Three Leading Dividend Stocks In India Yielding Up To 5.2%

The Indian stock market has shown robust growth, rising 2.4% in the past week and an impressive 45% over the last year, with earnings expected to grow by 18% annually. In this dynamic environment, dividend stocks can be particularly appealing for investors looking for steady income combined with potential capital appreciation.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Bhansali Engineering Polymers (BSE:500052) | 3.95% | ★★★★★★ |

Castrol India (BSE:500870) | 3.53% | ★★★★★☆ |

NMDC (BSE:526371) | 3.34% | ★★★★★☆ |

Balmer Lawrie Investments (BSE:532485) | 4.62% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.52% | ★★★★★☆ |

Great Eastern Shipping (BSE:500620) | 3.30% | ★★★★★☆ |

Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.17% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.64% | ★★★★★☆ |

PTC India (NSEI:PTC) | 3.44% | ★★★★★☆ |

Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.49% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

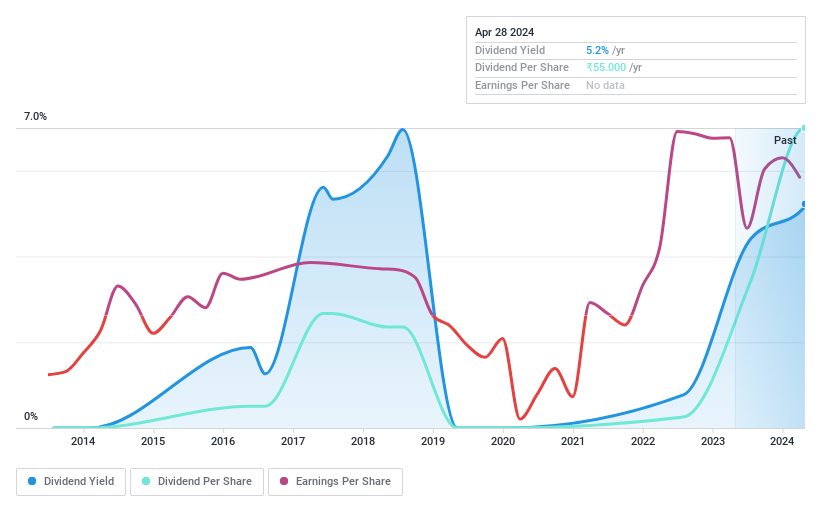

Chennai Petroleum

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chennai Petroleum Corporation Limited, engaged in producing and supplying petroleum products across India, has a market capitalization of approximately ₹156.64 billion.

Operations: Chennai Petroleum Corporation Limited generates its revenue primarily from the petroleum sector, amounting to approximately ₹66.39 billion.

Dividend Yield: 5.2%

Chennai Petroleum Corporation Limited, despite its unstable dividend track record over the past 8 years and high share price volatility recently, maintains a low cash payout ratio of 39.2% and earnings payout ratio of 29.8%, indicating that its dividends are well covered by both earnings and cash flows. Recently, the board recommended a preference dividend of INR 332.5 million for FY 2023-2024 and an equity dividend increase to INR 55 per share, subject to shareholder approval at the upcoming AGM. However, investors should note the forecasted significant decline in earnings by an average of 44.9% annually over the next three years which may impact future dividend sustainability.

