Three ASX Growth Companies With Insider Ownership Exceeding 12%

The Australian market is poised for a positive opening, buoyed by a strong performance in U.S. markets and optimism surrounding potential rate cuts. This upbeat sentiment is echoed across various sectors, highlighting the resilience and potential growth within the economy. In this context, companies with high insider ownership often signal strong confidence from those who know the business best, making them particularly interesting in these promising market conditions.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Change Financial (ASX:CCA) | 26.6% | 85.4% |

Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Alpha HPA (ASX:A4N) | 26.3% | 30.5% |

Underneath we present a selection of stocks filtered out by our screen.

Kelsian Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kelsian Group Limited operates in land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.40 billion.

Operations: The company generates revenue through three primary segments: Australian Bus services contributing A$934.76 million, International Bus operations at A$448.87 million, and Marine and Tourism activities totaling A$337.90 million.

Insider Ownership: 20.9%

Kelsian Group, with high insider ownership, shows a promising outlook despite some financial concerns. The company's earnings are expected to grow by 25.84% annually, outpacing the Australian market forecast of 13.9%. While its revenue growth at 5.8% yearly is modest compared to high-growth benchmarks, it still exceeds the market average of 5.3%. Recent insider activities reflect confidence as more shares were bought than sold in the last three months. However, challenges include a dividend coverage issue and interest payments not well covered by earnings.

Technology One

Simply Wall St Growth Rating: ★★★★☆☆

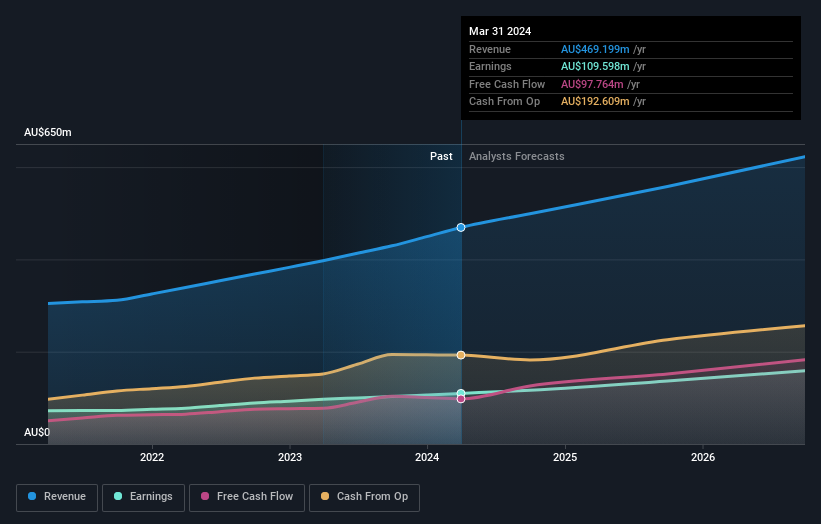

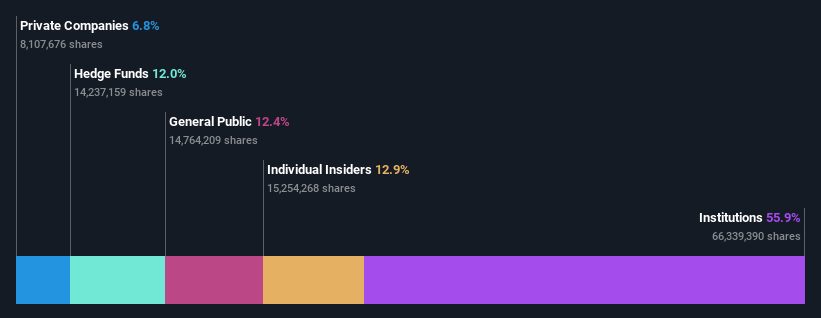

Overview: Technology One Limited is a company that develops, markets, sells, implements, and supports integrated enterprise business software solutions both in Australia and internationally, with a market capitalization of approximately A$5.87 billion.

Operations: The company's revenue is derived primarily from three segments: software, generating A$317.24 million; corporate, contributing A$83.83 million; and consulting, adding A$68.13 million.

Insider Ownership: 12.3%

Technology One, recognized for its substantial insider ownership, is poised for steady growth. Its earnings have expanded by 13.1% over the past year and are expected to increase annually by 14.3%, slightly outpacing the Australian market's projection of 13.9%. Revenue growth forecasts at 11.1% annually also exceed the national average of 5.3%. However, this growth is not considered high compared to more aggressive industry benchmarks. The firm's recent presentations and solid half-year earnings underline its ongoing operational success.

Temple & Webster Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products across Australia, with a market capitalization of approximately A$1.12 billion.

Operations: The company generates revenue primarily through the online sale of furniture, homewares, and home improvement products, totaling A$442.25 million.

Insider Ownership: 12.9%

Temple & Webster is set to grow robustly with earnings and revenue forecasts outpacing the Australian market significantly. Expected annual growth rates are 35.08% for earnings and 21.2% for revenue. Despite high insider ownership often signaling confidence, recent buyback activities, including a plan to repurchase shares worth A$30 million, suggest a strategic push to enhance shareholder value rather than direct insider buying or selling trends. However, its forecasted Return on Equity of 19.6% suggests moderate efficiency in generating profits from shareholders' equity.

Summing It All Up

Click here to access our complete index of 92 Fast Growing ASX Companies With High Insider Ownership.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:KLS ASX:TNE and ASX:TPW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance