Exploring Hour Glass And Two Additional High Dividend Stocks

The Singapore market has remained stable over the past week but has seen a decline of 3.4% over the past year, even as earnings are expected to grow by 7.1% annually. In this context, investors might consider high dividend stocks like Hour Glass and two others, which can offer potential income in a landscape where capital gains are subdued.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.33% | ★★★★★★ |

Singapore Exchange (SGX:S68) | 3.70% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.30% | ★★★★★☆ |

Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 3.76% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.96% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.87% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.58% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 7.10% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.28% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Hour Glass

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company that specializes in retailing and distributing watches, jewelry, and other luxury products across Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market capitalization of SGD 1.01 billion.

Operations: The Hour Glass Limited generates SGD 1.13 billion primarily through the retail and distribution of luxury watches and jewelry across multiple Asian and Oceanic markets.

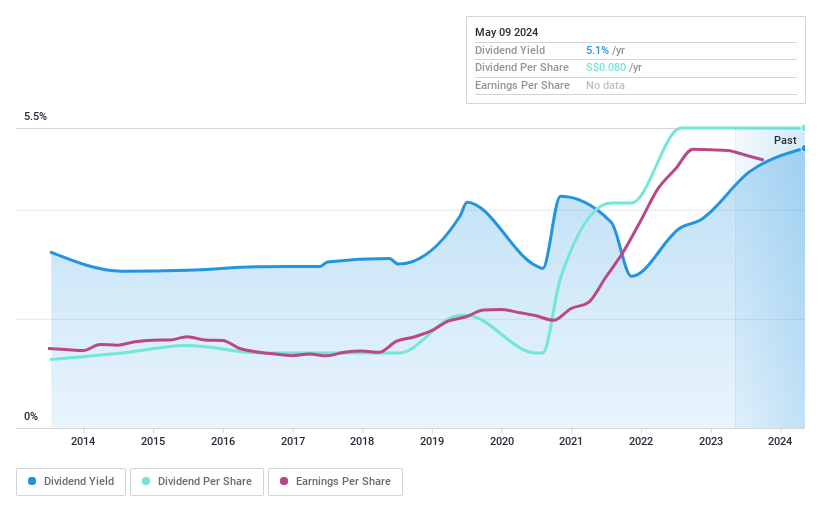

Dividend Yield: 5.1%

Hour Glass offers a dividend yield of 5.13%, which is below the top quartile of Singapore's dividend payers at 6.25%. Despite this, the company maintains a solid foundation for its dividends, with a payout ratio of 31.9% and a cash payout ratio of 42.3%, indicating that both earnings and cash flows sufficiently cover dividend payments. However, investors should note Hour Glass has had an unstable and volatile dividend track record over the past decade, although there has been growth in dividend payments within this period.

Yangzijiang Shipbuilding (Holdings)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company that specializes in shipbuilding, operating across Greater China, Canada, Japan, Italy, Greece, and other European countries with a market capitalization of approximately SGD 6.80 billion.

Operations: Yangzijiang Shipbuilding (Holdings) Ltd. generates revenue primarily through its shipbuilding segment, which amassed CN¥22.79 billion, and its shipping operations, contributing CN¥1.02 billion.

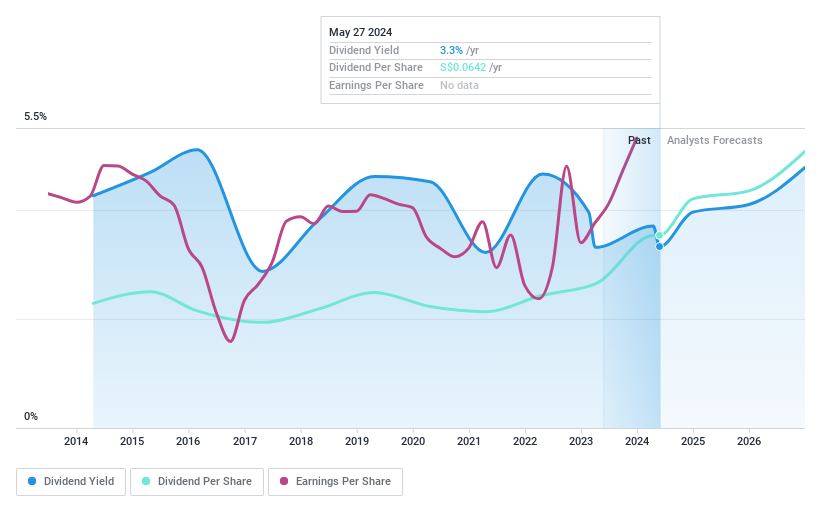

Dividend Yield: 3.8%

Yangzijiang Shipbuilding recently declared a final dividend of SGD 0.065 per share for FY 2023, reflecting its consistent dividend policy amidst robust financial performance with a significant increase in annual net income to CNY 4.10 billion from CNY 2.81 billion the previous year. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 33.6% and cash payout ratios at 19.1%, respectively, underscoring sustainability despite a lower yield of 3.76% compared to top market players. Recent board restructuring could influence future governance and dividend strategies.

Singapore Airlines

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Singapore Airlines Limited operates passenger and cargo air transportation services globally under the Singapore Airlines and Scoot brands, with a market capitalization of SGD 27.60 billion.

Operations: Singapore Airlines Limited generates revenue primarily through its Full Service Carrier segment at SGD 15.83 billion and its Low-Cost Carrier operations at SGD 2.37 billion, along with Engineering Services contributing SGD 0.95 billion.

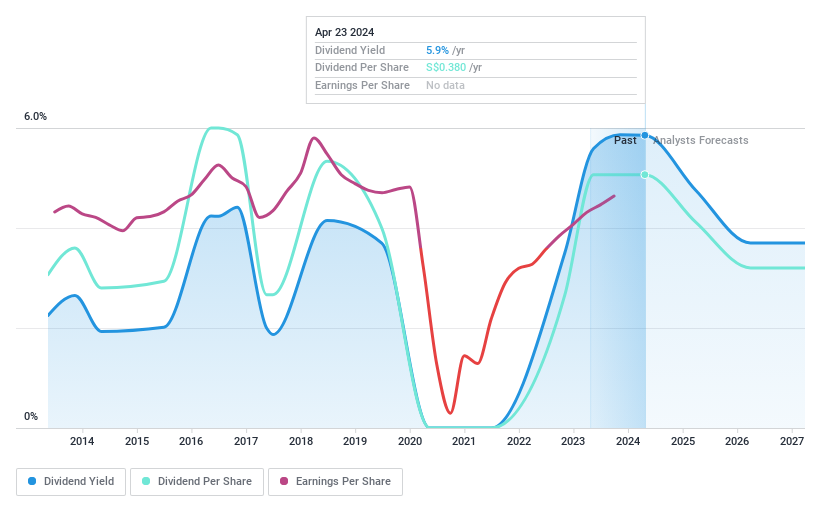

Dividend Yield: 5.7%

Singapore Airlines has demonstrated a robust operational performance with increased passenger numbers and seat availability in early 2024, signaling potential revenue growth. Despite this, the airline's dividend history is marked by instability and volatility over the past decade. The dividends are currently supported by earnings and cash flows, with a payout ratio of 73.2% and a cash payout ratio of 29.4%. However, its dividend yield at 5.7% remains below the top quartile of Singapore market payers at 6.3%. Additionally, recent fixed-income offerings suggest an active approach to managing long-term financing needs which could impact future dividend reliability.

Seize The Opportunity

Click through to start exploring the rest of the 18 Top Dividend Stocks now.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AGSSGX:BS6SGX:C6L and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance