Great Eastern shares close 37.5% higher at $25.72, above OCBC’s $25.60 offer price

The close price — a five-year high — follows OCBC’s $1.4 billion privatisation bid, announced pre-market.

Shares in Great Eastern Holdings G07 (GEH) closed 37.5% higher at $25.72 on May 10, after majority shareholder Oversea-Chinese Banking Corporation (OCBC) O39 announced a privatisation bid for some $1.4 billion.

The close price — a five-year high — is above OCBC's offer price of $25.60.

GEH had called for a trading halt before the market opened on May 10, which was lifted after the midday break at 1pm. The insurer’s shares reached an intra-day high of $26.

OCBC’s shares, meanwhile, closed 1.51% higher at $14.12. The bank’s shares reached an intra-day high of $14.22.

OCBC, with a current stake of 88.44% of GEH, plans to acquire the remaining 11.56% stake and delist the insurer from the Singapore Exchange S68.

OCBC’s offer price of $25.60 represents a 36.9% premium over GEH’s last traded price of $18.70 and premiums of 38.6%, 40.0% and 42.4% over the one-month, three-month and 12-month periods up to and including the last trading date of May 9.

Embedded value

However, OCBC’s offer represents a 30% discount to GEH’s $36.59 embedded value as at end-FY2023.

Is the offer final, or will OCBC revise the offer? OCBC group chief executive officer Helen Wong says she is unable to comment.

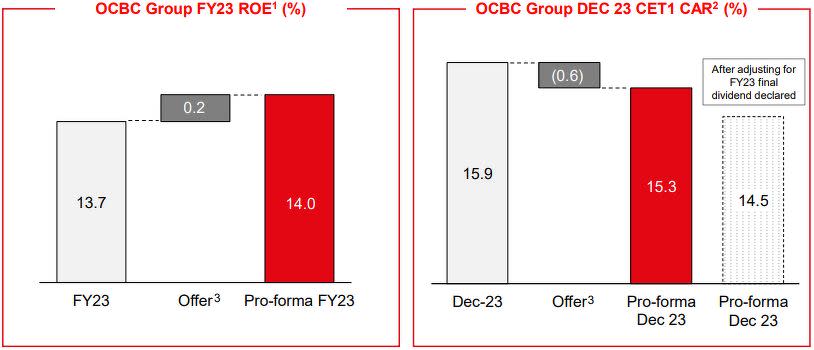

According to Wong, a successful privatisation of GEH, based on 100% acceptance at the offer price of $25.60, would add about 0.2 percentage points (ppt) to OCBC’s FY2023 return on equity (ROE).

OCBC intends to use internal cash to fund the offer, and the bank believes it is “well-capitalised” to do so. As at March 31, the group’s common equity tier-1 (CET-1) capital adequacy ratio (CAR) was 16.2%, up from 15.9% at end-2023 and 15.9% on March 31, 2023.

Calculated from end-2023 figures, the offer would trim OCBC’s CET-1 CAR by 0.6 ppt to 15.3%. After adjusting for FY2023’s final dividend, the pro-forma CET-1 CAR as at end-2023 would fall to 14.5%. Taking 1QFY2024’s figures into account, however, OCBC would be starting from a higher base of 16.2%.

This is still higher than its peers. DBS Group Holdings and United Overseas Bank U11 (UOB) reported CET-1 of 13.9% and 14.7% as at end-1QFY2024, or March 31.

Offer timeline

According to briefing slides shown on May 10, OCBC, as the offeror, will despatch the offer document no later than May 31. Following that, OCBC will despatch the circular to GEH’s shareholders no later than 14 days from the despatch of the offer document.

The closing date of the offer will be no earlier than 28 days from the date of the despatch of the offer document.

Shareholders have long called for OCBC to privatise the separately-listed GEH. In June 2023, OCBC bought 2.3 million GEH shares for nearly $40 million, which took its stake up from 87.9% to its current 88.4%.

The move, which accompanied OCBC’s 1QFY2024 results, came as a surprise. At OCBC's AGM on April 30, the bank’s chairman Andrew Lee did not give a clear indication of OCBC's plans, saying: “Since 2006, the free float of Great Eastern is lesser than 20%. OCBC is not in the business of providing liquidity for another company. We have our own strategic agendas… We have no direct interest in stimulating Great Eastern’s liquidity or share price.”

For 1QFY2024, the bank reported net profit of $1.98 billion for the quarter, 22% higher q-o-q and 5% higher y-o-y. Income growth outpaced the increase in operating expenses, which drove an improvement in cost-to-income ratio (CIR) to 37.1%, while credit costs decreased to 16 basis points (bps).

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Despite hiccups, local banks stay resilient with STI well-supported

With 1% stake in Great Eastern, Malaysia's Sungei Bagan Rubber Co sees shares jump to record high

OCBC’s spike in new non-performing assets shows modest stress ahead: Bloomberg Intelligence

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance