First Real Estate Investment Trust of New Jersey Inc Reports Mixed Q1 2024 Results

Net Loss: FREVS reported a net loss of approximately $512,000, a decrease from the prior year's net income of $419,000.

Earnings Per Share: Basic and diluted loss per share stood at $0.07, compared to earnings of $0.06 per share in the same quarter last year.

Revenue: Total real estate revenue saw a marginal increase of 0.3% year-over-year, reaching approximately $6,999,000.

Occupancy Rates: Residential occupancy remained high at 95.3%, while commercial occupancy dropped significantly to 50.1%.

AFFO: Adjusted Funds From Operations per share decreased to $0.04 from $0.17 year-over-year.

Dividends: The company maintained its dividend at $0.05 per share.

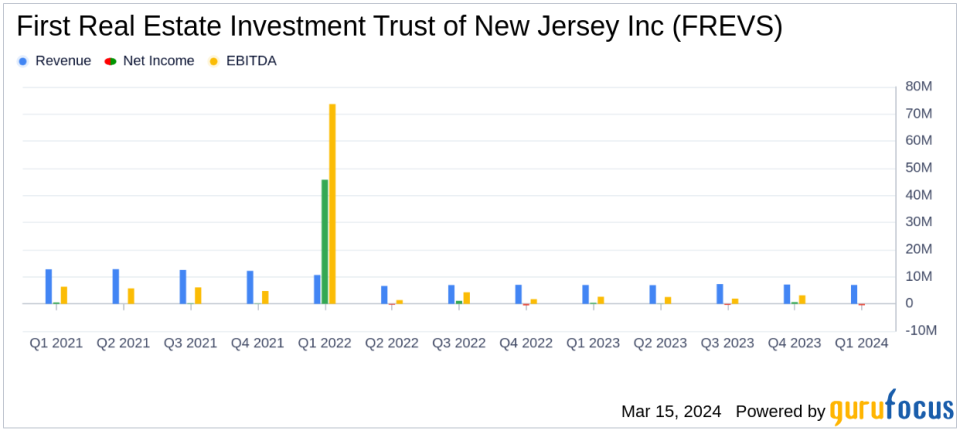

On March 15, 2024, First Real Estate Investment Trust of New Jersey Inc (FREVS) released its 8-K filing, detailing the financial results for the first fiscal quarter ended January 31, 2024. The company, which specializes in owning and managing residential and commercial properties primarily in New Jersey and New York, faced a challenging quarter marked by a slight increase in revenue but a notable decline in net income.

Performance Overview

The company's total real estate revenue inched up to approximately $6,999,000, a 0.3% increase from the previous year's figure of $6,979,000. This was largely due to an increase of approximately $340,000 in base rents from the residential segment, which helped to counterbalance a decline in average occupancy rates from 96.8% to 95.3%. However, the commercial segment experienced a decrease in revenue of approximately $273,000, primarily due to a significant drop in occupancy rates from 66.4% to 50.1%, following the departure of Kmart from the Westwood Plaza Shopping Center.

The net loss of approximately $512,000, or $0.07 per share, contrasted with the net income of $419,000, or $0.06 per share, reported in the same quarter of the previous year. The decline in net income was mainly attributed to an increase in general and administrative expenses, which rose by about $981,000. This increase was largely due to costs associated with a financial advisory firm and legal expenses related to ongoing proceedings between FREIT and Sinatra Properties, LLC.

Financial Highlights and Challenges

Segment Property Net Operating Income (NOI) for residential properties showed a modest increase, while NOI for commercial properties saw a decrease, reflecting the challenges faced in the commercial real estate market. The company also reported financing updates, including the full repayment of a $7.5 million loan on a residential property, which is expected to result in annual debt service savings of approximately $558,000.

Adjusted Funds From Operations (AFFO), a key metric for REITs, decreased to $0.04 per share from $0.17 in the prior year's comparable period. This decline in AFFO is significant as it may impact the company's ability to sustain dividend payments and fund operations or growth initiatives.

The Board of Directors declared a first quarter dividend of $0.05 on the common stock, consistent with the previous year's dividend, and will continue to evaluate the dividend on a quarterly basis.

Looking Ahead

While the company's residential segment remains robust, the substantial drop in commercial occupancy poses a challenge for future revenue streams. The management's efforts to negotiate loan terms and manage financing costs will be crucial in navigating the current real estate market conditions.

First Real Estate Investment Trust of New Jersey Inc's portfolio diversification between residential and commercial properties provides some stability, but the company will need to address the challenges in its commercial segment to improve its financial performance and maintain investor confidence.

For further details and to stay updated on FREIT's performance, investors are encouraged to visit the company's website and review their filings with the SEC.

Explore the complete 8-K earnings release (here) from First Real Estate Investment Trust of New Jersey Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance