Three High Yield Dividend Stocks In Hong Kong Offering Up To 8.4%

Amid a generally positive backdrop in global markets, with indices like the Hang Seng showing notable gains, investors are increasingly attentive to opportunities within Hong Kong's dividend stock arena. In this context, understanding the characteristics that define a robust dividend stock is crucial, especially in a market buoyed by recovery optimism and solid holiday spending figures.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Construction Bank (SEHK:939) | 7.78% | ★★★★★★ |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.52% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 8.97% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.36% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.00% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.93% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.52% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 3.93% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 8.48% | ★★★★★☆ |

Click here to see the full list of 84 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

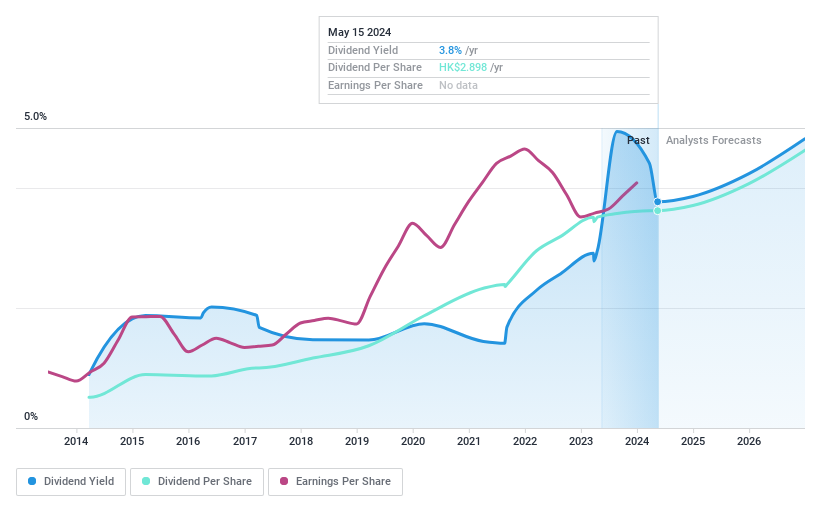

ENN Energy Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Energy Holdings Limited operates primarily in the investment, construction, operation, and management of gas pipeline infrastructure across the People’s Republic of China, with a market capitalization of approximately HK$86.42 billion.

Operations: ENN Energy Holdings Limited generates revenue through several key segments: wholesale of gas (CN¥40.59 billion), retail gas sales (CN¥68.51 billion), integrated energy business (CN¥14.66 billion), value added business (CN¥7.94 billion), and construction and installation services (CN¥6.58 billion).

Dividend Yield: 3.8%

ENN Energy Holdings recently proposed a dividend of HK$2.31 per share for 2023, reflecting a commitment to shareholder returns despite earnings not fully covering the dividend payments, indicated by a high cash payout ratio of 106%. The company's earnings grew by 16.2% last year to CNY 113.86 billion, and dividends have shown growth over the past decade. However, with a yield of 3.77%, it falls below Hong Kong's top dividend payers average of 7.48%.