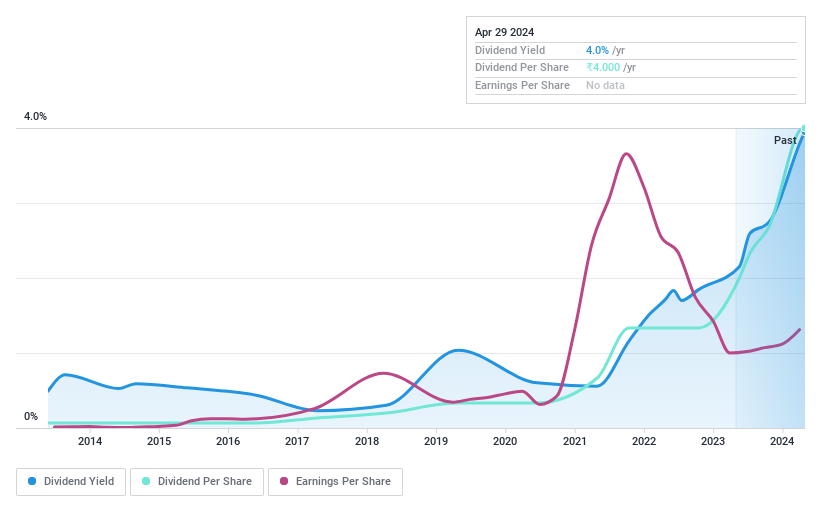

Bhansali Engineering Polymers

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bhansali Engineering Polymers Limited is a petrochemical company with operations in India and internationally, boasting a market capitalization of approximately ₹25.20 billion.

Operations: Bhansali Engineering Polymers Limited generates revenue primarily from the sale of highly specialized engineering thermoplastics, amounting to ₹12.22 billion.

Dividend Yield: 4%

Bhansali Engineering Polymers has demonstrated a consistent dividend track record, with a 3.95% yield, ranking in the top 25% of Indian dividend payers. The dividends are well-supported by both earnings and cash flows, with payout ratios of 55.5% and 47.7%, respectively. The company's price-to-earnings ratio stands at a competitive 14x against the broader Indian market's 31.7x, indicating potential value for investors seeking income through dividends. On April 20, 2024, Bhansali proposed an annual dividend of INR1 per share for FY2024, pending shareholder approval at their upcoming AGM scheduled before July 2, reflecting confidence in ongoing financial health despite a slight revenue dip reported for the year ending March 31, 2024.

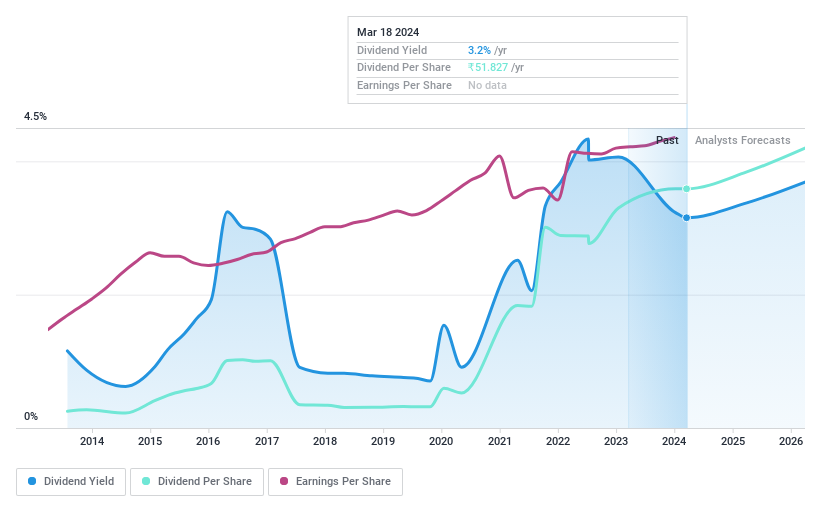

HCL Technologies

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HCL Technologies Limited, a global company, provides software development, business process outsourcing, and infrastructure management services with a market capitalization of approximately ₹3.99 trillion.

Operations: HCL Technologies Limited generates revenue primarily through three segments: HCL Software at $1.41 billion, IT and Business Services at $9.80 billion, and Engineering and R&D Services at $2.12 billion.

Dividend Yield: 3.5%

HCL Technologies has shown a mixed dividend profile, with an increase in dividends over the past decade but marked by volatility. The company maintains a high payout ratio of 89.1% and a cash payout ratio of 65.1%, indicating that while dividends are covered by earnings and cash flows, there's little room for error without affecting payouts. Recently, HCL declared an interim dividend of INR 18 per share for FY2024-2025, aligning with its latest financial performance where annual sales reached US$13.27 billion and net income was US$1.896 billion, reflecting steady growth and operational stability.

Taking Advantage

Investigate our full lineup of 24 Top Dividend Stocks right here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BSE:500110 BSE:500052 and NSEI:HCLTECH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance