Price & Time: Important Turn Setting Up in the Pound

Talking Points

Price action over next few days will be crucial for the Pound

EUR/USD rebounds from key support level

AUD/USD trades at highest level in over 3-months

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

Foreign Exchange Price & Time at a Glance:

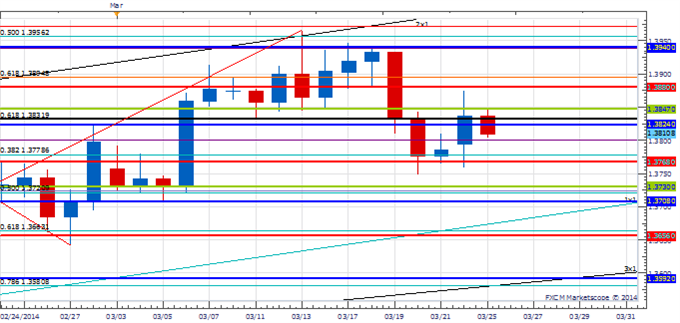

Price & Time Analysis: EUR/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

EUR/USD is in consolidation mode above the 9th square root relationshipof the 2013 low near 1.3765

Our near-term trend bias is lower in EUR/USD while below 1.3930

The 1.3765 level is an important near-term pivot with a move below needed to signal a continuation of the recent decline

A cycle turn window is seen around the second half of the week

Only aggressive strength back over 1.3930 on a daily close basis would turn us positive on the Euro

EUR/USD Strategy: We like selling into strength over the next few days.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | 1.3730 | *1.3765 | 1.3810 | 1.3880 | *1.3930 |

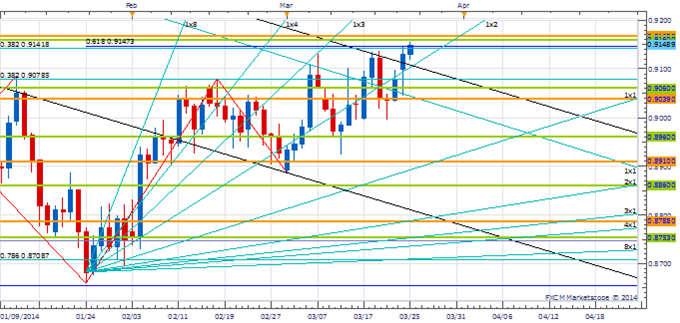

Price & Time Analysis: AUD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

AUD/USD overcame the 61.8% projection of the Jan/Feb advance near .9150 to trade at its highest level since early December on Tuesday

Our near-term trend bias is higher in the Aussie while over .9060

The 5th square root relationship of the year’s low at .9160 is immediate resistance ahead of an important Fibonacci convergence just above .9200

A Gann cycle turn window is eyed later in the week

A daily close below .9060 would turn us negative on the Aussie

AUD/USD Strategy: We like the long side while over .9060, but may look to trim heading into the latter part of the week.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

AUD/USD | .9060 | .9105 | .9150 | .9160 | *.9210 |

Focus Chart of the Day: GBP/USD

GBP/USD fell to its lowest level in almost a month and a half yesterday before rebounding sharply from the 161.8% extension of the late February/early March advance near 1.6460. An important cycle turn window related to last year’s low should influence around the end of the week, but will it lead to a high or a low? The price action over the next few days is expected to shape the answer. A continuation of yesterday’s reversal into Friday would set up some sort of secondary top. This our favored scenario as it squares up best with the action we are seeing in some of the other USD pairs. A continuation of the recent decline to new lows into the end of the week, however, would flip the script on us and set up an important low.

To receive Kristian’s analysis directly via email, pleaseSIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance