Hot Picks: Bracing For The End Of QE

So, the bond purchase programme instituted by the US Federal Reserve is projected to end in 2014. A tapering of the programme is expected to begin before the last quarter of this year. With the impending conclusion of this programme, long term interest rates are expected to rise.

While the Federal Reserve said that it would maintain short term interest rates at its current near zero levels at least until 2015, investors have been reading the latest developments as the end of an era. The era of low interest rates. When the age of low interest rates draws to a close, increasing costs of capital will become a reality for all companies.

In an earlier article , theShares Investment team noted that two main company centric factors should be taken into consideration. This, especially so when investors are trying to brace for the end of Quantitative Easing.

Bracing For The End Of QE – Low Debt, High Cash!

Essentially, the article speaks about how highly leveraged companies in capital intensive sectors will definitely feel the pinch (or blow). So to combat this, we at Tradeable felt that companies who might be able to weather at least the initial onslaught of higher interest rates will be companies who have lower debts (duh!).

Also, in our analysis, we figured that companies with a large cash hoard will be better placed to negotiate a high interest rate climate. So the main ratios we have used to screen all the companies on the stock market were:

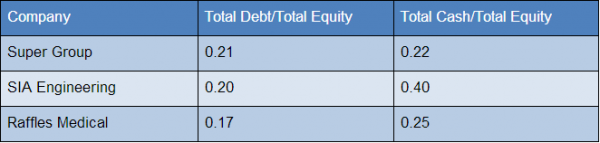

Total Debt/Total Equity

Total Cash/Total Equity

Aside from these two primary factors, we have also done some fundamental analysis homework for you! We have come up with three great stocks that you can look at in your efforts to brace your portfolio against higher interest rates.

Source: Company’s financial reports

Super Group – Large Hoard Of Cash For Expansion?

According to our analysis, Super Group has low debt for its relative size. Its gearing levels (total debt/total equity) as at 31 March 2013 stood at 0.21 while its sizeable cash hoard of around $93.6 million has put it within our scopes.

On the fundamental side, Super Group currently boasts a market leading position in the new economic frontier that is Myanmar. The firm has been in the country for around 15 years and is a market leader there with a market share of more than 40 percent.

Even though the recent riots in Myanmar have dampened 1Q13 growth there, analysts note that Super Group still has firm growth prospects in that country as well as in other countries such as China and the Philippines.

The sizeable cash hoard as well as strong cash flow generation by its operating segments have continued to be a boon for Super Group.

Source: FactSet, candlestick graph depicting Super Group’s share price movements over the past 1 month

On the technical analysis front however, Super Group appears to be heading on a downward trend as our shorter, two day moving average line is heading south. The divergence of both the short term (two days) and longer term (19 days) moving average lines also indicate that the stock could be headed for further volatility.

SIA Engineering – The Magpie Of SGX?

SIA Engineering (SIAE) has a low gearing ratio (total debt/total equity) of 0.20 and an extremely high level of cash as at 31 March 2013. The amount of cash is twice (based on total cash/total equity) of the amount of the total debt ratio (based on total debt/total equity). Essentially, a magpie gathering all that glitters in its nest.

Looking forward, the company is well poised for growth as it has the necessary capital to expand its facilities. We expect the company to expand its facilities to accommodate the increase in workload when the Airbus A350 goes into operation.

The A350 is a new wide-body aircraft by Airbus that has attracted much interest from different airlines as demand for bigger long-haul aircraft increases. Specifically, the A350 only uses the Trent Engine which is from manufacturer, Rolls Royce. It just so happens that SIAE is part of a joint venture (JV) which specialises in fixing Trent Engines. We are of the opinion that, given SIAE’s expertise as well as experience, demand for its engineering services should increase when the A350 enters into services.

Perhaps a common misunderstanding amongst investors is that SIAE only services SIA’s planes. However, in reality, SIAE does servicing for other airlines through its JVs. These accounts for more than 30 percent of its revenue. With the positive servicing demand outlook, we expect SIAE to increase its capacity beyond the current 250 engine repairs a year to meet demand.

Source: FactSet, candlestick graph depicting SIA Engineering’s share price movements over the past 1 month

While the fundamentals look good, market watchers have largely given SIAE neutral ratings. Looking at our technical analysis however, we find that the recent correction to SIAE seems to have ended. The short term (two days) moving average line has now cut the longer term (19 days) moving average line. The “piercing” of the 19 days moving average line by the two days moving average line should be seen as a buying opportunity for investors. However, investors should still be wary about dipping into the pool as macroeconomic news could still cause the upward trend to flip.

Raffles Medical Group – In The Pink Of Health

Raffles Medical Group (RMG) has amassed significant cash as the group previously planned to redevelop the property on 30 Bideford Road to a medical centre. However, the plan was rejected by the government twice. RMG has since approached Jones Lang LaSalle regarding the sale of the property which is expected to increase the cash position of the group.

Looking at its gearing ratio (total debt/total equity), it is currently low at 0.17 which is nearly half of its cash reserve ratio(total cash/total equity).

Aside from its financial health, the recent haze situation in Singapore might bring in an unexpected gain in revenue for the group. With the recent pollutant index hitting over 400, we can foresee an increase in outpatient clinic visits as the haze is likely to bring about respiratory issues for patients. With a strong network of clinics in Singapore, RMG is well positioned to take advantage in this situation.

RMG is a domestic private healthcare player with more than 95 percent of its revenue derived from Singapore. In recent years, however, RMG has been diversifying its business through expansion in China. Currently, it operates a medical centre in Shanghai and is looking be involved in an integrated international hospital development in Shenzhen. The expansion in China, a growing market in the healthcare sector, is sure to bring more value to investors.

Source: FactSet, candlestick graph depicting Raffles Medical’s share price movements over the past 1 month

The recent correction to RMG’s share price may have taken its toll. However, according to our technical analysis, the stock may be on the verge of rallying. RMG’s short term (two days) moving average is converging with the longer term (19 days) moving average. It may present a buying opportunity for investors if the lower moving average line passes through the moving average line above. In the meantime, investors might want to continue to monitor RMG’s stock price movement.

More From Shares Investment:

Yahoo Finance

Yahoo Finance