Unveiling 3 SGX Dividend Stocks With Yields Starting At 4.9%

As the Singapore market continues to innovate, with recent developments like the collaboration between Mastercard and Standard Chartered exploring tokenised deposits and carbon credits, there is a growing interest in financial technologies that could reshape investment landscapes. In this dynamic environment, dividend stocks remain a cornerstone for investors looking for stable returns, particularly those yielding starting from 4.9%, which can offer a blend of reliability and potential growth amidst ongoing market advancements.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.24% | ★★★★★★ |

Singapore Exchange (SGX:S68) | 3.70% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.27% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.64% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.44% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.92% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.61% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 7.26% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.63% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.03% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

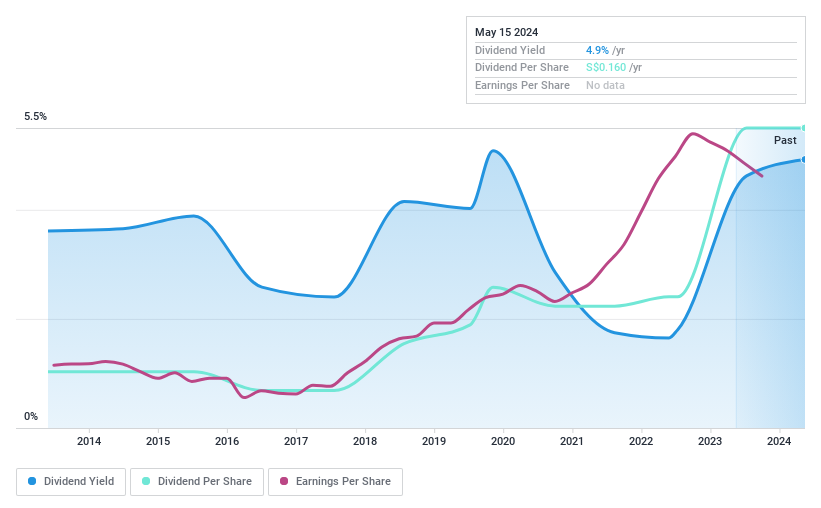

Cortina Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cortina Holdings Limited operates as an investment holding company that retails and distributes timepieces and accessories across several countries including Singapore, Malaysia, Thailand, Indonesia, Hong Kong, Taiwan, Australia, with a market cap of approximately SGD 538.13 million.

Operations: Cortina Holdings Limited generates revenue primarily through its retail and wholesale segments, with retail sales amounting to SGD 771.57 million and wholesale sales totaling SGD 129.15 million.

Dividend Yield: 4.9%

Cortina Holdings has demonstrated a mixed track record in its dividend distributions, characterized by volatility with significant annual fluctuations over the past decade. Despite this, its dividends are well-supported financially, evidenced by a low payout ratio of 4.8% and a reasonable cash payout ratio of 74.5%, ensuring that earnings and cash flows adequately cover the dividend payments. However, Cortina's dividend yield of 4.92% falls short when compared to the top quartile of Singaporean dividend payers at 6.17%. Additionally, while Cortina's price-to-earnings ratio stands at an attractive 7.7x against the broader Singapore market average of 11.5x, potential investors should weigh these aspects carefully due to the stock's historical dividend instability and below-average yield.

Click to explore a detailed breakdown of our findings in Cortina Holdings' dividend report.

Our valuation report here indicates Cortina Holdings may be overvalued.

