July 2024 Insight Into Three German Growth Companies With High Insider Ownership

As Germany's DAX index advanced 1.48% this past week, reflecting a broader European market uplift triggered by favorable U.S. inflation data, investors are increasingly attentive to opportunities within this buoyant environment. In such a climate, growth companies with high insider ownership in Germany may offer an appealing blend of entrepreneurial commitment and potential for robust performance.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

Deutsche Beteiligungs (XTRA:DBAN) | 39.1% | 31.6% |

YOC (XTRA:YOC) | 24.8% | 21.8% |

NAGA Group (XTRA:N4G) | 14.1% | 79.2% |

Exasol (XTRA:EXL) | 25.3% | 105.4% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stratec (XTRA:SBS) | 30.9% | 21.9% |

elumeo (XTRA:ELB) | 25.8% | 99.1% |

Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

Let's dive into some prime choices out of from the screener.

Hypoport

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hypoport SE is a technology-based financial service provider in Germany, with a market capitalization of approximately €2.07 billion.

Operations: The company's revenue is primarily generated through its Credit Platform and Insurance Platform segments, which respectively contributed €155.60 million and €66.29 million.

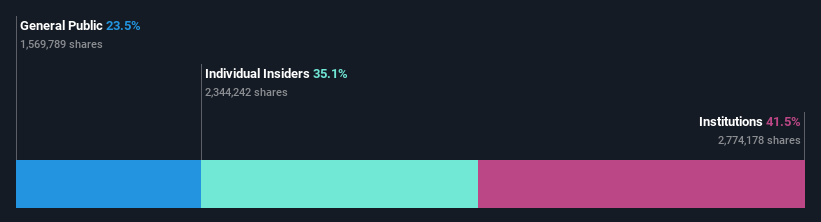

Insider Ownership: 35.1%

Hypoport SE, a German company, demonstrates robust growth with its revenue and earnings forecast to outpace the national market. Earnings grew by 240.5% over the past year and are expected to continue growing significantly at 31.9% annually over the next three years, compared to Germany's average of 18.9%. However, its Return on Equity is projected low at 9.1%. Recent events include strong Q1 results with sales up from €93.72 million to €107.47 million year-over-year, and net income increasing significantly from €0.503 million to €3.04 million.

Click to explore a detailed breakdown of our findings in Hypoport's earnings growth report.

The valuation report we've compiled suggests that Hypoport's current price could be inflated.

Redcare Pharmacy

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV is an online pharmacy operating across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market capitalization of approximately €2.81 billion.

Operations: The company generates €1.62 billion from its DACH region operations and €0.37 billion internationally.

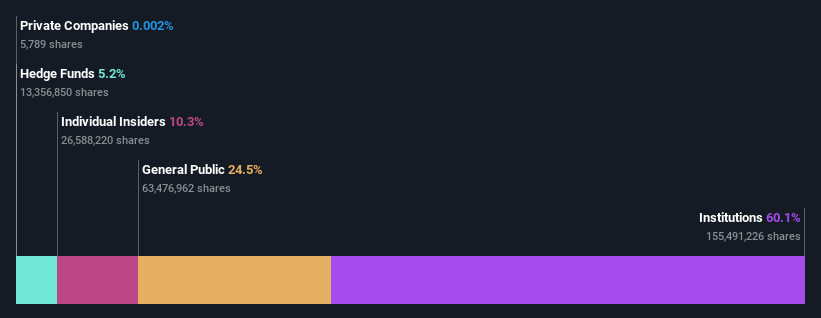

Insider Ownership: 17.7%

Redcare Pharmacy is positioned for substantial growth, trading at 72.2% below its estimated fair value with expected revenue growth of 17.1% per year, outpacing the German market's 5.2%. Although its Return on Equity may remain low at 7.5%, the company is forecast to turn profitable within three years, with earnings projected to increase by 47.38% annually. Recent financial results show a significant reduction in net loss and a sharp increase in sales, indicating potential recovery and growth ahead.

Take a closer look at Redcare Pharmacy's potential here in our earnings growth report.

Upon reviewing our latest valuation report, Redcare Pharmacy's share price might be too optimistic.

Zalando

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE is an online retailer specializing in fashion and lifestyle products, with a market capitalization of approximately €6.26 billion.

Operations: The company generates €10.40 billion in revenue from its online fashion and lifestyle platform.

Insider Ownership: 10.4%

Zalando SE, a German e-commerce giant, is trading at €51.5% below its estimated fair value, indicating potential for significant upside. While its revenue growth forecast of 5.4% per year slightly outpaces the German market's 5.2%, its earnings are expected to surge by 26.42% annually over the next three years. Despite these promising figures, Zalando's Return on Equity is projected to remain modest at 12.6%. Recent guidance confirms an operating profit outlook with modest sales growth for 2024.

Summing It All Up

Discover the full array of 18 Fast Growing German Companies With High Insider Ownership right here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:HYQXTRA:RDC XTRA:ZAL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com