Families in S’pore more likely to sell or float their businesses: survey

While 38 per cent of family businesses in Singapore would pass on management to the next generation, still a close 30 per cent of those would rather sell or float their companies, says a recent survey.

The Pricewaterhouse Coopers (PwC) Family Business Survey 2012 found that this 30 per cent is significantly higher than the 17 per cent of family businesses around the world that would go with the "sell or float" route.

Of those respondents, 18 per cent of Singapore companies would consider an initial public offering (IPO), 14 per cent would sell the company to equity investors, 6 per cent would sell it to the management team while 4 per cent would sell it to another company.

The main concern cited by respondents in Singapore was that the next generation may not have the skills or aptitude to run the business.

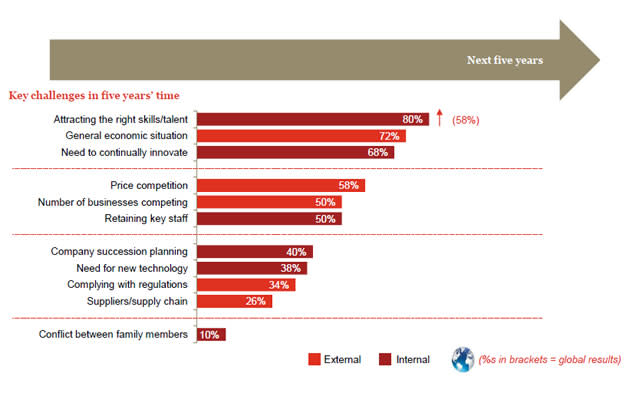

Another key finding was that 76 per cent of family businesses in the country cited staff recruitment as the biggest key internal issue for the next year -- much higher than the global average of 43 per cent which cited the same issue.

A substantially larger proportion of local family businesses identified attracting the right skills and talent as a key challenge in five years' time compared to the rest of the world. 80 per cent of businesses in Singapore cited this as the greatest challenge compared to 50 per cent of global family businesses who had the same concerns.

Commenting on the trends of the survey, Ng Siew Quan, private client services leader of PwC Singapore said, "Family businesses need to behave like large corporations if they want to compete on a global stage. This means they need to engage their successors and professionalise their business further."

The survey covered family companies with a sales turnover of more than S$6 million in over 30 countries and included interviews with top executives from 1,952 companies.

Yahoo Finance

Yahoo Finance