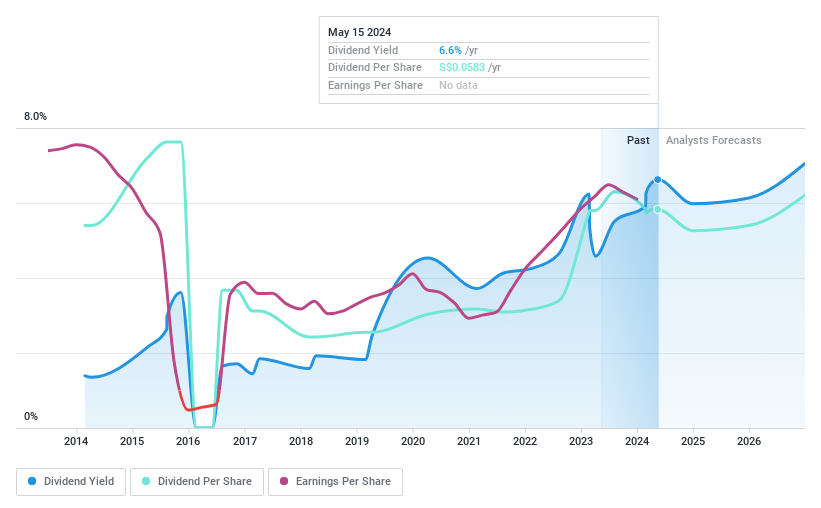

Delfi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delfi Limited is an investment holding company that specializes in manufacturing, marketing, distributing, and selling chocolate and chocolate confectionery products across Indonesia, the Philippines, Malaysia, Singapore, and other international markets with a market capitalization of SGD 537.82 million.

Operations: Delfi Limited generates revenue primarily through its operations in Indonesia, which brought in SGD 370.41 million, and its regional markets contributing SGD 185.07 million.

Dividend Yield: 6.6%

Delfi Limited, despite trading 42.4% below its estimated fair value, faces challenges with its dividend reliability and coverage. The company's dividend payments have shown volatility over the past decade and are not well-supported by earnings or cash flows, with a high cash payout ratio of 1776.7%. However, Delfi has reported a modest growth in earnings by 5.4% over the past year and offers a competitive yield at 6.62%, placing it in the top quartile of Singaporean dividend payers. Recent board changes aim to enhance governance but may also introduce uncertainty regarding future dividend policies.

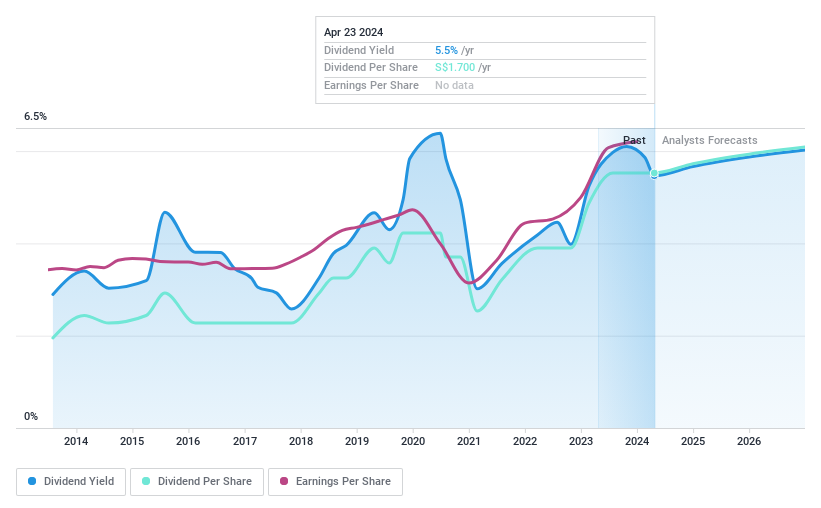

United Overseas Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited operates globally, offering a range of banking products and services, with a market capitalization of approximately SGD 50.15 billion.

Operations: United Overseas Bank Limited generates its revenue through a diverse array of banking products and services on a global scale.

Dividend Yield: 5.7%

United Overseas Bank's recent share repurchase program and stable dividends highlight a commitment to shareholder returns, despite slight dips in quarterly earnings and net interest income as reported on May 8, 2024. The bank maintains a dividend payout ratio of 50%, with dividends well-covered by earnings. However, the dividend history shows some volatility over the past decade, reflecting occasional fluctuations in payout consistency. Recent executive changes could influence strategic directions but underscore a focus on robust management practices.

Summing It All Up

Access the full spectrum of 21 Top SGX Dividend Stocks by clicking on this link.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:C41 SGX:P34 and SGX:U11.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance