Three Japanese Exchange Growth Companies With High Insider Ownership And Earnings Growth Up To 57%

As global markets experience fluctuations, Japan's stock market has seen a retreat from recent highs amid currency intervention speculations and economic data releases. In this context, identifying growth companies with high insider ownership can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

Hottolink (TSE:3680) | 27% | 59.7% |

Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 42.9% |

Medley (TSE:4480) | 34% | 28.7% |

Micronics Japan (TSE:6871) | 15.3% | 39.8% |

Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

SHIFT (TSE:3697) | 35.4% | 32.5% |

ExaWizards (TSE:4259) | 21.9% | 91.1% |

Money Forward (TSE:3994) | 21.4% | 64.4% |

Astroscale Holdings (TSE:186A) | 20.9% | 90% |

AeroEdge (TSE:7409) | 10.7% | 28.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Medley

Simply Wall St Growth Rating: ★★★★★★

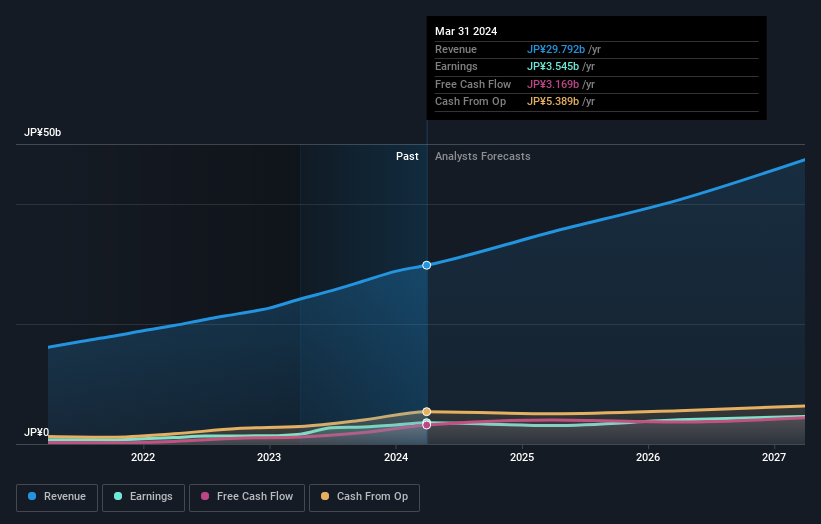

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan, with a market capitalization of approximately ¥135.30 billion.

Operations: The firm focuses on platforms dedicated to recruitment and healthcare services in Japan.

Insider Ownership: 34%

Earnings Growth Forecast: 28.7% p.a.

Medley, a growth-oriented company in Japan with high insider ownership, is trading at 41.5% below its estimated fair value, indicating potential undervaluation. Recently, Medley raised its fiscal year guidance significantly, reflecting robust financial health and confidence in future performance. Despite a highly volatile share price recently, the company's earnings are expected to grow by 28.68% annually over the next three years, outpacing the Japanese market average significantly. Revenue forecasts also exceed market expectations with a growth rate of 24.9% per year.

Click here and access our complete growth analysis report to understand the dynamics of Medley.

Our valuation report unveils the possibility Medley's shares may be trading at a premium.

LITALICO

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LITALICO Inc. operates schools for learning and preschools in Japan, with a market capitalization of approximately ¥60.77 billion.

Operations: The firm specializes in educational services across learning schools and preschools in Japan.

Insider Ownership: 37.7%

Earnings Growth Forecast: 12.6% p.a.

LITALICO Inc., a Japanese growth company with substantial insider ownership, is currently trading at 36.8% below its estimated fair value, suggesting potential undervaluation. The company's earnings have grown by 115.6% over the past year and are forecast to increase by 12.56% annually, outstripping the Japanese market average. Additionally, LITALICO recently announced a significant private placement aimed at funding expansion, indicating proactive management and growth potential despite revenues growing slower than anticipated rates.

Get an in-depth perspective on LITALICO's performance by reading our analyst estimates report here.

Our valuation report here indicates LITALICO may be undervalued.

Marvelous

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Marvelous Inc. is a Japanese company that specializes in the planning, development, production, marketing, and sale of game software for home-use game machines, with a market capitalization of approximately ¥40.16 billion.

Operations: The company specializes in the creation and distribution of gaming software, primarily for domestic gaming consoles.

Insider Ownership: 24.1%

Earnings Growth Forecast: 57.7% p.a.

Marvelous Inc., a Japanese company with high insider ownership, is expected to become profitable within the next three years, outpacing average market growth. Despite a dividend yield of 4.98%, it's not well-supported by earnings or cash flow. Revenue growth projections stand at 5% per year, slightly above the market forecast of 4.4%. The company has no recent insider trading activity but is anticipated to see earnings increase significantly at a rate of 57.69% annually.

Taking Advantage

Get an in-depth perspective on all 98 Fast Growing Japanese Companies With High Insider Ownership by using our screener here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:4480 TSE:7366 and TSE:7844.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com