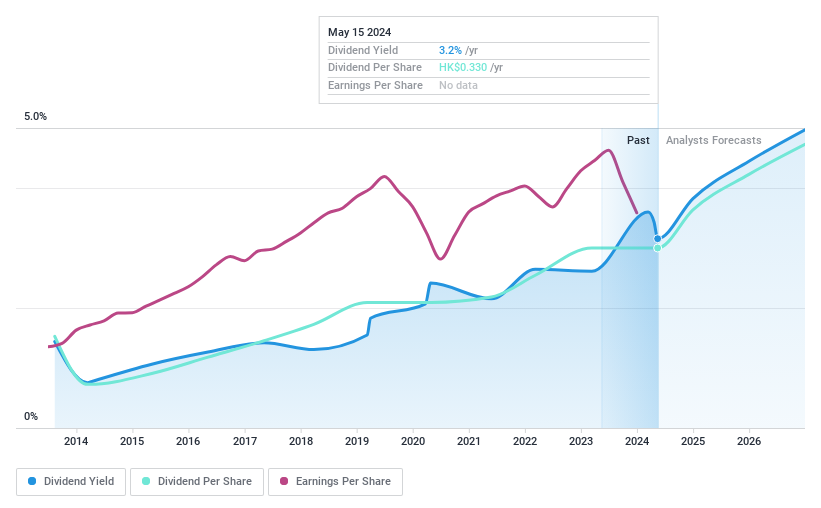

Beijing Tong Ren Tang Chinese Medicine

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Tong Ren Tang Chinese Medicine Company Limited operates in manufacturing, retailing, and wholesaling healthcare products and Chinese medicine, with a market capitalization of approximately HK$8.76 billion.

Operations: Beijing Tong Ren Tang Chinese Medicine generates revenue primarily through its operations in Hong Kong (HK$1.17 billion), overseas markets (HK$0.48 billion), and Mainland China (HK$0.23 billion).

Dividend Yield: 3.2%

Beijing Tong Ren Tang Chinese Medicine recently proposed a final dividend of HK$0.33 per share for 2023, with a modest yield of 3.15%, below the top Hong Kong dividend payers' average. Despite this, dividends have increased over the past decade but have shown volatility and unreliability in their growth pattern. The company's payout ratio stands at 51.1%, suggesting dividends are well-covered by earnings, yet its historical track record raises concerns about stability and sustainability in its dividend policy.

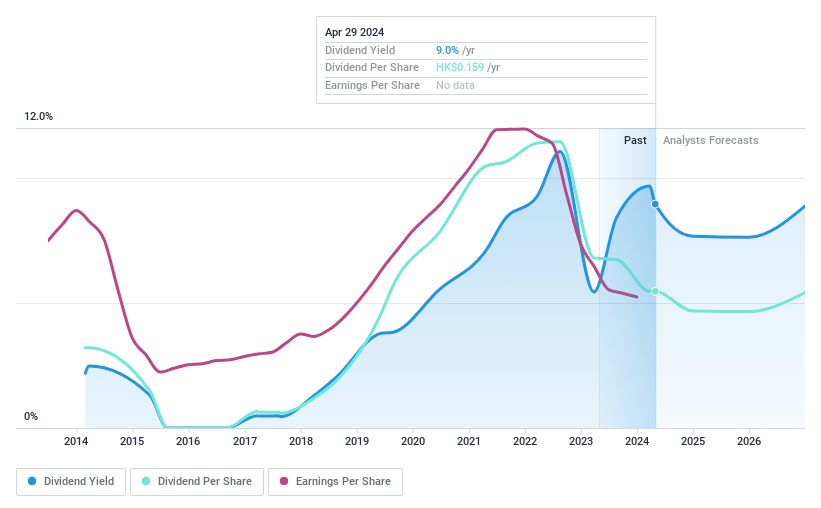

China Overseas Grand Oceans Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Overseas Grand Oceans Group Limited operates as an investment holding company, focusing on the investment, development, and leasing of real estate properties in the People's Republic of China and Hong Kong, with a market capitalization of approximately HK$6.69 billion.

Operations: China Overseas Grand Oceans Group Limited generates revenue primarily through property investment and development, which accounted for CN¥56.08 billion, and property leasing activities, contributing CN¥0.24 billion.

Dividend Yield: 8.5%

China Overseas Grand Oceans Group has shown a mixed performance in dividend reliability, with payments being volatile over the past decade. Despite this, dividends are well-covered by both earnings and cash flows, with low payout ratios of 22.5% and 5.8% respectively, indicating potential sustainability. However, recent financial results show a decline in net income and sales year-over-year, alongside significant decreases in property contracted sales for early 2024. These factors could impact future dividend stability and growth prospects.

Seize The Opportunity

Click through to start exploring the rest of the 81 Top Dividend Stocks now.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2688SEHK:3613 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance