Exploring Japanese Exchange Value Stocks With Estimated Low Prices in July 2024

As of July 2024, the Japanese stock market has shown signs of retreat from recent highs amid speculation about currency intervention efforts to support the yen, which could impact export-focused industries. This environment might present opportunities for investors to explore undervalued stocks that could be poised for recovery or growth despite broader market fluctuations. In such a market scenario, identifying stocks with solid fundamentals yet trading below their intrinsic value could be particularly compelling. These selections often appeal to those looking for potential resilience and growth in a fluctuating economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Hibino (TSE:2469) | ¥2614.00 | ¥5164.41 | 49.4% |

Mimaki Engineering (TSE:6638) | ¥2003.00 | ¥3909.22 | 48.8% |

Fujibo Holdings (TSE:3104) | ¥4760.00 | ¥9409.68 | 49.4% |

BayCurrent Consulting (TSE:6532) | ¥4323.00 | ¥8579.77 | 49.6% |

S-Pool (TSE:2471) | ¥331.00 | ¥622.36 | 46.8% |

Macromill (TSE:3978) | ¥874.00 | ¥1680.04 | 48% |

Yokowo (TSE:6800) | ¥2027.00 | ¥3893.63 | 47.9% |

DKS (TSE:4461) | ¥3760.00 | ¥7187.05 | 47.7% |

Atrae (TSE:6194) | ¥882.00 | ¥1715.93 | 48.6% |

freee K.K (TSE:4478) | ¥2717.00 | ¥5245.24 | 48.2% |

Let's dive into some prime choices out of from the screener.

freee K.K

Overview: freee K.K., based in Japan, specializes in providing cloud-based accounting and HR software solutions, with a market capitalization of approximately ¥159.12 billion.

Operations: The company generates its revenue primarily from cloud-based accounting and HR software solutions.

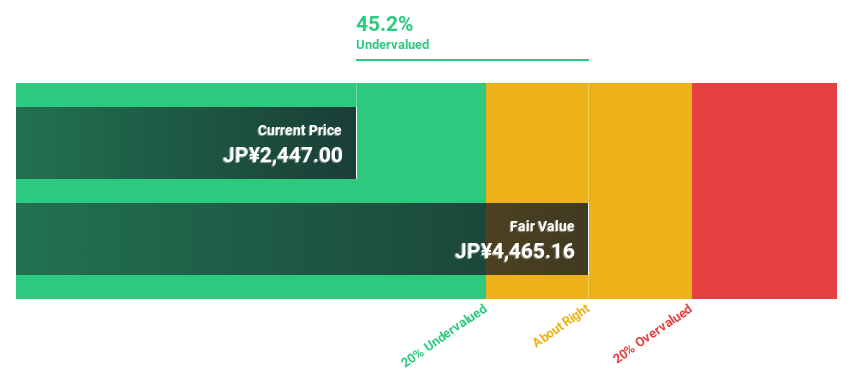

Estimated Discount To Fair Value: 48.2%

Freee K.K. is trading at ¥2717, substantially below the estimated fair value of ¥5245.24, indicating a significant undervaluation based on cash flows. Despite its highly volatile share price recently, the company's revenue is expected to grow by 20.2% annually, outpacing the Japanese market's 4.4%. While currently unprofitable, Freee K.K. is projected to achieve profitability within three years with earnings growth forecasted at 72.92% per year, suggesting potential for considerable financial improvement and return on equity anticipated to remain low at 17.7%.

Our growth report here indicates freee K.K may be poised for an improving outlook.

Delve into the full analysis health report here for a deeper understanding of freee K.K.

AGC

Overview: AGC Inc., a global company, engages in the manufacturing and selling of glass, automotive products, electronics, chemicals, and ceramics with a market capitalization of approximately ¥1.13 trillion.

Operations: The firm operates in diverse sectors, including glass, automotive products, electronics, chemicals, and ceramics.

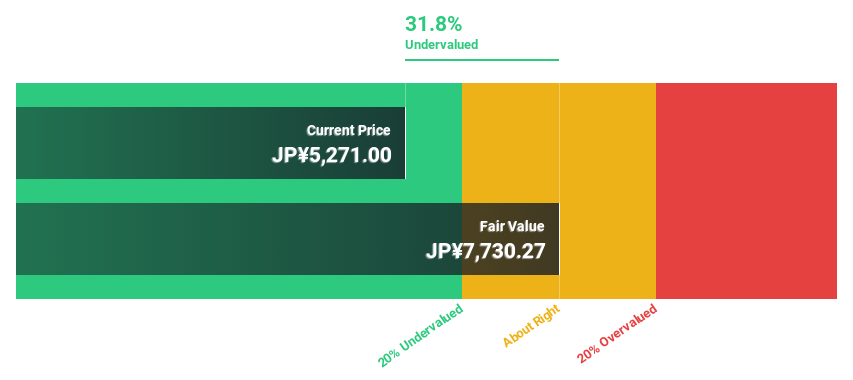

Estimated Discount To Fair Value: 36.1%

AGC Inc., valued at ¥5327, is significantly undervalued with a fair value estimate of ¥8336.19, representing a 36.1% discount based on discounted cash flows. While its dividend coverage is weak, AGC's earnings are expected to grow by 33.8% annually over the next three years, outperforming the Japanese market's average. However, its forecasted return on equity remains low at 8.2%, and revenue growth projections are modest at 4.5% annually compared to the market's 4.4%.

Insights from our recent growth report point to a promising forecast for AGC's business outlook.

Get an in-depth perspective on AGC's balance sheet by reading our health report here.

KATITAS

Overview: KATITAS CO., Ltd. operates in Japan, engaging in the surveying, purchasing, refurbishing, remodeling, and selling of used homes to individuals and families with a market capitalization of ¥147.13 billion.

Operations: The company generates revenue by surveying, acquiring, upgrading, and reselling residential properties in Japan.

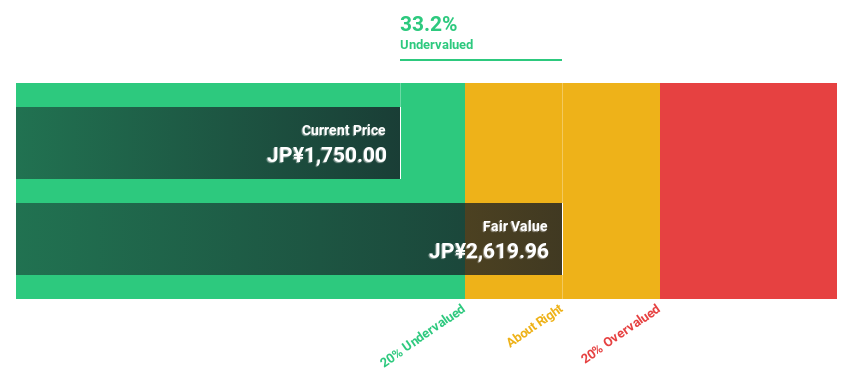

Estimated Discount To Fair Value: 32.8%

KATITAS, priced at ¥1887, is significantly below its fair value of ¥2808.4, suggesting a potential undervaluation based on cash flows. Its earnings and revenue are both projected to outpace the Japanese market with respective growth rates of 9.1% and 7.3% per year. Despite this promising growth, the company's dividend track record remains unstable. Recent corporate actions include resolutions on treasury stock disposal as restricted compensation and an appeal to the Supreme Court decision.

Where To Now?

Delve into our full catalog of 89 Undervalued Japanese Stocks Based On Cash Flows here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:4478 TSE:5201 and TSE:8919.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com