Will These 5 Drug/Biotech Stocks Beat Q1 Earnings Forecast?

The first-quarter 2024 reporting cycle of the Medical sector is currently in full swing. The sector mainly comprises pharma/biotech and medical device companies.

With many pharma and biotech bigwigs having already reported results, the earnings picture has been mixed. Although nearly all of these companies have beat bottom-line estimates, some have missed out on the top line. Last week, AbbVie and AstraZeneca reported impressive first-quarter results, with their earnings and sales beating estimates. While AstraZeneca’s top line was driven by increased demand for its key oncology and rare disease drugs, AbbVie’s sales grew on the back of strong demand for immunology and oncology products.

The Earnings Trends report indicates that as of Apr 24, 16.7% of the companies in the Medical sector — representing 32.6% of the sector’s market capitalization — reported quarterly earnings. While 100% of participants beat on earnings, only 70% outperformed on revenues. Earnings and revenues increased 0.7% and 3.6% year over year, respectively. Overall, first-quarter earnings of the Medical sector are expected to decline by 7.6%, while sales are expected to rise 6.3% year over year.

Pfizer PFE is scheduled to release its first-quarter earnings report before the opening bell on May 1. The following day (i.e., May 2), Moderna MRNA, Novo Nordisk NVO and Regeneron Pharmaceuticals REGN are scheduled to release their respective Q1 earnings reports before the opening bell, while Amgen AMGN will share its quarterly results after the market closes on the same day.

Let’s see how these pharma/biotech companies are likely to have performed in the soon-to-be-reported quarter.

Pfizer

Pfizer has an encouraging earnings track record. It beat earnings estimates in each of the last four quarters, delivering an average earnings surprise of 60.54%. In the last reported quarter, PFE beat earnings estimates by 152.63%.

Pfizer Inc. Price and EPS Surprise

Pfizer Inc. price-eps-surprise | Pfizer Inc. Quote

Our proven model indicates that the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

For the quarter to be reported, Pfizer has an Earnings ESP of -6.76% and a Zacks Rank #3. The Zacks Consensus Estimate for earnings is pegged at 56 cents per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

Though revenues from its COVID product are likely to decline, Pfizer expects its operational revenues to improve, driven by its in-line products like Vyndaqel, new launches like Abrysvo and newly-acquired products, including those acquired from Seagen.

Moderna

Moderna has an impeccable earnings track record to date. Its earnings beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 79.46%. In the last reported quarter, MRNA’s earnings beat estimates by 170.51%.

Moderna, Inc. Price and EPS Surprise

Moderna, Inc. price-eps-surprise | Moderna, Inc. Quote

For the quarter to be reported, Moderna has an Earnings ESP of -6.17% and a Zacks Rank #3. The Zacks Consensus Estimate for earnings is pegged at a loss of $3.59 per share.

During the first quarter, investors would likely be seeking updates from Moderna on its commercial launch plans for the RSV vaccine, which is expected to receive potential approval from the FDA next month.

Novo Nordisk

Novo Nordisk has a mixed earnings track record so far. It beat earnings estimates in two of the last four quarters and missed the mark on one occasion while meeting the mark on another. On average, the company delivered an earnings surprise of 1.85%. In the last reported quarter, NVO beat earnings estimates by 7.58%.

Novo Nordisk A/S Price and EPS Surprise

Novo Nordisk A/S price-eps-surprise | Novo Nordisk A/S Quote

For the quarter to be reported, Novo has an Earnings ESP of -1.30% and a Zacks Rank #3. The Zacks Consensus Estimate for earnings is pegged at 77 cents per share.

Novo Nordisk's revenues in the quarter are expected to have been driven by its diabetes and obesity care product sales, especially Ozempic, Rybelsus and Wegovy.

Regeneron Pharmaceuticals

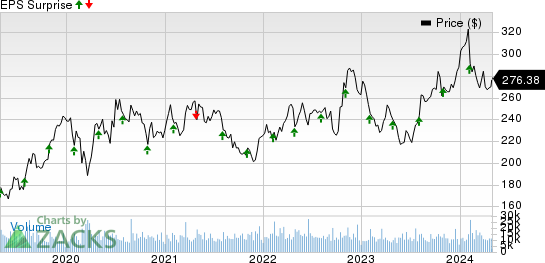

Regeneron has an impressive earnings track record. Its earnings beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 8.33%. In the last reported quarter, REGN beat earnings estimates by 13.71%.

Regeneron Pharmaceuticals, Inc. Price and EPS Surprise

Regeneron Pharmaceuticals, Inc. price-eps-surprise | Regeneron Pharmaceuticals, Inc. Quote

For the quarter to be reported, Regeneron has an Earnings ESP of -1.32% and a Zacks Rank #2. The Zacks Consensus Estimate for the bottom line is pegged at $10.14 per share.

Investors' focus is likely to be on the performance of asthma drug Dupixent and the uptake of ophthalmology drug Eylea HD when Regeneron reports its first-quarter results.

Amgen

Amgen also has an encouraging earnings track record. Its earnings beat estimates in each of the trailing four quarters, delivering an average earnings surprise of 6.00%. In the last reported quarter, AMGN beat earnings estimates by 1.07%.

Amgen Inc. Price and EPS Surprise

Amgen Inc. price-eps-surprise | Amgen Inc. Quote

For the quarter to be reported, Amgen has an Earnings ESP of -1.47% and a Zacks Rank #3. The Zacks Consensus Estimate for the bottom line is pegged at $3.76 per share.

Amgen’s product sales are expected to have been driven by strong volume growth of key products like Evenity, Repatha, Prolia, and Blincyto, among others. However, lower revenues from oncology biosimilars and legacy established products are expected to have hurt the top line.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance