Candy Crush Saga hits China with upcoming tie-in on Tencent’s WeChat

Fasten your seatbelts and get out your toothbrushes, because an avalanche of hard candy is about to hit China. The Wall Street Journal just reported that Candy Crush Saga, the mega-hit mobile game made by London-based King Digital Entertainment, will be integrated into Tencent’s wildly popular WeChat messaging app. Tencent tells Tech In Asia that the localized game will be released this summer.

Candy Crush Saga is already available for download in China through the App Store and some domestic Android app stores, including Baidu’s. However, Chinese versions of Candy Crush don’t contain the social sharing features that helped the game go viral in international markets. For what it’s worth, the Candy Crush Saga in the Baidu App Store isn’t localized beyond a Chinese title, and touts the app’s integration with Facebook – not exactly something to brag about if you’re looking to win over Chinese consumers.

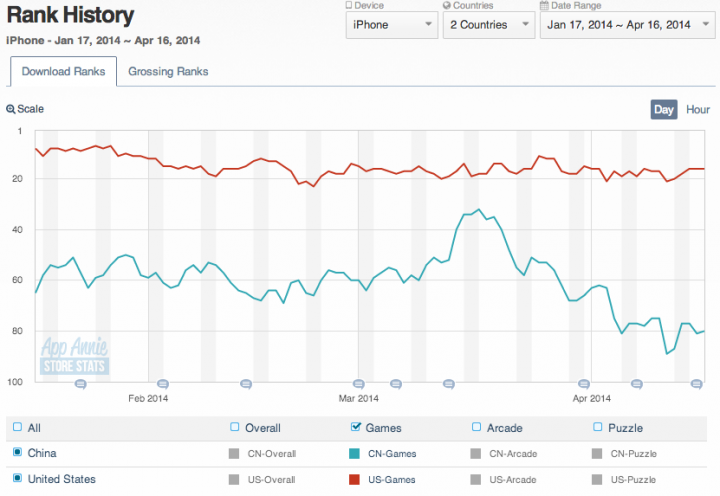

Perhaps for this reason, the game hasn’t performed as highly in China as it has in other markets – the graph below from App Annie charts Candy Crush Saga’s performance in the Games category in the App Store, and shows that over the past 90 days, the game has remained far more popular in the US than in China.

The mobile games industry might run on one-hit wonders, but with Candy Crush Saga, King scored a hit among hits. The match-three game generated an estimated US $1.54 billion for King in 2013, and accounted for over 70 percent of King’s revenue that year. It’s not clear what type of revenue sharing agreement Tencent has inked with King, or if such an agreement was made at all. But a figure that high ought to convince almost any social networking company that Candy Crush Saga will attract eyeballs, along with plenty of cash.

Of course, the real winner here is King. In markets where messaging apps have high penetration rates among consumers, the companies that own these apps are in a unique position to push their own games onto their users. It’s no surprise that three out of the top ten highest grossing games in Taiwan’s App Store right now are affiliated with Line, and eight out of the top ten highest grossing games in South Korea are affiliated with Kakao. In China, WeChat has already gotten millions of Chinese addicted it’s popular Tian Tian casual game series. As a result, WeChat ought to be the perfect platform for King to export its special brand of sugar high.

WeChat currently has over 355 million monthly active users, the majority of whom likely reside in China. Revenues from WeChat currently make up only a small percentage of Tencent’s overall revenues, but that looks set to change as games like Candy Crush Saga make their way onto app, and as merchants large and small sign up for it’s payment services.

Editing by Terence Lee; top image modified using content from Flickr user savannahgrandfather

The post Candy Crush Saga hits China with upcoming tie-in on Tencent’s WeChat appeared first on Tech in Asia.

Yahoo Finance

Yahoo Finance