacuation would cost another $120,000.

Because the man had been diagnosed with heart failure in 2012, his insurer considered it a pre-existing condition and therefore no claim was possible. Currently, one insurer that covers pre-existing conditions is MSIG TravelEasy Pre-Ex travel insurance.

Total Premium

S$70.50

Total Premium

Covers Pre-Existing Conditions

MSIG TravelEasy Pre-Ex Standard

More Details

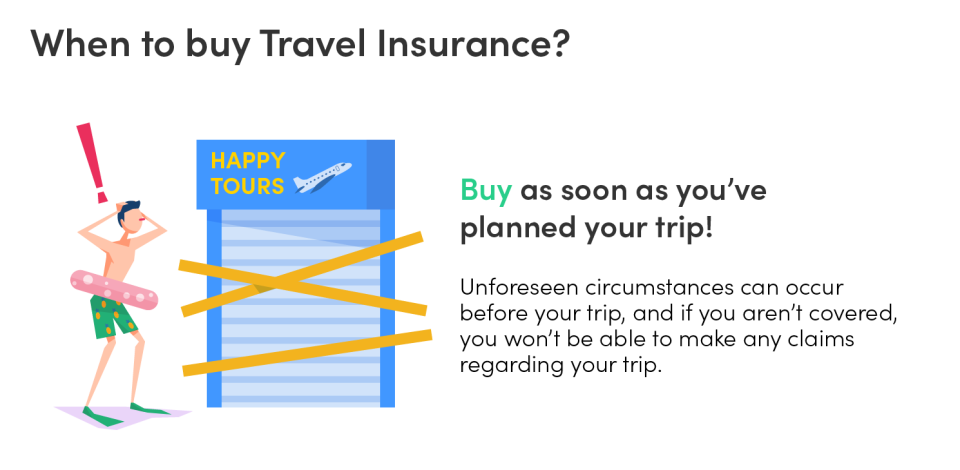

7. When should I buy travel insurance?

There are many, many things that can go wrong when you’re travelling. Half of these things could happen even before you leave the country!

Waiting to buy your travel insurance policy on the day you travel (or worse, after you’ve already crossed into international waters) puts you at risk for travel inconveniences big and small like delays or postponement.

A good travel insurance policy also covers you for your entire trip being cancelled unexpectedly.

You should buy a travel insurance online as soon as you’ve planned your trip. Getting your travel policy as early as possible does not make you “kiasu”. It makes you smart.

This is because you’ll want to maximise the coverage you can get from the policy. For example, if you haven’t bought a policy yet and the travel agency you’re booking with closes down a week before your travel, you won’t be able to claim anything. The same goes for flight delays and flight cancellations.

There is no penalty for buying travel insurance earlier, except maybe missing out on promotions that often happen around the travel season. But what’s the point of saving a few dollars and risk losing hundreds due to cancelled flights and hotel deposits?

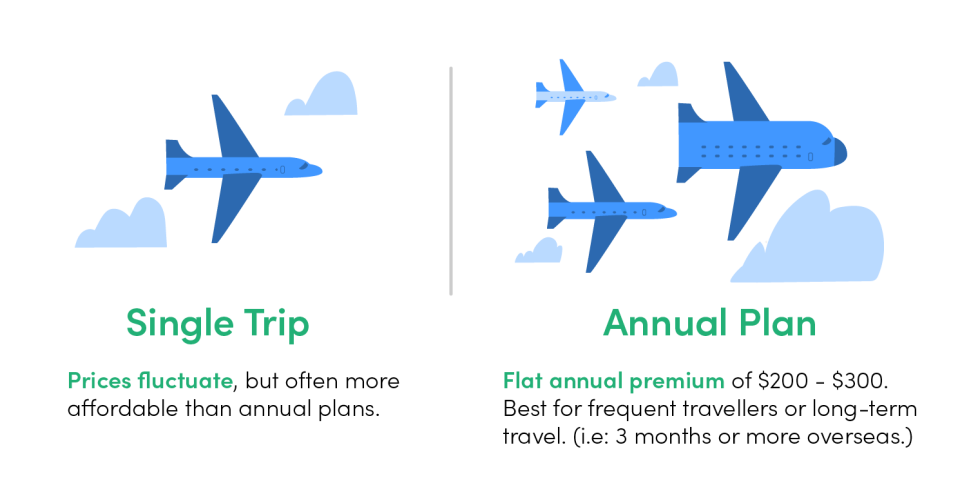

8. Buy single trip or annual travel insurance?

In the past, it made more sense to buy single trip travel insurance plans when you leave Singapore. That’s because in the past, most people only travel once or twice a year. With the greater nomad and remote working culture… and travels over long weekend, though? It might actually be more convenient to buy an annual plan for your travel insurance.

A good gauge to determine whether to choose between a single trip plan and an annual plan is to ask yourself if you’re going to be travelling more than 3 times a year. And we’re not just talking about weekend getaways either!

Whether you’re just going across the Causeway or travelling further overseas for work, an annual plan definitely makes more sense to your wallet.

Depending on how often you travel and how far you travel, it might be worthwhile to consider buying annual travel insurance.

If you are a frequent traveller, you not only save money by buying an annual policy, but you’ll never have to spend time buying insurance every time you fly overseas. Of course, just like single trip travel insurance, you should still compare the various policies online before you commit.

Annual travel insurance has a flat premium and covers you for an entire year of travel. It usually costs about $200-$300 a year, so only buy it it you are a frequent traveller. That is, it only makes sense if you are going to travel overseas more than 7-8 times a year, at least.

9. Why should I compare travel insurance before buying it?

Comparing allows you to choose the best travel insurance policy for your needs. You’ll be able to see at a glance what coverage policies have for various situations, such as medical costs, and compensation levels for lost, delayed and damaged baggage.

But of course, comparing travel insurance in Singapore allows you to see that the cheapest travel insurance policy may not be the best. This is because the cheaper policies usually have significantly less coverage, naturally. While that may be a good thing for some travellers – there’s no need to get a $1,000 coverage for lost luggage if you’re only bringing the bare minimum to a staycation in Bangkok, for example.

ALSO READ: Best Travel Insurance in Singapore: AIG vs AXA vs FWD vs NTUC

Are you headed overseas? Compare the cheapest travel insurance here.

The post Travel Insurance Singapore Guide (2024): Must-Knows for Choosing the Best Travel Insurance appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Travel Insurance Singapore Guide (2024): Must-Knows for Choosing the Best Travel Insurance appeared first on MoneySmart Blog.

Original article: Travel Insurance Singapore Guide (2024): Must-Knows for Choosing the Best Travel Insurance.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance