Euronext Paris Highlights: 3 Growth Companies With High Insider Ownership And Revenue Growth Of At Least 10%

Amid a backdrop of fluctuating global markets and nuanced economic data, the French market has shown resilience with the CAC 40 Index experiencing modest gains. In such an environment, growth companies with high insider ownership in France are particularly noteworthy, as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.5% | 25.2% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 30.8% |

Adocia (ENXTPA:ADOC) | 11.9% | 63% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.2% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 31.9% |

Arcure (ENXTPA:ALCUR) | 21.4% | 27.5% |

S.M.A.I.O (ENXTPA:ALSMA) | 17.3% | 35.2% |

Munic (ENXTPA:ALMUN) | 29.4% | 149.2% |

MedinCell (ENXTPA:MEDCL) | 16.4% | 69.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.6% | 5.9% |

Here's a peek at a few of the choices from the screener.

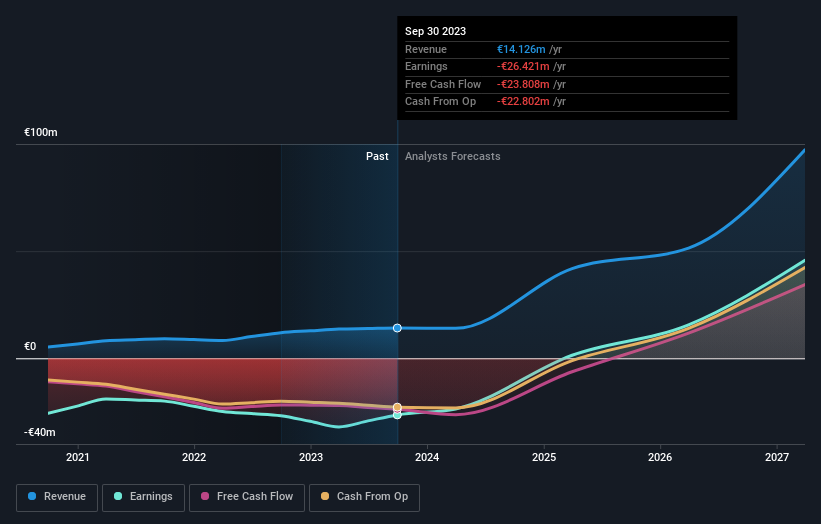

MedinCell

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company that specializes in developing long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €427.19 million.

Operations: The company generates revenue primarily from its pharmaceutical segment, totaling €11.95 million.

Insider Ownership: 16.4%

Revenue Growth Forecast: 43.8% p.a.

MedinCell, a French biotech company, is expected to become profitable within three years with projected annual profit growth surpassing the market average. Despite recent revenue declines to €11.95 million and a net loss of €25.04 million in 2024, its revenue growth forecast remains robust at 43.8% per year, outpacing the French market significantly. The company's high insider ownership aligns with its strategic decisions but shareholder dilution over the past year raises concerns about equity value retention.

Dive into the specifics of MedinCell here with our thorough growth forecast report.

Our expertly prepared valuation report MedinCell implies its share price may be too high.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.07 billion.

Operations: The company generates revenue through three main segments: Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud (€185.43 million).

Insider Ownership: 10.5%

Revenue Growth Forecast: 10.8% p.a.

OVH Groupe, a French cloud services provider, is poised for notable growth with expected revenue increases of 10.8% annually. Despite trading 25.1% below estimated fair value and forecasted to achieve profitability within three years, challenges persist such as a low projected return on equity at 1.7%. Recent advancements include launching the third generation Advance dedicated servers featuring AMD EPYC processors, enhancing performance and network capabilities which could bolster future earnings despite current share price volatility and past financial losses.

Click here and access our complete growth analysis report to understand the dynamics of OVH Groupe.

Our valuation report unveils the possibility OVH Groupe's shares may be trading at a discount.

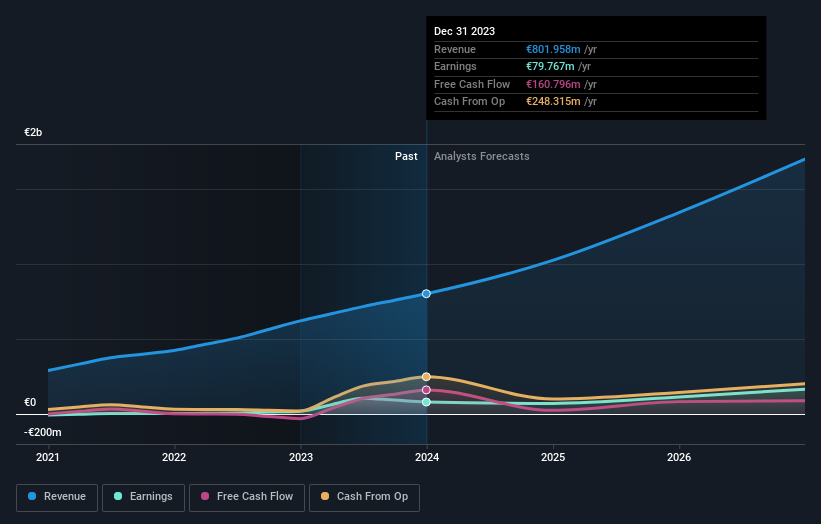

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. operates in Europe, Asia, and North America, offering digitalization solutions for commerce with a market capitalization of €2.27 billion.

Operations: The company generates €801.96 million from installing and maintaining electronic shelf labels.

Insider Ownership: 13.5%

Revenue Growth Forecast: 21.9% p.a.

VusionGroup, a French growth company with significant insider ownership, has seen substantial earnings growth of 320.8% over the past year, with revenues increasing from €620.86 million to €801.96 million. The firm's digital solutions are enhancing retail efficiency as evidenced by a recent implementation at Hy-Vee stores, automating price updates and reducing waste through intra-day promotions. Despite its high volatility in share price, analysts predict a strong upward trajectory in stock value by 36.8%, supported by forecasted annual earnings growth of 25.24% and revenue growth at 21.9%, both well above market averages.

Make It Happen

Discover the full array of 20 Fast Growing Euronext Paris Companies With High Insider Ownership right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:MEDCL ENXTPA:OVH and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com