Credit Bureau Asia's (SGX:TCU) Upcoming Dividend Will Be Larger Than Last Year's

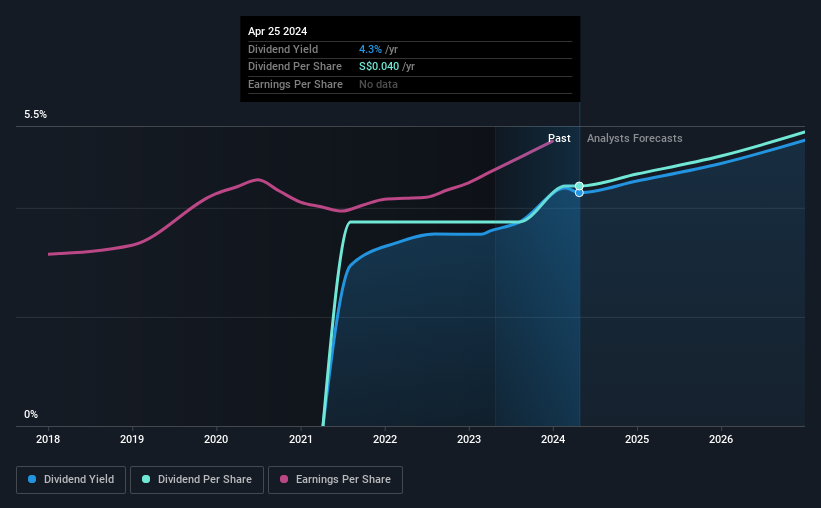

Credit Bureau Asia Limited (SGX:TCU) will increase its dividend from last year's comparable payment on the 24th of May to SGD0.02. The payment will take the dividend yield to 4.3%, which is in line with the average for the industry.

See our latest analysis for Credit Bureau Asia

Credit Bureau Asia's Dividend Is Well Covered By Earnings

Unless the payments are sustainable, the dividend yield doesn't mean too much. Before this announcement, Credit Bureau Asia was paying out 87% of earnings, but a comparatively small 37% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share is forecast to rise by 28.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 66%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Credit Bureau Asia Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. The annual payment during the last 3 years was SGD0.034 in 2021, and the most recent fiscal year payment was SGD0.04. This means that it has been growing its distributions at 5.6% per annum over that time. Investors will likely want to see a longer track record of growth before making decision to add this to their income portfolio.

Credit Bureau Asia Could Grow Its Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Credit Bureau Asia has seen EPS rising for the last five years, at 9.5% per annum. The payout ratio is very much on the higher end, which could mean that the growth rate will slow down in the future, and that could flow through to the dividend as well.

In Summary

Overall, we always like to see the dividend being raised, but we don't think Credit Bureau Asia will make a great income stock. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Credit Bureau Asia that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance