Exploring Three SGX Stocks Estimated To Be Undervalued By Between 40.2% And 46.3%

The Singapore market has shown a vibrant interest in technological advancements and innovations, as evidenced by the recent $60 million Series B funding raised by Partior. This fintech initiative, backed by major banks and investors, highlights the growing integration of blockchain technology in financial services within the region. In this context of technological embracement and economic growth, identifying stocks that are potentially undervalued becomes particularly compelling for investors looking to capitalize on emerging opportunities.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.38 | SGD8.15 | 46.3% |

Winking Studios (Catalist:WKS) | SGD0.285 | SGD0.51 | 43.7% |

Hongkong Land Holdings (SGX:H78) | US$3.34 | US$5.79 | 42.3% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.00 | SGD1.67 | 40.2% |

Seatrium (SGX:5E2) | SGD1.48 | SGD2.63 | 43.7% |

Digital Core REIT (SGX:DCRU) | US$0.64 | US$1.12 | 42.8% |

Nanofilm Technologies International (SGX:MZH) | SGD0.875 | SGD1.47 | 40.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

Frasers Logistics & Commercial Trust

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust specializing in industrial and commercial properties, with a portfolio valued at approximately S$6.4 billion across five developed markets and a market capitalization of about S$3.76 billion.

Operations: The trust generates revenue from a diverse portfolio of 107 industrial and commercial properties located in Australia, Germany, Singapore, the United Kingdom, and the Netherlands.

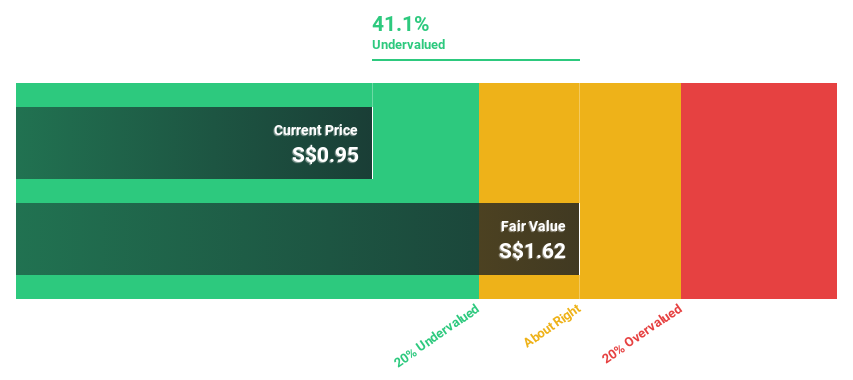

Estimated Discount To Fair Value: 40.2%

Frasers Logistics & Commercial Trust is currently trading at SGD1, significantly below the estimated fair value of SGD1.67, suggesting a potential undervaluation based on cash flows. Analysts predict a 26.4% price increase and an earnings growth of 40.96% per year, indicating strong future profitability. However, the trust's debt is poorly covered by operating cash flow, and it has an unstable dividend record with recent payouts reflecting varied income components. Revenue growth projections are modest at 6.1% annually but exceed the broader Singapore market's expected 3.6%.

Hongkong Land Holdings

Overview: Hongkong Land Holdings Limited operates in the investment, development, and management of properties across Hong Kong, Macau, Mainland China, Southeast Asia, and other international markets with a market capitalization of approximately $7.37 billion.

Operations: The company generates revenue through its investment properties, which brought in $1.08 billion, and development properties, contributing $0.76 billion.

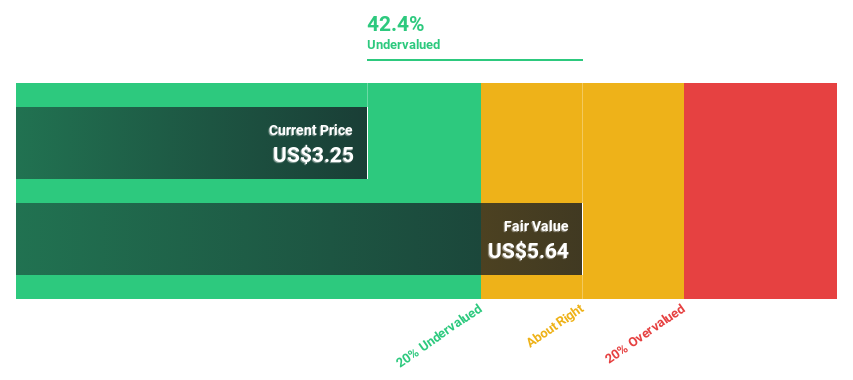

Estimated Discount To Fair Value: 42.3%

Hongkong Land Holdings is priced at US$3.34, well below the calculated fair value of US$5.79, indicating a significant undervaluation based on discounted cash flows. While its revenue growth forecast at 4.6% per year is modestly above Singapore's average (3.6%), expected profitability improvements are promising with earnings projected to increase substantially annually over the next three years. However, its low forecasted return on equity of 2.4% and a dividend yield of 6.59% poorly covered by earnings suggest potential financial strain.

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering firm with a market capitalization of SGD 13.66 billion.

Operations: The company's revenue is divided among three main segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

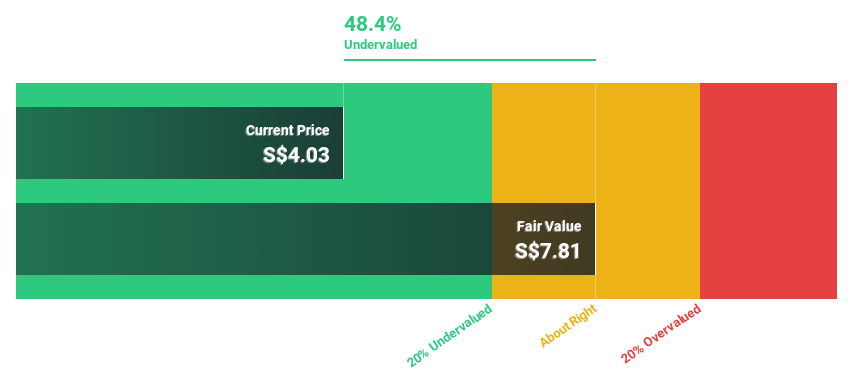

Estimated Discount To Fair Value: 46.3%

Singapore Technologies Engineering, trading at S$4.38, significantly below its fair value of S$8.15, appears undervalued based on cash flows. Despite a high level of debt and unstable dividend track record, the company's earnings are expected to grow by 11.71% annually. Recent initiatives include a share buyback program and consistent dividends affirming shareholder value amidst management shifts aiming for operational excellence which could influence future financial stability and growth prospects.

Key Takeaways

Take a closer look at our Undervalued SGX Stocks Based On Cash Flows list of 7 companies by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:BUOU SGX:H78 and SGX:S63.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com