Here's Why You Should Retain Quest Diagnostics (DGX) Stock Now

Quest Diagnostics Incorporated DGX is well poised to grow in the coming few quarters, gaining from strong growth in the base business, particularly in advanced diagnostics and direct-to-consumer testing. The company has raised its 2022 view, which buoys optimism. However, market headwinds and stiff competition remain concerns.

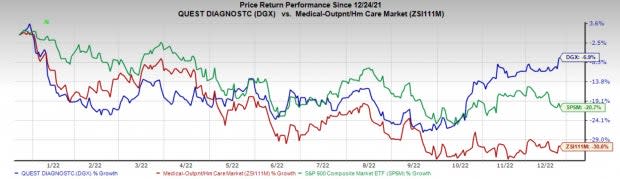

In the past year, shares of this Zacks Rank #3 (Hold) company have lost 6.9% compared with the 30.6% decline of the industry and 20.7% drop of the S&P 500.

The largest provider of commercial laboratory services in North America has a market cap of $17.72 billion. The company surpassed estimates in the trailing three quarters and missed the same in one, the average surprise being 5.81%.

Let us delve deeper.

Factors At Play

Impressive Q3 Results: Quest Diagnostics reported better-than-expected third-quarter 2022 earnings and revenues. The company drove 5% growth in the base business despite the impact of Hurricane Ian. Performance rebounded in August and September from a softer volume trend that it witnessed earlier in the year. Before Hurricane Ian hit in September, Quest Diagnostics witnessed some of its historically highest base testing volumes.

Base Volume Improves: Quest Diagnostics’ base testing volumes or base business refers to testing volumes, excluding COVID-19 testing. The company’s legacy base business grew 5.1% in the third quarter amid softer utilization trends, which impacted the entire healthcare industry. During the reported quarter, base business revenue per requisition was up 3.3%. The more favorable pricing environment remained consistent with the company’s expectations, with unit price reimbursement pressure of less than 50 basis points in the quarter.

The company also ramped up investments to accelerate growth in the base business, particularly in advanced diagnostics and direct-to-consumer testing. In the third quarter, the company continued to expand growth through health plan access. Quest Diagnostics noted that it is on track to meet its goal of realizing 50% of its health plan revenues from value-based relationships by the end of 2023.

Raised Guidance: The company raised its full-year 2022 guidance.

Full-year net revenues are currently estimated in the range of $9.72-$9.86 billion (compared with the earlier projection of $9.50-$9.75 billion). The Zacks Consensus Estimate for the same is pegged lower at $9.66 billion.

Adjusted earnings per share are now expected in the range of $9.75-$9.95 (the earlier guidance was $9.55-$9.95). The Zacks Consensus Estimate for the metric is pegged at $9.67

Downsides

Competitive Landscape: Quest Diagnostics faces intense competition from LabCorp, other commercial laboratories and hospitals. Hospitals control an estimated 60% of the diagnostic test market compared to Quest Diagnostic’s 15% share. While pricing is an important factor in choosing a testing lab, hospital-affiliated physicians expect a high level of service, including the accurate and rapid turnaround of testing results. As a result, Quest Diagnostics and other commercial labs compete with hospital-affiliated labs primarily based on the quality of service.

Image Source: Zacks Investment Research

Current Market Headwinds Weigh Heavy: The current market environment remains challenging for Quest Diagnostics due to a persistent decline in healthcare utilization rate, softer volume, commercial pricing pressure and reimbursement headwind.

Estimate Trends

Quest Diagnostics is witnessing a positive estimate revision trend for the current year. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 2.2% north to $9.85.

The Zacks Consensus Estimate for 2022 revenues is pegged at $9.80 billion, suggesting a 9.2% decline from the year-ago reported number.

Key Picks

A few better-ranked stocks in the broader medical space that investors can consider are ShockWave Medical, Inc. SWAV, Orthofix Medical Inc. OFIX and Merit Medical System MMSI.

ShockWave Medical, sporting a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 33.1% for 2023. The company’s earnings surpassed estimates in all the trailing four quarters, the average beat being 180.1%.

ShockWave Medical has outperformed its industry in the past year. SWAV has gained 35% against the industry’s 32.6% fall in the past year.

Orthofix Medical, currently carrying a Zacks Rank #1 (Strong Buy), reported third-quarter 2022 adjusted EPS of 13 cents, which beat the Zacks Consensus Estimate by a stupendous 550%. Revenues of $114 million outpaced the consensus mark by 2.7%.

Orthofix Medical has an estimated next-year growth rate of 58.97%. MMSI’s earnings surpassed estimates in the trailing three quarters and missed in one, the average being 129.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Merit Medical, currently carrying a Zacks Rank of 2, reported third-quarter 2022 adjusted EPS of 64 cents, which beat the Zacks Consensus Estimate by 20.8%. Revenues of $287.2 million outpaced the consensus mark by 5.2%.

Merit Medical has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average being 25.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

ORTHOFIX MEDICAL INC. (OFIX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance