Pharma Stock Roundup: LLY, NVO, PFE Q1 Results, JNJ's New Plan to Resolve Talc Claims

The first-quarter 2024 earnings season is almost over as far as large drugmakers are concerned. Eli Lilly LLY, Novo Nordisk NVO, Pfizer PFE and AbbVie ABBV announced their first-quarter results this week. J&J JNJ announced a new plan to completely resolve its talc-related lawsuits.

Recap of the Week’s Most Important Stories

Earnings Update: Pfizer’s first-quarter results were strong as it beat estimates for earnings as well as sales. While sales of COVID products declined due to lower demand, some key non-COVID products like Prevnar, Vyndaqel and Eliquis, new launches like Abrysvo and newly acquired products from Seagen boosted the top line in the first quarter. Sales of all key products like Prevnar, Vyndaqel and Eliquis beat estimates. Seagen drugs contributed $742 million to the top line in the first quarter. Revenues from Pfizer’s non-COVID products rose 11% operationally in the first quarter.

The company raised its 2024 earnings guidance while retaining revenue expectations. Adjusted earnings are expected in the range of $2.15 to $2.35 versus the prior expectation of $2.05 to $2.25 per share.The revenue guidance was maintained in the range of $58.5 to $61.5 billion in 2024, almost flat from the 2023 levels.

Lilly’s first-quarter results were soft as it beat estimates for earnings but missed the same for sales. Strong demand for Mounjaro, Zepbound, Verzenio and Jardiance pulled the top line in the quarter. However, continued supply constraints for incretin-based products like Trulicity, Mounjaro and Zepbound hurt sales. Demand for incretin-based products exceeded supply.

Mounjaro recorded sales of $1.81 billion during the quarter, while Zepbound’s sales were $517.4 million. Lilly is investing in new advanced manufacturing plants and lines in the United States and Europe to increase supply. Lilly expects the production of incretin-based products to increase from the second half of 2024. “Greater visibility” on its production expansion plans and strong demand for Mounjaro and Zepbound pushed Lilly to raise its sales and earnings guidance ranges for 2024. Lilly expects revenues in the range of $42.4 billion to $43.6 billion compared with the prior expectation of $40.4 to $41.6 billion. The earnings per share guidance was raised from the range of $12.20 to $12.70 to $13.50 to $14.00 per share.

Novo Nordisk beat estimates for both earnings and sales. Revenues rose 24% at a constant exchange rate (CER), driven by strong sales of its diabetes and obesity care products, mainly GLP-1 products. Its GLP-1 diabetes sales increased 32% at CER. Total Diabetes care rose 24% and Obesity care sales increased 42% at CER. Sales of the diabetes drug Ozempic rose 43%, while Wegovy rose 107% at CER. Rare disease segment sales were down 3%.

Backed by strong sales performance of Ozempic and Wegovy, Novo Nordisk raised its sales growth expectation for 2024 from a range of 18-26% at CER to 19-27%, while the operating profit growth range was raised from 21-29% to 22-30%at CER.

AbbVie beat estimates for both earnings and sales in the first quarter. While sales rose 0.7% year over year, earnings declined 6.1%. Sales of key immunology medicines Skyrizi and Rinvoq rose 47.6% and 59.3% on a reported basis, respectively, driven by successful label expansions to new indications. Humira sales declined 35.9% due to generic erosion. The company also raised its EPS guidance for 2024. AbbVie expects adjusted EPS in the range of $11.13-$11.33, up from the previously provided EPS guidance of $10.97-$11.17.

FDA Approves Pfizer’s Hemophilia Gene Therapy: The FDA granted approval to Pfizer’s gene therapy fidanacogene elaparvovec for the treatment of adults with hemophilia B, a rare genetic bleeding disorder. The therapy will be marketed by the name of Beqvez. Beqvez is a one-time treatment which will allow hemophilia B patients to produce factor IX (FIX), a blood clotting factor, themselves compared to the current standard of care, which require regular FIX infusions, thereby reducing the treatment burden for these patients. The approval is based on positive data from the phase III study called BENEGENE-2. A regulatory application is also under review in Europe. Beqvez was recently approved in Canada.

J&J’s New Plan to Resolve Talc Lawsuits: J&J announced that its subsidiary, LTL Management, which was established to manage claims in the cosmetic talc litigation, has proposed a “Plan of Reorganization” to resolve all present and future pending ovarian cancer talc lawsuits

J&J faces more than 50,000 lawsuits for its talc-based products, primarily its baby powders. The lawsuits allege that its talc products contain asbestos, which caused many women to develop ovarian cancer.

LTL Management twice filed for voluntary bankruptcy to equitably resolve all present and future talc-related claims. However, both the bankruptcy filings were rejected by courts stating that J&J was not in enough financial stress to qualify for bankruptcy.

Per the new plan, to completely resolve its cosmetic talc litigation, J&J has offered to pay $6.48 billion to claimants over a period of 25 years. If 75% of claimants vote in favor of the plan, J&J will file a third bankruptcy filing. The company claims that if the plan is approved by claimants through a majority vote, it would resolve 99.75% of all pending talc lawsuits against J&J.

J&J filed regulatory applications to the European Medicines Agency (EMA) seeking approval for its immunology medicine, Tremfya, for two new indications — moderately to severely active ulcerative colitis (UC) and moderately to severely active Crohn’s disease.

Tremfya is presently approved to treat certain patients with plaque psoriasis and active psoriatic arthritis in several countries, including the United States and the EU. The applications for the UC indication were based on data from the phase III QUASAR study, while that for Crohn’s disease was based on the phase III GALAXI. J&J has also filed an application seeking expanded use of Tremfya for the UC indication to the FDA.

The NYSE ARCA Pharmaceutical Index rose 1.2% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

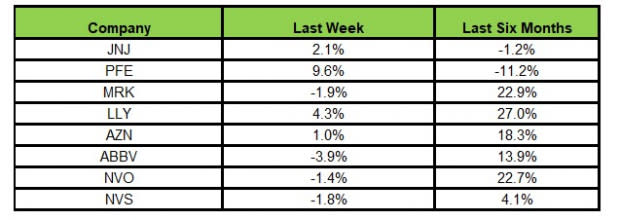

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, Pfizer rose the most (9.6%), while AbbVie declined the most (3.9%).

In the past six months, Lilly has risen the highest (27.0%), while Pfizer has declined the most (11.2%).

(See the last pharma stock roundup here: MRK, SNY, AZN, NVS’ Q1 Results, Pipeline & Regulatory Updates)

What's Next in the Pharma World?

Watch this space for regular pipeline and regulatory updates next week.

Lilly, Pfizer, Novo Nordisk, AbbVie and J&J have a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance