Exploring Undervalued Small Caps With Insider Action In Hong Kong July 2024

In recent weeks, the Hong Kong market has mirrored the broader global trend, with small-cap stocks showing notable resilience and growth. This positive momentum in small caps comes amid a backdrop of easing inflation and favorable shifts in economic indicators, setting an intriguing stage for investors looking at undervalued opportunities. A good stock often stands out due to its potential for growth and stability, which is particularly compelling in the current climate where small caps are gaining ground. This makes it an opportune time to explore such investments within Hong Kong's dynamic market landscape.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Wasion Holdings | 11.3x | 0.8x | 32.75% | ★★★★☆☆ |

China Overseas Grand Oceans Group | 2.7x | 0.1x | -0.04% | ★★★★☆☆ |

Kinetic Development Group | 3.9x | 1.7x | 21.58% | ★★★★☆☆ |

China Leon Inspection Holding | 9.4x | 0.7x | 30.39% | ★★★★☆☆ |

Nissin Foods | 14.7x | 1.3x | 40.28% | ★★★★☆☆ |

Transport International Holdings | 11.7x | 0.6x | 43.67% | ★★★★☆☆ |

Xtep International Holdings | 11.9x | 0.9x | 45.14% | ★★★☆☆☆ |

Giordano International | 8.6x | 0.8x | 36.44% | ★★★☆☆☆ |

Skyworth Group | 5.8x | 0.1x | -322.95% | ★★★☆☆☆ |

Ever Sunshine Services Group | 6.0x | 0.4x | 12.33% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

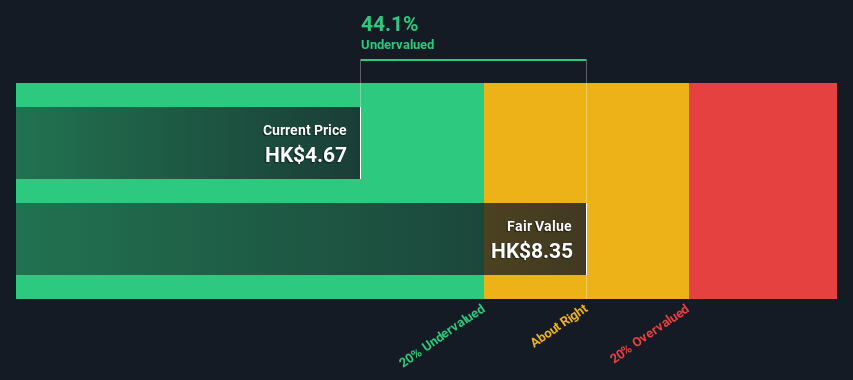

Xtep International Holdings

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Xtep International Holdings is a sportswear company that operates primarily in mass market, fashion sports, and professional sports segments with a market capitalization of approximately CN¥7.64 billion.

Operations: The company's revenue primarily derives from its Mass Market segment, which generated CN¥11.95 billion, significantly outpacing its Fashion Sports and Professional Sports segments, which brought in CN¥1.60 billion and CN¥795.53 million, respectively. The gross profit margin observed a slight increase over several periods, reaching 42.17% by the end of the data timeline provided.

PE: 11.9x

Recently, Xtep International Holdings displayed insider confidence as Shui Po Ding acquired 2 million shares for HK$14.15 million, signaling strong belief in the company's prospects. This move aligns with their robust retail growth forecasts, expecting a 10% increase in sell-through for Q2 and a high single-digit rise over six months. Despite relying solely on external borrowing—a higher risk funding strategy—the firm continues to innovate its financial and operational strategies under new leadership, enhancing its appeal in Hong Kong’s competitive market.

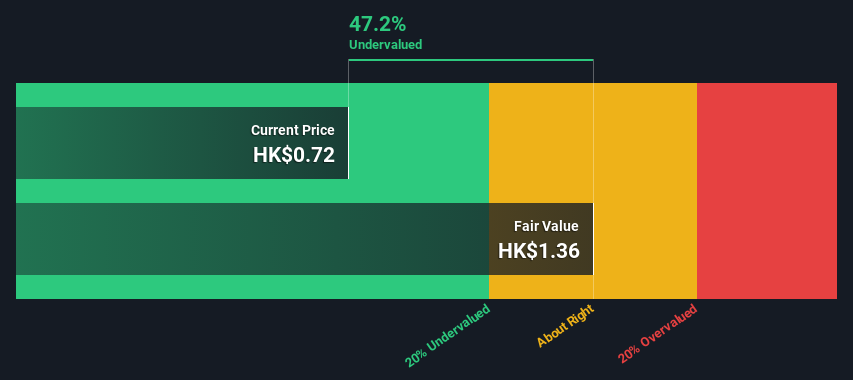

Comba Telecom Systems Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, with a market capitalization of approximately HK$1.57 billion.

Operations: The company generates a significant portion of its revenue from wireless telecommunications network system equipment and services, amounting to HK$5.82 billion, compared to HK$157.83 million from operator telecommunication services. Over the observed periods, gross profit margins have shown an increasing trend, reaching 0.29% by the end of the latest period reported.

PE: 344.5x

Recently, Comba Telecom Systems Holdings demonstrated insider confidence as Tung Ling Fok acquired 1.83 million shares, signaling strong belief in the company's potential. Despite a challenging environment with highly volatile share prices and lower profit margins compared to last year, the firm remains intriguing due to its strategic movements in the market, including a significant presentation at MWC Shanghai 2024. This activity underlines its ongoing efforts to enhance shareholder value and suggests possible future growth avenues amidst financial pressures from one-off items impacting results.

Minth Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: Minth Group is a diversified manufacturer specializing in automotive parts including metal, trim, plastic components, and battery housing, with a market capitalization of approximately CN¥26.82 billion.

Operations: The company generates revenue primarily from segments including Plastic, Aluminum, Metal & Trim, and Battery-Housing, with notable figures of CN¥5.63 billion, CN¥4.33 billion, CN¥5.46 billion, and CN¥3.54 billion respectively. Its gross profit margin has seen a fluctuation over the periods reviewed but stood at 27.39% as of the latest data point in 2024.

PE: 7.2x

Minth Group, a lesser-known entity in Hong Kong's bustling market, recently saw insider confidence with key figures buying shares, signaling strong belief in the company's prospects. Despite relying solely on external borrowing—a riskier funding method—Minth is poised for a 14.67% earnings growth annually. Their active participation at influential conferences like the Morgan Stanley China TMT suggests robust engagement with global investors, enhancing their industry footprint amidst strategic board reshuffles and bylaw amendments aimed at modernizing shareholder communications.

Take a closer look at Minth Group's potential here in our valuation report.

Evaluate Minth Group's historical performance by accessing our past performance report.

Turning Ideas Into Actions

Explore the 19 names from our Undervalued SEHK Small Caps With Insider Buying screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1368 SEHK:2342 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com