Fluor (FLR) Team Wins NNSA Contract for Pantex Plant Management

Fluor Corporation FLR has been selected to be part of a crucial management and operations contract for the Pantex Plant, a key facility in the U.S. Nuclear Security Enterprise. This significant contract, awarded by the U.S. Department of Energy’s (“DOE”) National Nuclear Security Administration (“NNSA”) to PanTeXas Deterrence LLC, a joint venture led by BWX Technologies, Inc. subsidiary, includes partners Fluor, SOC (a Day & Zimmermann Company), and The Texas A&M University System.

The initial contract term is five years, with the potential for three additional five-year options. If all options are exercised, this 20-year contract could reach a total funding level of approximately $30 billion.

This strategic win underscores Fluor's longstanding commitment to national security, dating back to 1944. As a key partner in this venture, Fluor is set to play a pivotal role in maintaining and enhancing the safety, security, and effectiveness of the nation's nuclear weapons stockpile.

The Pantex Plant, located outside of Amarillo, TX, is integral to the nation’s nuclear production capabilities. The work performed there includes life extension programs for nuclear weapons, surveillance, assembly, dismantlement, and the development, testing, and fabrication of high-explosive components. Fluor’s involvement will support these critical activities, ensuring the continued reliability and safety of the U.S. nuclear arsenal.

Fluor’s CEO emphasized the company’s readiness to deliver on the NNSA’s mission at Pantex, highlighting the importance of a culture of safety, production delivery, and program excellence. This contract aligns with Fluor's strategic objectives, reinforcing its role in national security while also contributing to the revitalization of America’s nuclear security infrastructure.

In conclusion, Fluor’s participation in this extensive and long-term contract is poised to significantly bolster its portfolio, enhance its reputation in the defense sector, and provide substantial long-term revenues. This partnership not only strengthens Fluor’s position in the nuclear security domain but also affirms its commitment to supporting and advancing the nation’s security interests.

Growing Backlog Level: A Boon

The demand for Fluor's services is clearly demonstrated by its robust prospect pipeline. The company is currently monitoring a list of potential projects that exceed its existing backlog by notable figures. The primary opportunities driving this demand include those in the chemicals sector, closely followed by energy transition, fuel production, as well as mining and metals and big data.

In the first quarter of 2024, Fluor successfully secured consolidated new awards amounting to $7 billion, with a book-to-burn ratio of 1.9x, which aligned with its full-year plan to achieve a book-to-burn ratio exceeding 1x.

The total backlog of Fluor stands at $32.7 billion, with 80% of it being reimbursable. The reported value portrays 27.7% year-over-year growth.

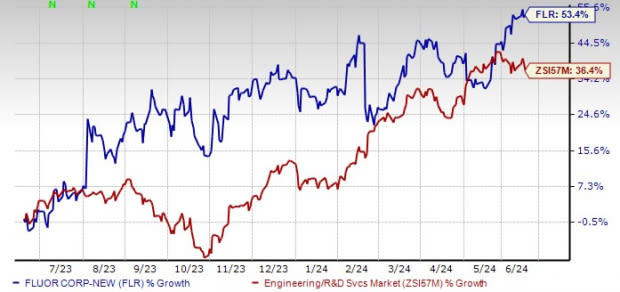

Image Source: Zacks Investment Research

Shares of this current Zacks Rank #3 (Hold) company have gained 53.4% in the past year compared with the Zacks Engineering - R and D Services industry’s 36.4% growth. The substantial backlog level underscores the continued strong demand for the company’s services and the recognized value it brings to its clients.

Key Picks

Some better-ranked stocks in the Zacks Construction sector are:

Howmet Aerospace Inc. HWM presently sports a Zacks Rank #1 (Strong Buy). HWM has a trailing four-quarter earnings surprise of 8.5%, on average. Shares of HWM have gained 71.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for HWM’s 2024 sales and EPS indicates a rise of 10.6% and 29.9%, respectively, from prior-year levels.

Gates Industrial Corporation plc GTES presently carries a Zacks Rank #2 (Buy). GTES has a trailing four-quarter earnings surprise of 14.9%, on average. Shares of GTES have gained 23.3% in the past year.

The Zacks Consensus Estimate for GTES’ 2024 sales indicates a 0.2% decline but EPS growth of 2.9% from the prior-year levels.

M-tron Industries, Inc. MPTI currently carries a Zacks Rank #2. It has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 26.7%. Shares of MPTI have gained 193.2% in the past year.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates a rise of 8.8% and 58.6%, respectively, from prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Gates Industrial Corporation PLC (GTES) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance