Tingyi (Cayman Islands) Holding Corp's Dividend Analysis

An In-depth Look at Upcoming Dividends and Historical Performance

Tingyi (Cayman Islands) Holding Corp (TYCMY) has recently declared a dividend of $0.76 per share, scheduled to be paid on July 24, 2024, with an ex-dividend date of June 12, 2024. This announcement has piqued the interest of investors, focusing attention on the company's dividend track record, yield, and growth metrics. Utilizing data from GuruFocus, this analysis delves into the dividend performance of Tingyi (Cayman Islands) Holding Corp and evaluates its sustainability.

Overview of Tingyi (Cayman Islands) Holding Corp

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

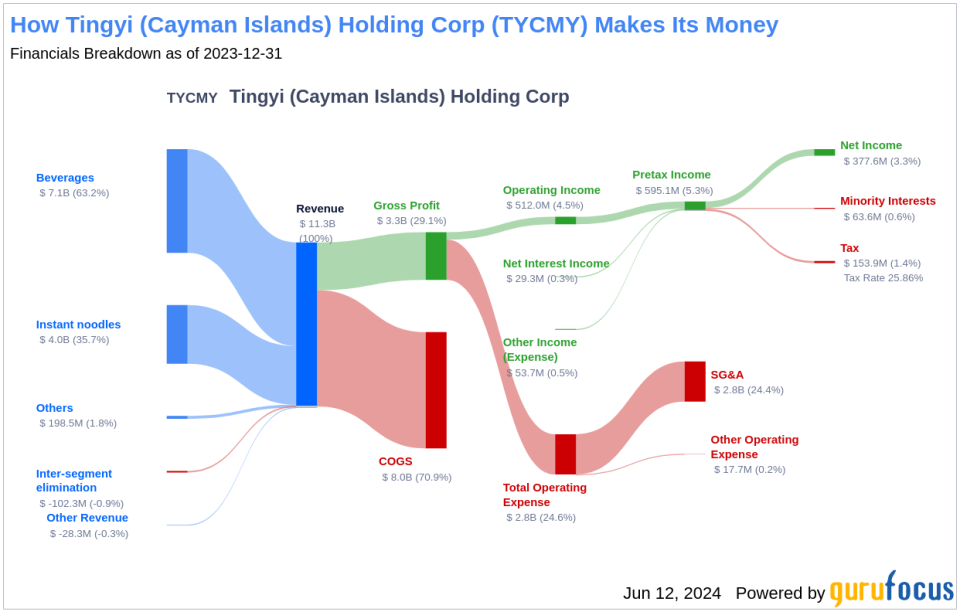

Tingyi (Cayman Islands) Holding Corp, a leading producer of instant noodles and ready-to-drink (RTD) beverages in China, is renowned for its Master Kong brand. Since its inception in 1992, Tingyi expanded its product lines into beverages by 1996. A significant milestone was reached in March 2012 when Tingyi forged a strategic alliance with PepsiCo, becoming the exclusive manufacturer and distributor of Pepsi's nonalcoholic beverages in China.

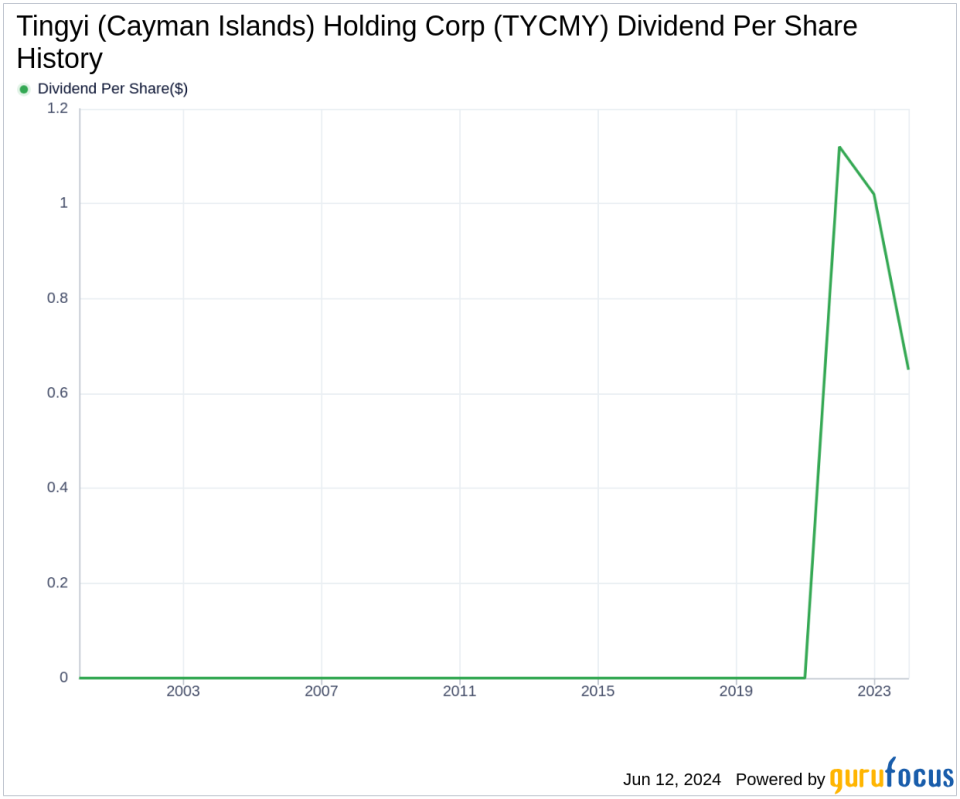

Examining Tingyi (Cayman Islands) Holding Corp's Dividend History

Since 2021, Tingyi (Cayman Islands) Holding Corp has consistently paid dividends annually. Below is a visual representation of the annual Dividends Per Share, providing insights into historical trends.

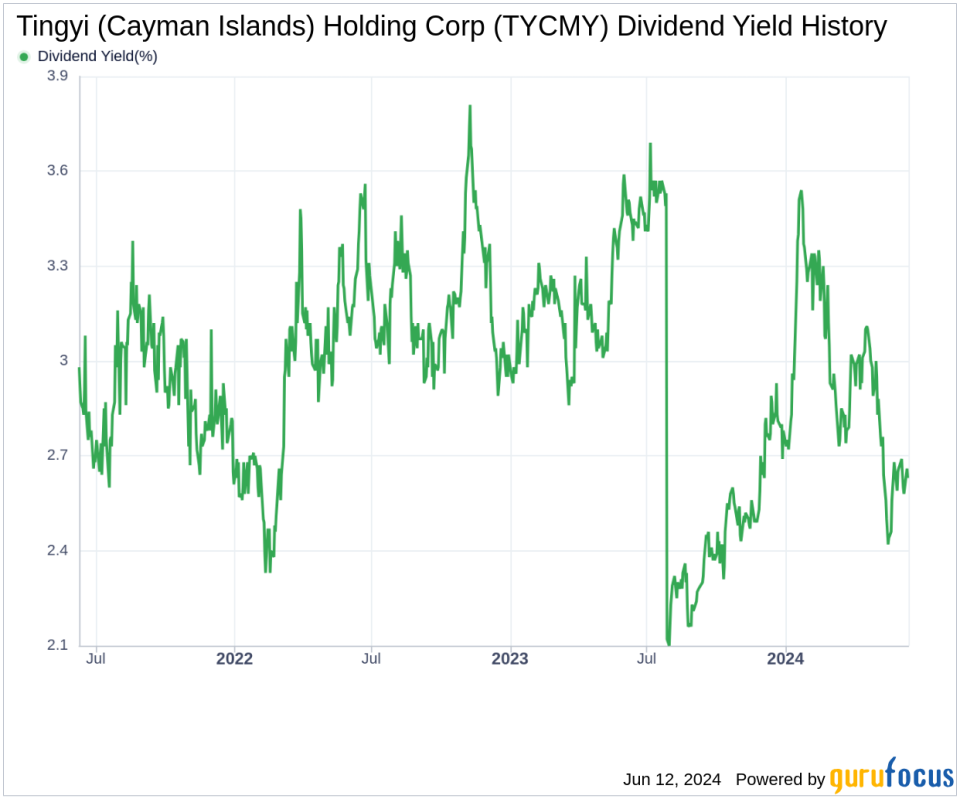

Dividend Yield and Growth Analysis

Currently, Tingyi (Cayman Islands) Holding Corp boasts a trailing dividend yield of 2.63% and a forward dividend yield of 3.06%, indicating anticipated increases in dividend payments over the next year. Over the past three years, the company's annual dividend growth rate has declined by 10.60%, but a longer-term view shows a 12.50% annual increase over five years, and a 7.00% growth rate over the past decade. The 5-year yield on cost for Tingyi (Cayman Islands) Holding Corp stock is approximately 4.74% as of today.

Assessing Dividend Sustainability

The sustainability of dividends is often gauged by the dividend payout ratio, which for Tingyi (Cayman Islands) Holding Corp stands at 0.42 as of December 31, 2023. This ratio indicates that the company retains a substantial portion of its earnings, which supports growth and buffers against economic downturns. Tingyi's profitability rank is 7 out of 10, reflecting strong earnings relative to its peers and consistent positive net income over the past decade.

Future Growth Prospects

For dividends to be sustainable, a company must exhibit robust growth metrics. Tingyi (Cayman Islands) Holding Corp's growth rank is 7 out of 10, suggesting a favorable growth trajectory. The company's revenue per share and 3-year revenue growth rate of approximately 3.10% per year, although lagging behind 63.78% of global competitors, still indicates a solid revenue model. However, the 3-year EPS growth rate and 5-year EBITDA growth rate have underperformed compared to many global competitors, which could be areas for future improvement.

Concluding Thoughts on Tingyi (Cayman Islands) Holding Corp's Dividend Outlook

Considering Tingyi (Cayman Islands) Holding Corp's consistent dividend payments, a reasonable payout ratio, and solid profitability, the company's dividend prospects appear sustainable. However, investors should keep an eye on the company's growth metrics and global competitive position to ensure long-term dividend stability. For those interested in exploring more high-dividend yield opportunities, GuruFocus Premium offers a comprehensive High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance