Will Petrobras (PBR) Report Q1 Earnings Beat on Output Gains?

Petroleo Brasileiro S.A., or Petrobras PBR is set to release first-quarter 2024 results on May 13. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 84 cents per share on revenues of $24.6 billion.

Let’s delve into the factors that might have influenced Brazil's state-run energy giant’s results in the March quarter. But it’s worth taking a look at PBR’s previous-quarter performance first.

Highlights of Q4 Earnings & Surprise History

In the last reported quarter, the Rio de Janeiro-headquartered oil company beat the consensus mark on higher oil and gas production. PBR had reported earnings per ADS of $1.27, above the Zacks Consensus Estimate of $1.12. Revenues of $27.1 billion generated by the firm also outperformed the Zacks Consensus Estimate by 2.5%.

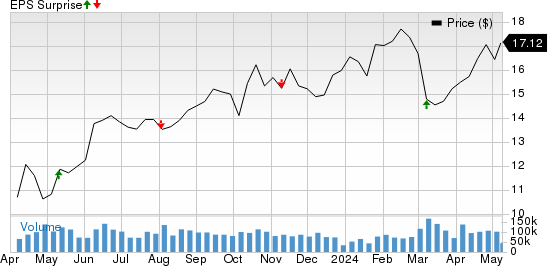

Petrobras beat the Zacks Consensus Estimate in two of the last four quarters and missed in the other two, which resulted in an earnings surprise of 2.8%, on average. This is depicted in the graph below:

Petroleo Brasileiro S.A.- Petrobras Price and EPS Surprise

Petroleo Brasileiro S.A.- Petrobras price-eps-surprise | Petroleo Brasileiro S.A.- Petrobras Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the first-quarter bottom line has remained unchanged in the past seven days. The estimated figure indicates a 24.3% decline year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests an 8% decrease from the year-ago period.

Factors to Consider

Petrobras is expected to have reaped the reward of higher production during the first quarter. PBR continues to churn out an impressive output from its pre-salt reservoirs that lie below the Espírito Santo, Campos and Santos basins in deep and ultra-deep water.

According to the company’s “Production and Sales Report” for the first quarter of 2024, production of oil, natural gas and NGLs has risen 3.7% from the prior-year level. The total production of hydrocarbons reached 2,776 million barrels of oil equivalent (boe) per day. In particular, crude oil production increased 4.4% from the prior-year level to 2.24 million boe per day. The increase in production can be attributed to the ramp-up of the five FPSOs — Almirante Barroso, P-71, Anna Nery, Anita Garibaldi and Sepetiba. The uptick in output is expected to have buoyed its revenues and cash flows.

But on a somewhat bearish note, the increase in Petrobras’ costs might have dented its to-be-reported bottom line. PBR’s pre-salt lifting costs in the fourth quarter increased around 7.5% year over year to $6.13 per barrel. The upward cost trajectory is likely to have continued in the first quarter due to the prevailing inflationary environment.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Petrobras is likely to beat estimates in the first quarter of 2024. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Petrobras has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 84 cents per share each.

Zacks Rank: PBR currently carries a Zacks Rank #2, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult this earnings season.

Stocks to Consider

While an earnings beat looks uncertain for Petrobras, here are some firms that you may want to consider on the basis of our model:

ANI Pharmaceuticals, Inc. ANIP has an Earnings ESP of +9.74% and a Zacks Rank #2. The firm is scheduled to release earnings on May 10.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Over the past 90 days, the Zacks Consensus Estimate for ANI Pharmaceuticals’ 2024 earnings per share has moved up 9.4%. Valued at around $1.4 billion, ANIP has gone up 58.2% in a year.

Nextracker Inc. NXT has an Earnings ESP of +9.80% and a Zacks Rank #3. The firm is scheduled to release earnings on May 14.

Over the past 90 days, the Zacks Consensus Estimate for Nextracker’s fiscal 2024 earnings per share has moved up 3.9%. Valued at around $6.3 billion, NXT has gained 31.6% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A.- Petrobras (PBR) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Nextracker Inc. (NXT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance